Using Portfolio Diversification to Reduce Investment Risks

Post on: 3 Апрель, 2015 No Comment

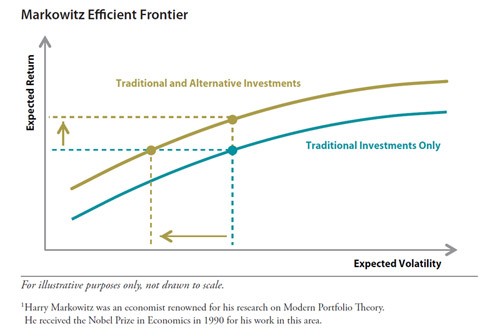

The goal of diversification is to reduce the risk involved in building a portfolio. Volatility is limited by the fact that not all asset classes or industries or individual companies move up and down in value at the same time or at the same rate. While this limits the rate of growth as well, it reduces the likelihood of substantial losses and allows for more consistent performance under a wide range of economic conditions.

Devising an asset allocation plan is the first step toward diversifying a portfolio. Dividing funds between different asset classes provides some protection against loss when one type of investment is underperforming. Because the values of different investments often move in opposite directions, investing in a range of securities reduces the risk that all assets will be decreasing in value at the same time. The process of diversification, however, does not end with asset allocation.

Within asset classes, it is important to purchase securities from a variety of industries, so that poor performance in one area will not send an entire portfolio reeling. Certain industries perform better under certain economic conditions, but a diverse portfolio should continue to build overall value under almost any conditions. Diversification should then continue even within industries by purchasing securities from a mix of companies that serve different roles within the industry. A single stock in a high-flying industry may still fail, but a group of ten diverse stocks within that industry will have lower volatility than just one would.

Learning enough about the many industries and companies that make up a diverse portfolio is no easy task. A great deal of research is required to make good decisions. For investors who wish to learn about a few specific areas to pick individual investments, mutual funds can fill in the gaps. Professionals design mutual funds to have a great deal of diversification built in. Even mutual funds that focus on a particular part of a particular industry will usually provide the chance to invest in a broad cross-section of that sector .

Index funds provide another option for diversification by giving investors the opportunity to invest in all of the stocks that appear in a certain index. While these funds vary widely in terms of the stocks they cover, they all provide the opportunity to tie the returns on invested funds to the performance of a large number of individual stocks. These funds differ from the actively managed funds discussed above in that the contents of the funds are determined independently by whoever maintains the index instead of relying on a fund manager who has the power to make decisions about where to invest the money.