Vanguard Mutual Funds v Which Are Better

Post on: 6 Май, 2015 No Comment

When Vanguard lowered its stock and ETF trading fees this week, I received an email from Eric, one of the long time readers of Bargaineering. He wondered if this made Vanguard ETFs superior to their mutual funds, to which I was pretty sure the answer was Yes.

You have to make the assumption that the mutual fund and the ETF will track the underlying index in the same way. If theyre run by the same company, in this case Vanguard, I think this is a fairly safe assumption to make. If there is no tracking error, then it comes down to costs. Whichever investment is cheaper, wins.

Mutual Funds vs. ETFs

Heres a quick recap on the practical differences between mutual funds and ETFs: Exchange traded funds (ETF) are mutual funds you can buy and sell throughout the day. There are underlying structural differences in how theyre created, but for our purposes thats the only practical difference.

The Trade-Off

The trade-off was that mutual funds tended to have larger minimum investment requirements but you could get into them for free (a mutual fund company doesnt charge you money to buy and sell shares of the fund). Youll pay a transaction fee when you buy and sell shares of an ETF, like any other stock.

If your plan is to accumulate shares and dollar cost averaging, mutual funds make more sense because of the transaction fees. Once you reach the initial minimum, additional investments limits are much lower. For Vanguards 500 Index, the minimum initial investment is $3,000 but additional investments are only $100. For the Fidelity Spartan 500 Index, the minimum initial investment is $10,000 but there is no minimum additional investment amount.

Are ETFs Better?

It comes down to costs. Now that Vanguard gives free ETF trades, you need to compare their expense ratios. The Vanguard Total Stock Market ETF (VTI) has a mutual fund version, VTSMX (Investor Shares) and VTSAX (Admiral Shares). It turns out that the expense ratio of the ETF is the same as the Admiral Shares, which normally requires you to have a $100,000+ balance in that fund. The Investor Shares fund, VTSMX, has an expense ratio of 0.18%, versus the 0.07% of the ETF and Admiral shares.

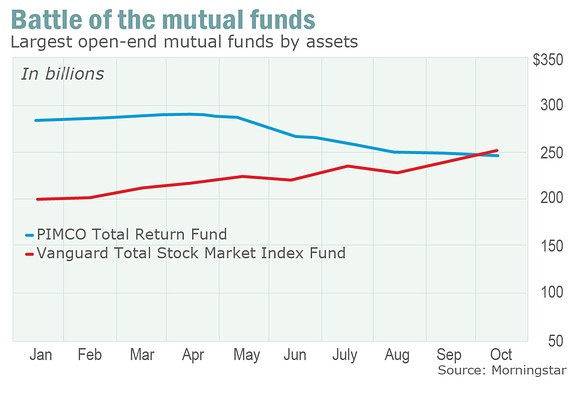

Based on Vanguards own charts, it appears the ETF is better. The ETF is the blue line, whereas the mutual funds, in yellow and red, are below it in the return chart. The chart may be inaccurate as wed expect there should greater divergence at the end, reflecting the Investor class shares higher expense ratio. Whatever the case may be, the ETF doesnt perform any differently than the mutual fund and now its cheaper.

It appears that, with these fee changes, Vanguard ETFs are superior to Vanguard Mutual Funds of the same type.