Understanding What Intangible Assets Are

Post on: 16 Март, 2015 No Comment

Investing Lesson 3 — Analyzing a Balance Sheet

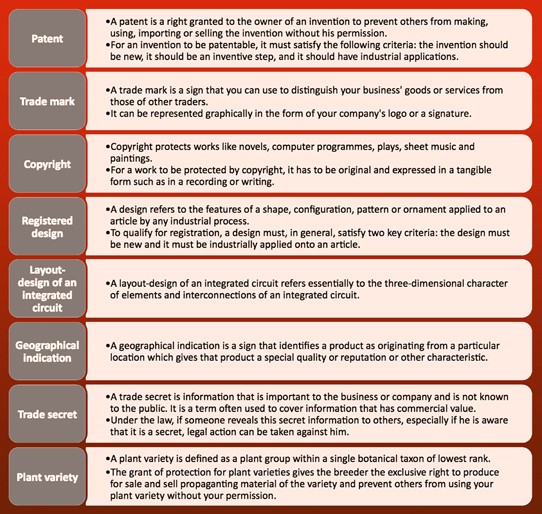

Companies often own things of value that cannot be touched, felt, or seen. These consist of patents, trademarks, brand names, franchises, and economic goodwill (which is different than the accounting goodwill we’ve discussed. Economic goodwill consists of the intangible advantages a company has over its competitors such as an excellent reputation, strategic location, business connections, etc.) While every effort should be made for businesses to carry them at costs on the balance sheet. they are normally given completely meaningless values.

To prove the point that the intangible value assigned on the balance sheet can be deceptive, here’s an excerpt from Michael F. Price’s introduction to Benjamin Graham’s The Interpretation of Financial Statements .

In the spring of 1975, shortly after I began my career at Mutual Shares Fund. Max Heine asked me to look at a small brewery — the F&M Schaefer Brewing Company. I’ll never forget looking at the balance sheet and seeing a +/- $40 million net worth and $40 million in ‘intangibles’. I said to Max, ‘It looks cheap. It’s trading for well below its net worth. A classic value stock!’ Max said, ‘Look closer.’

I looked in the notes and at the financial statements. but they didn’t reveal where the intangibles figure came from. I called Schaefer’s treasurer and said, ‘I’m looking at your balance sheet. Tell me, what does the $40 million of intangibles related to?’ He replied, ‘Don’t you know our jingle, ‘Schaefer is the one beer to have when you’re having more than one.’?’

That was my first analysis of an intangible asset which, of course, was way overstated, increased book value. and showed higher earnings than were warranted in 1975. All this to keep Schaefer’s stock price higher than it otherwise would have been. We didn’t buy it.

When analyzing a balance sheet, you should generally ignore the amount assigned to intangible assets. These intangible assets may be worth a huge amount in real life (Coca-Cola’s brand name is priceless), but it is the income statement. not the balance sheet. that gives investors insight into the value of these intangible items.

This page is part of Investing Lesson 3 — Understanding the Balance Sheet. To go back to the beginning, see the Table of Contents . If you have already read this lesson, you can skip directly to the Balance Sheet Quiz .