Understanding the time value of money from the Course Setting Your Financial Goals

Post on: 16 Март, 2015 No Comment

FAQs

Watch the Online Video Course Setting Your Financial Goals

1h 7m Appropriate for all Dec 01, 2014

Viewers: in countries Watching now:

Looking for a guide to the basics of money management and savings? Look no further! Author and CPA Ken Boyd helps you understand the basic principles of money management—financial planning, budgeting, managing debt, and investing—so that you can create a financial action plan that best suits your life stage and tolerance for risk.

Understanding the time value of money

- There’s a quote I like from Ralph Waldo Emerson, The ancestor to every action is a thought. The process of financial planning always starts with a thought or a goal. Maybe you want to save for a house or pay off credit card debt, the point is, you think about something that’s important to you, and then create a plan to reach that goal. Say that Julie takes a job that pays her $60,000 a year. She decides to invest $3,000 each year to accumulate a down payment on a house. Her financial advisor tells her that she can expect to earn six percent on her investments, and reinvest those earnings each year.

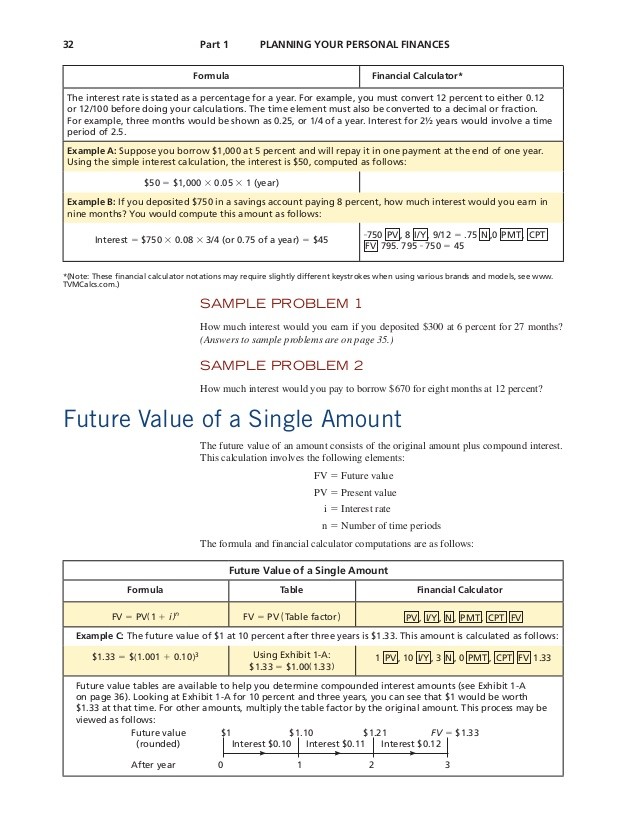

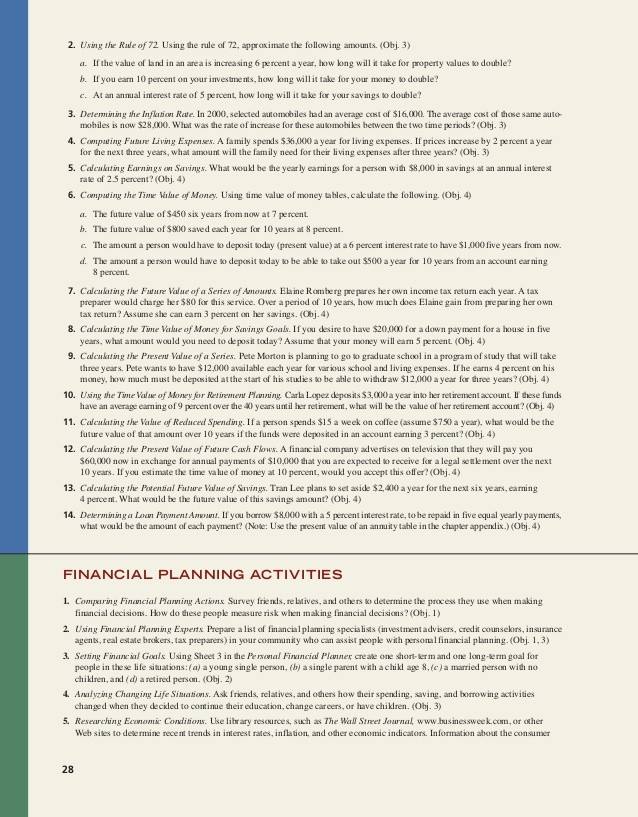

How much will Julie have at the end of five years? Well this question involves the concept of future value. Keep in mind that Julie is going to earn interest on her investment each year, because she is reinvesting her interest she will accumulate even more dollars. Fortunately, you can easily find tables on the web that will compute this answer for you. You’ll also find calculators that allow you to plug in numbers to get your answer. There’s one more term that Julie needs to understand before figuring out an answer.

She needs to know the future value of an annuity. An annuity is a series of equal payments. In this case the payments are $3,000 each year. At this point you can head to Google, and type in future value of an ordinary annuity. That search result will provide some tables that contain future dates, and interest rate assumptions. Nearly all tables list the number of years down the left side vertical axis of the table. The interest rates are displayed horizontally across the top.

Find five years on the vertical axis, and move across left to right until you find six percent. The number you will find should be 5.64 with rounding. Financial people refer to that number as the future value factor. If Julie multiplies $3,000 times 5.64 her answer is $16,920. That’s the amount she’ll have after investing $3,000 a year for five years.

Now here’s the reason I used a table rather than a calculator. Julie is investing for five years, note that the future value factor is more than five it’s 5.64. That’s because Julie is reinvesting her earnings each year. Using a table can help you understand the logic of the calculation. Okay, let’s change the example to explain present value. Here’s how present value differs from future value. Future value starts at today and moves forward.

Present value starts at the future date and works backward to the present day. The easiest way to connect these two concepts is to use the same years in interest rate. This time Google present value of an ordinary annuity table. Just like before, find five years on the vertical axis, and move across left to right until you find six percent. The number you find should be 4.21 with rounding, which is your present value factor. Now again, I use the table to reinforce the concept of present value.

You’re investing $3,000 a year for five years for a total of $15,000. When you multiply $3,000 times 4.21 you get $12,630. Why is the present value less than $15,000? Present value discounts the value of each payment based on a rate. Now, you have to be careful with language here. For future value think about the rate as an interest rate you earn on investment.

With present value, think about an inflation rate that makes each payment less valuable over time. The term rate means two different things depending on whether you’re talking about present value or future value. Inflation is defined as the overall increase in prices over time. Generally food, housing, gas, and other costs become more expensive over time. A dollar in your pocket today will buy more goods than that same dollar five years from now.

In this present value example we assume that each year moving forward a dollar buys six percent fewer goods. Our discount rate or inflation rate is six percent. A good example to visualize present value is retirement income. Assume that your financial advisor calculates that your investments will generate $50,000 in annual income. You’ve decided to retire in ten years. Okay, so how far will $50,000 get you 10 years from now? You’ll need to come up with an inflation rate for your assumption just like we did before.

Using a present value table you can find out what $50,000 is worth in today’s dollars. Take a few minutes and Google for a present value or a future value calculator on the web. If you’re using a series of annual payments you’ll use an annuity calculator. If there’s a single payment you’ll use a single sum or lump sum table, either term might be used. Plug in some years and some rates and see what you come up with.

The present value and future value calculators are a great tool for financial planning.