WARNING to All US LNG Investors

Post on: 16 Март, 2015 No Comment

The World of Energy

Marin Katusa. Chief Energy Investment Strategist

I love being the first to a story. (Yes, I have an ego.) And yes, I was the first to come out and state that Canadas liquefied natural gas (LNG) sector has huge problems and to recommend avoiding the bubble in Canadian LNG. I repeated this warning several times over the last two years.

Canadas LNG bubble popped last week. Heres what US LNG investors can learn from it.

In the March 2014 issue of the Casey Energy Report . I listed hard facts of why the North Americanespecially British Columbian (BC)LNG sector will fail. This report was published in arguably the most bullish period for LNG-related companies and was immediately met with pushback, from both the industry and investors.

The bubble in the Canadian LNG sector has now popped.

LNG was touted as the savior of the Canadian gas markets, destined to ship gas overseas to be sold for 2-4 times domestic prices. The theme was so prevalent that it was estimated about CDN$200 billion would be invested in Canadian LNG alone, and even the mere mention of LNG was enough to give companies a boost in share price.

Nevertheless, I stuck to my numbers, and our thesis came to fruition much earlier than we anticipated with Petronas just this past week putting BC LNG on hold by delaying its final investment decision into the BC LNG sector, citing two items:

- capital expenditures cost overruns; and

- international weakness in energy prices.

So why was I so bearish before anyone else in Canada on BC LNG?

First, there are just too many liquefaction facilities planned. Over the next five years, LNG production is set to increase by more than 30%, with Australia leading the wave of expansion.

Australia has significant customers in Asia which are just on its door step. Australia being first also means that the United States and Canada are significantly late to the game.

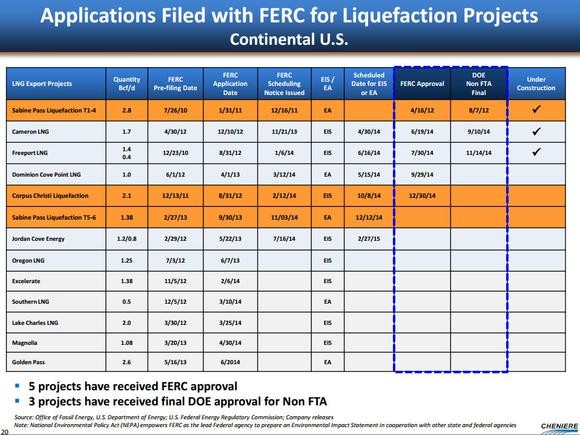

Many companies in the US have applied for a chance to build liquefaction plants, with Cheniere Energy (LNG) hoping to begin exporting in 2015. However, even if only half of the planned facilities make it through construction, there will still be a significant glut in LNG supplies.

Second, cost overruns will deteriorate the majority of profits. The project costs for both brownfields (existing developments) and greenfields (new developments) are going to see dramatic increases over the next few years:

Just look at Australia, where labor shortages, cost of materials, and weather have wrecked LNG project budgets and extended deadlines. Chevrons Gorgon LNG project was budgeted for $37 billion when it first began construction on Barrow Island in 2009 and was set to be completed 2014. The deadline has now been pushed to late 2015 with a final price tag escalated to be approximately$54 billion. Chevrons Wheatstone LNG project is also suffering from the same setbacks. The project began in 2011 with an expected cost of $26.4 billion and with its first cargo being delivered in 2016. The plants price tag is currently at $29.7 billion, with deliveries expected in 2017. The reality is that major LNG projects are normally in the middle of nowhere, and labor and resources are hard to come by; LNG is becoming a victim of its own success.

Third, the demand for LNG is not as rosy as everyone makes it out to be. Most of the worlds LNG is bound for East Asia, as Japan and South Korea account for over 50% of LNG imports. The Fukushima disaster in Japan made the country even more reliant on LNG. With nuclear power unavailable and natural gas its only source of peak-load power, Japans power authority had to scramble to import enough LNG to keep the countrys lights on and its industries running. However, as Japan begins restarting its nuclear power plants, one of the largest markets for LNG will drop considerably, and no other country will come close to filling the void that Japan will leave behind. In November, Kagoshima Governor Yūichirō Itō approved the restart of two reactors at Sendai despite public concerns. This was the final step before the reactors restart in the new year, which is a huge milestone moving forward.

Its no secret that Japanese Prime Minister Shinzō Abe is very pro-nuclear and understands that the prolonged shutdown of nuclear power plants is hurting the Japanese economy. Abe has made it clear hed like to restart Japans nuclear power plants. If that comes to pass as we expect, LNG demand in Japan would drop significantly.

Thus, the combination of increasing supply, significant cost overruns in building natural gas liquefaction plants, and decreasing demand led to a weak LNG market. When combined with the rise of spot contracts, this is all bearish news for LNG operators and producers. North American facilities may find it difficult to compete with LNG plants in Australia, Eastern Russia, Qatar, and Southeast Asia for the all-important East Asian market. The amount of LNG growth in Australia could easily depress prices worldwide and discourage further development of LNG in America, particularly if the Henry Hub price stays near todays levels.

Petronas deferment of the Pacific Northwest LNG project off British Columbias west coast is the first of many in North America. The event was one of many that vindicated the controversial thesis we put out in the beginning of the year. Nevertheless, due to the reasons we outlined in this article and accompanied by the decline in commodity prices, expect to see more major projects mothballed and continued selling pressure in the LNG sector. We congratulate our readers who didnt jump on the LNG bandwagon and were patient with this investment.

But this is all good news to me, as Im a contrarian value investor. Blood in the streets? Now Im interested. Fortune favors the bold.

So how can we profit from the blood in the energy markets? Easy.

If you agree today to try my newsletter risk-free for three months, youll get the news and our newest recommendation at the same time as our current subscribers.

Theres no risk to you: If you dont like the Casey Energy Report or dont make any money over your first three months, just cancel within that time for a full, prompt refund, no questions asked. Even if you miss the three-month cutoff, cancel anytime for a prorated refund on the unused part of your subscription.

As a subscriber, youll receive instant access to our current issue, which details how to protect yourself falling oil prices, plus our current top recommendations in the oil patch. Also, as a new subscriber, youll get access to all the past issues and the current portfolio on the website. Do your portfolio a favor and have me on your side to increase your chances of success.

Also, an open invite to all Casey subscribers who happen to be in Vancouver, BC, Canada: