Vanguard Mutual Funds Vs ETFs

Post on: 8 Июль, 2015 No Comment

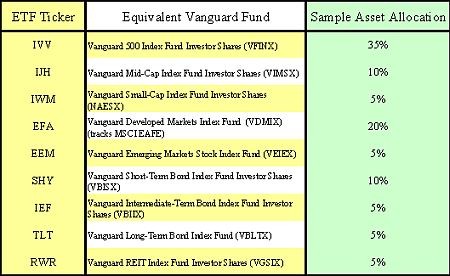

Vanguard funds have some of the lowest expense ratios in the industry. Almost all of Vanguards ETFs have a corresponding mutual fund that either track an asset class or an index. But then, for an investor, deciding between a Vanguard ETF and mutual Fund is just not a trade-off between convenience and flexibility, although it may seem so. The cost structure between Vanguards ETFs and mutual funds are actually quite different.

I decided to take a closer look at some of Vanguards funds.

Vanguard ETFs vs. Mutual Funds

Vanguard Short Term Bonds

The results speak for themselves. If your trading commission is low and if you dont trade frequently, in most cases, ETFs seem to be a better deal. Atleast one of Vanguards mutual funds (VEIEX), had a purchase fee, redemption fee and an expense ratio! VEIEXs ETF peer doesnt carry any restrictions and its expense ratio is lower than VEIEXs ER. You need to pay careful attention to costs when deciding between Vanguards mutual funds and ETFs.

Although for most of Vanguards mutual funds, the minimum required is around $3,000, some funds like the Vanguard Tax-Managed International Fund (VTMGX) have a high barrier to entry with a minimum investment of $10,000.

From what I see, the advantages are tilted heavily towards Vanguard ETFs.

Why Vanguard?

Vanguard was founded by the legendary investor, John Bogle. Bogle was is credited with having created the first index fund, the Vanguard 500 Index fund in 1975. At a time when actively managed mutual funds were all the rage, Bogle advocated passive funds with emphasis on low costs and zero loads. Bogle believed that costs matter as much as returns and as a result, Vanguard funds have low expense ratios when compared to its peers.

Today, Vanguard is the worlds largest no-load mutual fund company with over $1.8 trillion in assets under its belt. Vanguards company structure is also little unusual. A regular investment firm has to make money for its investors and its shareholders, often at the expense of each other.

At Vanguards, each fund contributes a certain amount towards management overhead, thus pooling the money back into the firm. Vanguard specializes in indexed funds since they pioneered this concept. With the explosion of ETFs, Vanguard also started offering ETF equivalent to most of its indexed mutual funds.

Along with Schwab and Fidelity, Vanguard too started offering commission-free trades of its ETFs .

This is for informational purposes only and not a recommendation to buy or sell securities mentioned in this post. While every effort is made to ensure accuracy of the data presented here, the author is not responsible for errors or omissions.