Understanding Stock Sector Rotation Select Sector ETFs

Post on: 3 Май, 2015 No Comment

by Silicon Valley Blogger on 2011-12-06 4

Have you ever considered investing in stock sectors? Here are some thoughts on the phenomenon called sector rotation.

While many long term investors may dabble in some level of sector investing for the purposes of diversification, perhaps by using sector specific mutual funds, ETFs, or even individual stocks, others may prefer to introduce some degree of market timing in the picture. These are investors who want to take advantage and exploit changes in market sectors over time, with the goal of possibly beating the market. There are a few ways to address stock sector rotation, which well discuss below.

Investing In Stock Sectors & Analyzing Sector Rotation

One thing that the professional money managers and investors are always looking for is a bargain. They don’t often buy at the high end of a stock’s range. Some of these professionals watch for otherwise good companies that have low stock prices or whose stocks have fallen out of favor. The same thing happens with sectors. If a sector looks like its underperforming the other sectors of the economy, this could signal a buying opportunity and professional investors look for those. Let’s look at a chart.

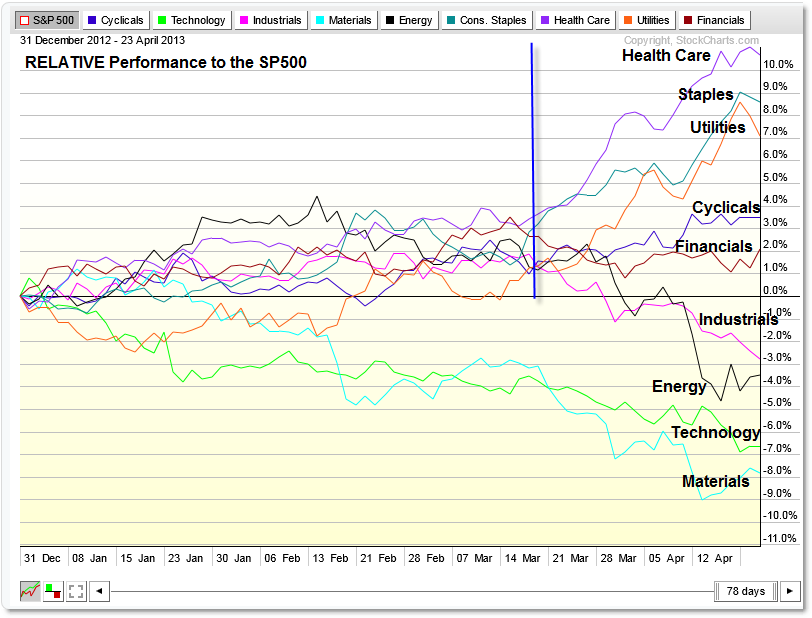

Figure 1. Sector Rotation. Please click the image for a larger picture.

The above chart shows each of the Select Sector Spider ETFs’ performance, with the S&P 500 as the baseline. Each of these ETFs tracks a sector of the economy, and the graph shows their movement compared to the S&P 500. This chart is useful for showing which group of stocks showed the most growth in a certain period. In this case, the period of time is November 2010 to July 2011.

Energy stocks massively outperformed all sectors. At a 22% growth rate, energy stocks far outpaced the next best performing group, Consumer Discretionary stocks coming in at just about 5%. The worst performing sector was the Financials sector, which was down 11%. Although we’re not focusing on diversification, it’s important to note that a 33% spread in performance illustrates how important it is to diversify your portfolio. Although you may be happy with yourself if you were investing only or primarily in energy stocks, for reasons we’ll look at next, putting all of your money into one sector is a bad idea.

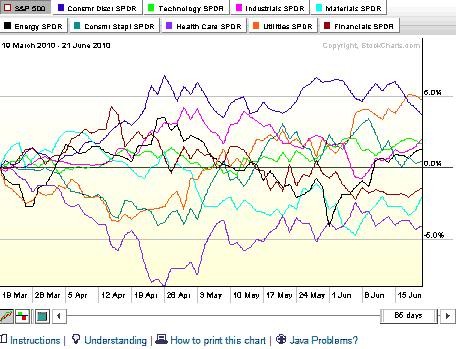

Figure 2. Sector Rotation. Please click the image for a larger picture.

Looking at the chart from July 2009 to March 2010, you wouldn’t have felt so confident about your energy investments for that period. By March of 2010, your energy sector names would have been down an average 15%! (Remember that these two charts are a weighted average of selected companies. Your energy sector names may have performed better or worse than what is represented in these charts.) This also tells us that in very general terms, if we look at the July 2011 gains of 22%, that’s an impressive but more realistic gain of 7% since March of the previous year. In other words, most of that 22% was about making up for previous losses.

Weve referenced the SPDR ETFs above. To invest in these sectors, you can check out this list of Select Sector ETFs: