Value Line Research Center

Post on: 24 Август, 2015 No Comment

Value Line Research Center

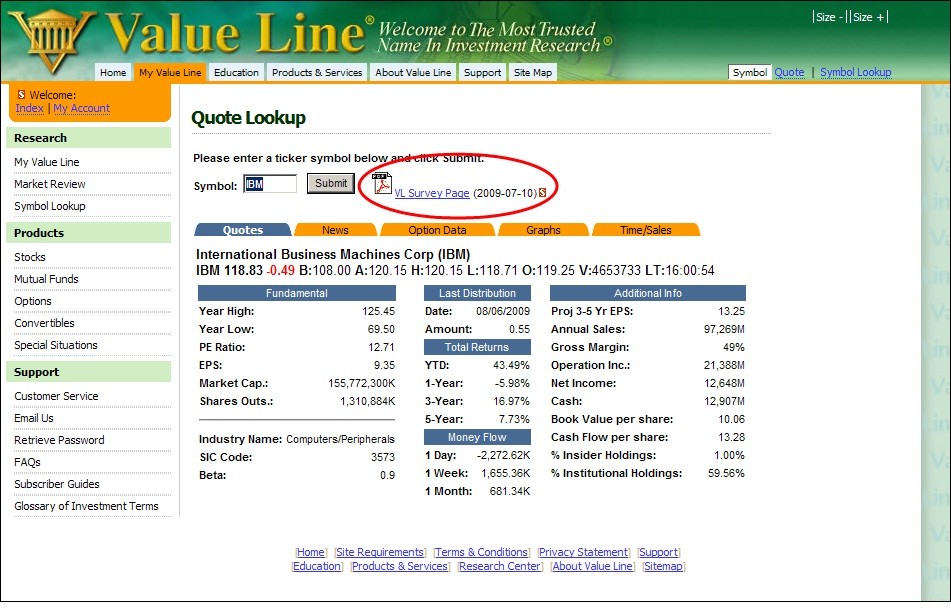

Value Line is a complete, multidimensional investment management solution that enables both new and experienced investors to make timely, better-informed decisions. It provides a wealth of in-depth financial information, intelligently presented both in print and online, plus objective research, insightful commentary, proven price projections, and advanced analytical tools.

In addition, The Value Line Research Center also provides users free delayed stock quotes, company news, extensive graphing, market updates, portfolio tracking with alerts, Value Line Analyst Supplements in real time, educational programs and a great deal of free information from Wall Streets most respected source.

We have access to several reports/publications on this site:

- The Value Line Research Center includes on-line access to Value Lines leading publications covering stocks, mutual funds, options and convertible securities as well as special situation stocks.

- The Value Line Investment Survey online is one of the most highly regarded and widely used independent investment newsletters. Published weekly, it tracks approximately 1,700 stocks in over 90 industries. Its legendary Timeliness Ranking System ranks stocks on a scale of 1 to 5 for probable market performance over the next 6 to 12 months.

- The Value Line Mutual Fund Survey for Windows (Software & Weekly Updates) is a data/software service which includes extensive capabilities for viewing, sorting, screening, graphing, and preparing reports on mutual funds in the Value Line universe. It presents full data on approximately 13,000 funds, with monthly updates. Users also can access weekly performance updates online.

- The Value Line Fund Advisor is the essential, one of a kind, mutual fund investment guide that no investor wants to be without. Dont be overwhelmed trying to choose from thousands of funds. Well help you determine your risk tolerance and time horizon, and use this information to recommend a model portfolio of funds that is right for you.

- The Value Line Daily Options Survey delivers interactive daily analysis and rankings of more than 200,000 Stock and Stock Index Options — now with Bid and Ask Prices and Evaluations. Also included is access to Value Lines powerful Online Options Screener.

- The Value Line Special Situations Service is designed for investors seeking investment ideas in small cap stocks that span the range from aggressive to income oriented. Value Lines team of special situation analysts maintains a constant search for the very best small cap companies, sifting through hundreds of annual and interim reports, prospectuses, SEC filings, and press releases in their quest. Published monthly, each issue features two new recommendations; an agressive stock from a high-growth industry, and a conservative stock from a more stable industry that may pay dividends.

- The Value Line Convertibles Survey provides a unique, systematic approach to assessing the performance of convertibles, ranking over 600 issues for potential risk and return, showing you which convertibles make the best buys, and which ones should probably be sold.

- Value Line Select provides subscribers a 15- to 20-page detailed report recommending a specific stock, on a monthly basis. The portfolio manager and the Select committee, composed of senior research personnel, meet regularly to discuss and identify high-quality companies whose stocks have superior total return potential. Once a stock is recommended, subscribers are kept abreast of developments through Supplementary reports that include updated Buy, Hold, or Sell recommendations.

- Value Line ETF Professional Solution is a comprehensive online resource offering data, tools, analysis, and education on all ETFs listed in the United States and Japan. Provided in the ETF Survey is Value Lines proprietary Ranking System which quantitatively evaluates and ranks each ETF based on actual and known data. As the number of ETFs available continues to grow and the complexity of these funds increases, the Value Line ETF Survey will allow users to easily navigate toward the funds that best match their investment needs.

Rights

- Concurrent users:

- Permissions:

- Restrictions:

- ILL:

- Authorized users:

- Resource advisory: