Value Averaging Investing Information research and examples

Post on: 23 Апрель, 2015 No Comment

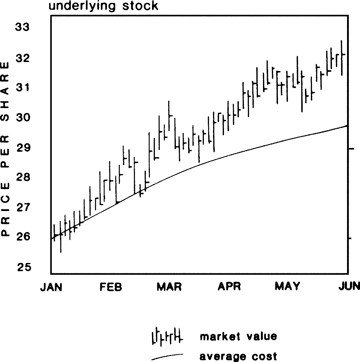

When the stock market is in a downturn, doesnt it make sense to increase contributions to your investment accounts, thus buying more shares at a lower price? And when the market has rebounded and is at a high, would it not make sense to scale back contributions, buying fewer shares at the higher price or even selling shares at a profit?

What the above question is asking about is an investment strategy called Value Averaging (VA).

The purpose of this website is to introduce you to the concept of VALUE AVERAGING and to show how it can be used to increase the value of your investment portfolio over time.

The concept of Value Averaging is not new. It was first written about by Harvard Finance Professor and former Nasdaq Chief Economist, Michael E. Edleson, back in 1988. Edleson went on to publish a book dedicated to the topic of Value Averaging copyrighted in 1993. His book provided significant detail on Value Averaging and specifically the math which supports the fact that Value Averaging can produce higher investment returns as compared to other investment approaches. There have also been detailed studies completed by Professor Paul S. Marshall (Journal of Financial and Strategic Decisions, 2000) and by Professors Leggio and Lien (Journal of Financial Planning, 2003) comparing Value Averaging to other investment strategies.

Studies outlining this investment strategy can be found in the research section of this site.

The power of the Value Averaging method derives from its marriage of two proven but separate techniques: Dollar Cost Averaging and Portfolio Rebalancing .

Dollar Cost Averaging (DCA) and its variations, such as Value Averaging (VA), offer investors an alternative, allowing them to ease into the market over time, which reduces the timing risk. The mechanical aspects of Value Averaging provides an investment discipline, requires no market forecasts and is relatively simple to initiate. More and more mutual funds are offering automatic investment and exchange programs a cruise control for your investment plan that eliminates the more routine aspects of maintaining an averaging plan.

Statistical research has shown that over time there is no real difference between DCA vs. lump sum investing (see research papers ), therefore there is really no real benefit to an investor to using a DCA strategy. The only benefit is reduction of the risk level and probably peace of mind to the investor.

Value Averaging on the other hand, has statistically been proven to outperform other investment methods, especially in periods of high market volatility. A VA fund or investment program will inherently reduce an investors risk level and enhance their investment returns.

Please browse through our website to learn more about the power of the Value Averaging method and feel free to contact me with any questions that you may have.