Vanguard ETF Review 7 Reasons Why You Should Buy Vanguard ETFs

Post on: 8 Июль, 2015 No Comment

Our Vanguard ETF Review Explains Why Vanguard ETFs are Worth Your Investment and How to Buy Vanguard ETFs

Vanguard is like a credit union versus a bank. The shareholders of the Vanguard funds own Vanguard. That means the profits go to the individuals who own Vanguard ETFs, not to outside investors. Also, Vanguard created the first index fund and their ability to follow an index has proven to be the best in the industry. More importantly, Vanguard is the low-cost leader. They have a belief system that cost matters and numerous studies demonstrate that cost is one of the biggest determinants of future performance.

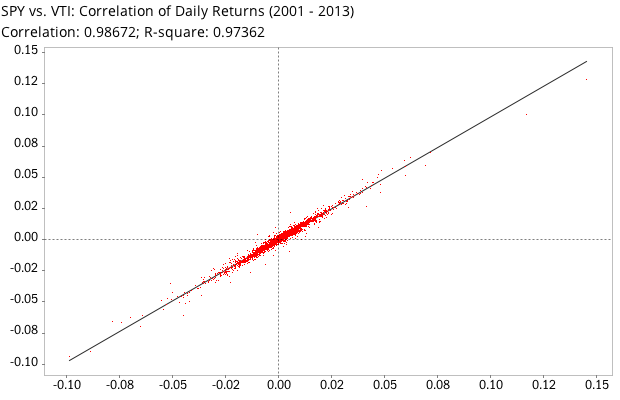

On average, Vanguard ETFs do a better job of tracking an index at a lower cost than other ETFs. This is a good reason to learn how to buy Vanguard ETFs. We use ETFs to buy an index, and we are looking for those ETFs that have the least portfolio drift for the least cost. Vanguard ETFs consistently come out on top in our ETF analysis. See my article ETF Fees Explained to learn about the six ETF expenses and one offsetting income.

Vanguard ETF Review Question 1

Even a company as great as Vanguard does not have the answer to every investment question. We use Vanguard ETFs to create our core portfolios, which are designed to hold a majority of the investment assets. We use other ETFs for our satellite portfolios, such as our Small Cap ETF or Dividend ETF satellites, which are smaller portfolios, designed for additional concentration in an area of interest or need.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Vanguard ETF Review Question 3

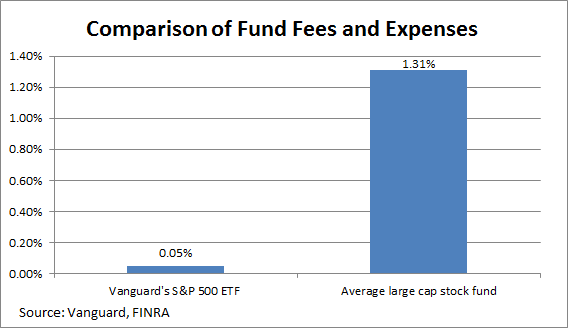

I understand that Vanguard ETFs are low cost but how much does it matter?

“ under plausible conditions, a person saving for retirement who chooses low-cost investments instead of higher-cost ones could have a standard of living throughout retirement [that’s] more than 20 percent higher.”

This quote comes from Dr. William Sharpe (Nobel Prize Winner) from an interview on April 18th, 2013 with Stanford Graduate School of Business entitled “William Sharpe: How to Invest in a Turbulent Market”. The article was authored by Bill Snyder.

“ there’s no reason to pay an expensive management fee to invest in a mutual fund when super-low- cost index funds that mimic large indexes like the Standard & Poor’s 500-stock index are available,” he says. “If they are incurring large expenses in connection with their investing,” says Buffett, “they are making a big mistake.”

This quote comes from a USA Today article on October 26th 2013 entitled “Warren Buffett. Top 3 Investing Mistakes to Avoid”. The article was authored by Adam Shell.

No one can control the markets. However, you can control how much money you spend on investments, including the fees that can take a bite out of your total returns. By choosing to invest in funds with the lowest costs, you get to keep more of the money you make from growth and upside. You get what you pay for does not apply to investing. When you consider how to buy Vanguard ETFs, you must realize that higher fees often do not mean better performance. Research shows that lower fees yield higher returns. Herein lies one of the only aspects of investment returns that you have the power to control yourself: Choosing the most cost-effective investments. Every mutual fund and ETF charges fees that can have a dramatic impact on your ability to create a secure retirement – see the figures below for examples of what a difference this makes.

Vanguard ETF Reviews Question 4

How do Expensive Funds Compare to Inexpensive Funds

Taking the 5,375 stock mutual funds and ETFs with at least a 15-year track record, ending November 30, 2014, and buying the bottom 25 percent lowest-cost funds, instead of the top 25 percent highest-cost funds, would have resulted in a higher return for the lower-cost funds during the past one-year, three-year, five-year, 10-year and 15-year time periods.

As the chart below demonstrates, the same concept of lower costs creating higher returns can be seen even when you look at different asset classes within the universe of mutual funds and ETFs discussed above.

This simple choice of a lower-cost fund is better than anything you could get from sophisticated trading software or even an old crystal ball. By opting for lower cost investments, you would have increased your wealth at a faster rate in every period. See Best Low Cost Index Funds for Highest Portfolio Returns for more great low cost investing information.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Vanguard ETF Reviews Question 5

How do Vanguard ETF Costs Compare to Other Investments

Source: Morningstar

Many people assume they are paying more for an investment to get better advice and better returns. Extensive costs studies, such as those demonstrated above, show that, on average, you are not getting extra value for your money; you are actually getting less return, which can dramatically impact your wealth creation.

The following chart demonstrates the effect of cost on your net worth. Assuming a gross return of 10 percent and subtracting the average net expense ratio for each type of investment results in significant investment value differences in the long term.

Subtracting the average net expense ratio of the ETF from the hypothetical 10 percent gross return nets the investor $28,538 versus the hypothetical net return of the mutual funds, and using the average net expense ratio of the Vanguard ETFs nets the investor an incredible $50,270 during a 15-year timespan.

Vanguard ETF Review Question 6

How Do I Buy Vanguard ETF Funds and Pay Zero Commission

If possible, open a Vanguard brokerage account and you can buy Vanguard ETFs commission free. Many of the Vanguard ETFs are also available commission free at TD Ameritrade. Also, see Low Cost Investment Ideas: Commission Free Vanguard ETFs

How should I Invest in Vanguard ETFs

I have created 6 risk-adjusted, globally balanced Vanguard ETF portfolios in my free Retirement Income Builder Report report.Here is a sample Vanguard Global ETF Portfolio.

Download 6 Easy-to-Copy, Risk-Calibrated, Vanguard ETF Portfolios

This report is full of critical information for the Vanguard investor. Find out how to combine Vanguard ETFs into a portfolio. I disclose my Retirement Income Builder Program and I share my 6 risk-calibrated, easy-to-copy Vanguard ETF portfolios.

Click on the link below and I will email the report to you. You will also have the option of receiving my free email newsletter where you can see my best articles, delivered to your inbox, before anyone else.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Remonsy ETF Network exists to enhance your life-long investing success by providing independent and authoritative investment advice you can trust. Landmark academic financial studies, proprietary in-depth research and over a quarter century of real world financial advisory experience during good times and bad provide the foundation for our time-tested, proven investing guidance. And most important, we work only for you: We dont hold or manage your money. We dont earn trading commissions. And we dont take money from investment companies.