UPDATE 4Plunge in 10 ETFs triggers flash crash memories

Post on: 26 Апрель, 2015 No Comment

Analysis & Opinion

* Prices on 10 new ETFS crash briefly at market open

* NYSE says limit orders were placed as market orders

* Nasdaq cancels related trades (Adds comment, background)

NEW YORK, March 31 (Reuters) — Ten new exchange-traded funds suffered their own mini flash crashes just after the stock market opened on Thursday, suggesting recent measures put in place to protect against violent market moves may not be enough.

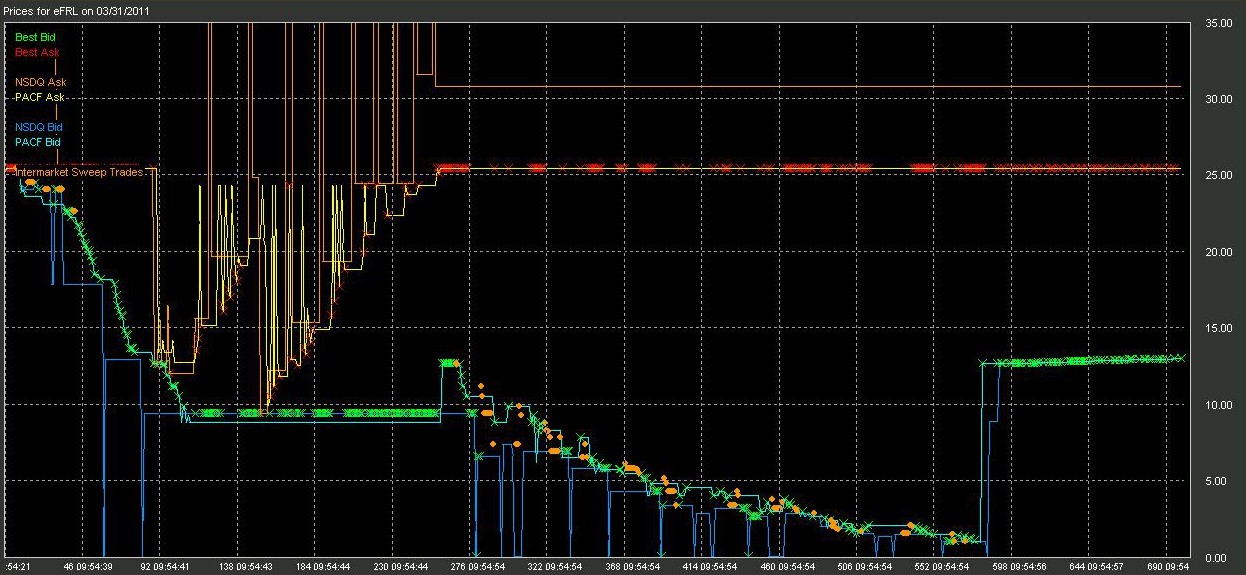

Nasdaq OMX Group Inc ( NDAQ.O ) said it canceled trades in 10 new ETFs sponsored by Scottrade affiliate FocusShares, some of which briefly plummeted as much as 98 percent.

The latest abrupt share drop comes on the heels of several sudden and unexplained plunges that remind investors of the May 2010 flash crash, which wiped out nearly $1 trillion in market capitalization in a few minutes and have kept retail investors wary of trading stocks.

I would be surprised if this (a flash crash) doesn’t happen again in the future, unless they really address these issues, said James Dailey, portfolio manager of TEAM Asset Strategy Fund in Harrisburg, Pennsylvania.

Mechanisms implemented after the May 6, 2010, flash crash, including single-stock trading halts on shares that have a price change of 10 percent or more during a rolling five-minute period, did not cover these new ETFs.

The New York Stock Exchange later said the errors occurred after market orders were entered that were intended to be limit orders. Under a market order a stock is immediately bought or sold at the best available price, while a limit order is meant to protect an investment by selling a share at a specific, requested price.

A FocusShares spokeswoman said a mispricing by a market maker triggered the faulty trades.

Exchange-traded funds own baskets of stocks, or other securities or commodities, and resemble mutual funds except that they are priced and traded in real-time on exchanges. In theory, the funds are supposed to track closely the value of an underlying index.

The plunge in the ETFs follows similar occurrences in other shares. Apple Inc ( AAPL.O ) shares dropped by more than 2 percent in just minutes before recovering in February. Last July, trading in Cisco Systems Inc ( CSCO.O ) shares was briefly halted after the stock fell more than 10 percent.

The new FocusShares ETFs started trading on Wednesday and are trying to compete with more established funds by offering lower costs for broad-market ETFs. Like many new ETFs, the FocusShares were illiquid and more prone to market fluctuations.

Nasdaq OMX canceled trades in all of the ETFs that were more than 10 percent lower in price than where they trading previously, calling them clearly erroneous.

The Focus Morningstar Healthcare ETF FHC.P fell as low as 60 cents after trading as high as $25.33, while the Focus Real Estate ETF FRL.P dropped to $1.48 from $25.50.

The canceled trades took place between 9:54 a.m. (1354 GMT) and 9:56 a.m. (1356 GMT) ,according to Nasdaq.

The FocusShares Focus Morningstar US Market Index ETF carries an expense ratio of 0.05 percent, less than broad-market ETFs from Schwab and Vanguard. The sector-specific ETFs have expense ratios of 0.19 percent.

Schwab’s US Broad Market ETF has a 0.06 percent expense ratio. The Vanguard Total Stock Market ETF carries an expense ratio of 0.07 percent, according to Vanguard. (Reporting by Rodrigo Campos and Angela Moon ; additional reporting by Chuck Mikolajczak and Edward Krudy; editing by Jeffrey Benkoe and Leslie Adler)