Vanguard ETF Portfolio Strategies TaxEfficient Investing

Post on: 31 Март, 2015 No Comment

How to save money with a tax efficient ETF portfolio

Taxes are a cost that can slow down the accumulation of wealth. The stock market is uncontrollable, but understanding the tax strategies of tax efficient investing is one of the controllable events in portfolio creation that the wise investor learns to master. In this article, we provide you with tips for building a tax efficient ETF portfolio.

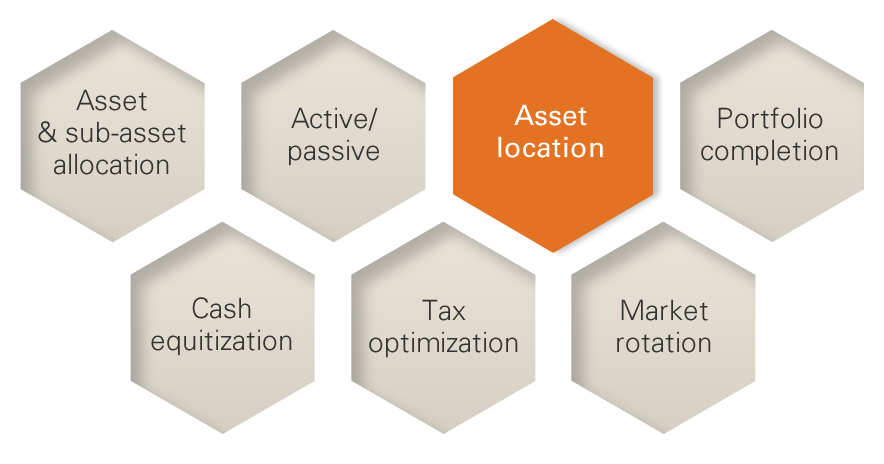

You have many possible ways to save taxes on investments. You can use ETFs, which are generally more tax-efficient than mutual funds. You can employ tax-loss harvesting to capture any current losses. You can buy ETFs that produce qualified dividends with special low tax rates, but we will focus on one of the more important decisions you will make, which is called asset location.

Assets are placed into different types of investment accounts, and these accounts can have different tax treatments. Investment accounts can be taxable, such as a jointly owned brokerage account; tax deferred, such as an IRA or 401(k); or tax free, such as a Roth IRA. Asset location (the assets you place in which type of account) is one important determinant of long-term performance. In general, you want to place your most tax-efficient investments into your taxable accounts, and the least tax-efficient holding in your tax-deferred accounts.

Tax Efficient Investing Tip How to figure out the tax efficiency of the Vanguard ETFs for building a tax efficient ETF portfolio

In order to figure out what investments to place in what type of account, you must first have a method to rank your investments by their tax efficiency.

At Remonsy ETF Network, we make extensive use of the Morningstar Tax Cost Ratio to determine an ETFs tax efficiency.

The Morningstar Tax Cost Ratio represents the percentage-point reduction in an annualized return that results from income taxes, which excludes additional gains, taxes, or tax losses incurred upon selling the ETF. State and local taxes as well as individual-specific issues are ignored.

Morningstar gives the following example: If a fund made short-term capital gains and income distributions that averaged 10 percent of its NAV during the past three years, an investor in the 35 percent tax bracket would have a tax-cost ratio of 3.5 percentage points.

Remonsy 5 Factor Investing is in a specific order for a reason. Asset allocation decisions have the most impact on your total return, and lowering the cost of your investments applies to everyone. The effect of taxes is variable for each person depending on where they have a majority of their assets, and their current tax bracket. In general, you want to create an asset allocation using low-cost ETFs, and then rank these ETFs by their Morningstar Tax Cost Ratio. If possible, place the ETFs with the highest Morningstar Tax Cost Ratio in your tax-deferred or tax-free accounts, and place your lowest Morningstar Tax Cost Ratio ETFs in your taxable accounts.

Can I see an example of how asset allocation works?

A simplified, real-world example may help explain this concept best. This example will be demonstrated using two existing Vanguard ETFs: the Vanguard Total Stock Index ETF (VTI), which tracks the CRSP U.S. Total Market Index that covers a majority of the United States stock market, and the Vanguard Total Bond Market ETF (BND), which tracks the Barclays Capital Aggregate Float Adjusted Bond Index that covers a majority of the United States bond market.

The assumption will be a five-year holding period ending November 30, 2013.

For this example, assume an investor has $500,000 in a taxable brokerage account and $500,000 in a tax-deferred IRA.

Compare what happens when the Vanguard Total Stock Market ETF is placed in the taxable account and the Vanguard Total Bond Market ETF is placed in the IRA as opposed to doing the opposite. For the purpose of calculating the investors after-tax returns, we will use a 35 percent tax rate for short-term capital gains, interest income, and non-qualified dividends, and a 15 percent rate for long-term capital gains and qualified dividends.

As you can see from this example, asset location would have made an incredible difference of $121,698 in after-tax net worth in just five years. The results may vary depending on tax bracket, but asset location is worth understanding.

Focusing on the controllable portions of investing leads to higher returns and net worth. Tax-efficient investing is an important controllable variable that often lacks attention in many investors’ portfolios. Applying Remonsy 5 Factor Investing includes executing all three parts of tax-efficient investing: Using tax-efficient ETFs, tax-loss harvesting and using asset location to your advantage.

Would you like a happy retirement? Download our FREE report Retirement Income Builder: 6 Easy to copy Vanguard Global Portfolios with time-tested retirement planning advice for every investor. Learn more.

Remonsy ETF Network exists to enhance your life-long investing success by providing independent and authoritative investment advice you can trust. Landmark academic financial studies, proprietary in-depth research and over a quarter century of real world financial advisory experience during good times and bad provide the foundation for our time-tested, proven investing guidance. And most important, we work only for you: We dont hold or manage your money. We dont earn trading commissions. And we dont take money from investment companies.