Value vs Growth vs Index Investing Which is Best

Post on: 22 Август, 2015 No Comment

Which is Best? Definitions, Comparisons, Strategies, History and Charts

Which is best — growth, value or index funds? Take a look at the data. Getty Images

The value vs growth debate is as old as investing itself. Which is best, value or growth? When is the best time to invest in value stock mutual funds. When is the best time to invest in growth stock mutual funds? Is there a smart way to balance both value and growth in one mutual fund? What happens to the debate when we enter index funds into the comparison?

Definitions of Value, Growth & Index Stock Funds

- Value stock mutual funds primarily invest in value stocks. which are stocks that an investor believes are selling at a price that is low in relation to earnings or other fundamental value measures.

- Growth stock mutual funds primarily invest in growth stocks. which are stocks of companies that are expected to grow at a rate faster in relation to the overall stock market .

- Index stock funds seek to mimic the price movement of a particular index. which is a sampling of stocks or bonds that represent a particular segment of the overall financial markets. For example, the Standard & Poor’s 500 (S&P 500 ), is an index representing roughly 500 of the largest US companies (large-cap stocks), such as Wal-Mart, Microsoft and Exxon Mobil. This article will also analyze the S&P Midcap 400 (mid-cap stocks ) and the Russell 2000 (small-cap stocks).

The Debate: Strategies and Comparisons for Value & Growth

There is no doubt that value stocks generally perform better than growth in certain market and economic environments and that growth performs better than value in others. However, there is no question that followers of both camps—value and growth objectives—strive to achieve the same result—the best total return for the investor.

Much like the divides between political ideologies, both sides want the same result but they just disagree with the way to accomplish that result (and they often argue their sides just as passionately as politicians)!

Value investors believe the best path to higher returns, among other things, is to find stocks selling at a discount; they want low P/E Ratios and high dividend yields .

Growth investors believe the best path to higher returns, among other things, is to find stocks with strong relative momentum; they want high earnings growth rates and little to no dividends.

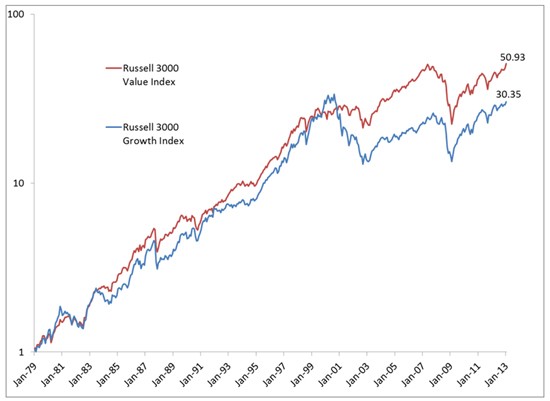

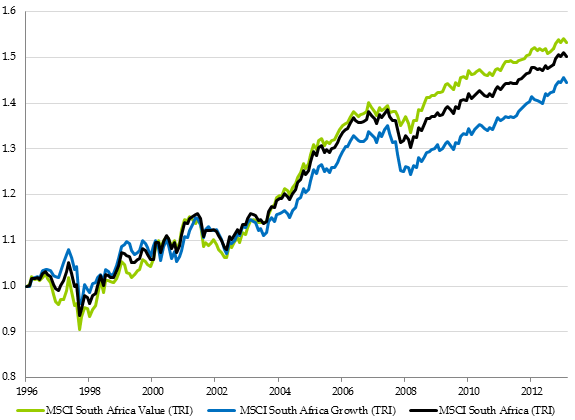

Value vs Growth: Perspective on Returns

It is important to note that the total return of value stocks includes both the capital gain in stock price and the dividends, whereas growth stock investors must rely solely on the capital gain (price appreciation) because growth stocks do not often produce dividends. In different words, value investors enjoy a certain degree of dependable appreciation because dividends are fairly reliable, whereas growth investors typically endure more volatility (more pronounced ups and downs) of price.

Furthermore, an investor must note that, by nature, financial stocks, such as banks and insurance companies, represent a larger portion of the average value mutual fund than the average growth mutual fund. This oversize exposure can carry more market risk than growth stocks during recessions. For example, during The Great Depression. and more recently The Great Recession of 2007 and 2008, financial stocks experienced much larger losses in price than any other sector .

How Index Funds Compare to Value and Growth

Index stock funds are normally grouped into the Large Blend objective or category of mutual funds because they consist of a blend of both value and growth stocks. An index investor usually prefers a passive investing approach. which is to say that they don’t believe the research and analysis required for active investing (neither value, nor growth independently) will produce superior returns that are consistently higher than that of the simple, low-cost index fund. Index investors may also believe that the blend of both value and growth attributes can combine for a greater result — a one plus one equals three effect (or actually one-half value plus one-half growth equals greater diversity and reasonable returns for less effort).

10-year Performance Analysis: Value vs Growth vs Index

Now let’s let the numbers do the talking and do a bit of analysis following the chart, which consists of annual total returns on a year-by-year basis from 2002 through 2011: