Understanding Stock Market Indexes for Beginners Stock Investing Basics

Post on: 21 Май, 2015 No Comment

Understanding Stock Market Indexes for Beginners

What is common between the Sensex, Nifty, FTSE 100 and American S&P 500? Answer: They are the stock market indices of various countries. So the question arises: what is a stock market index? How does it help us in making investment decisions?

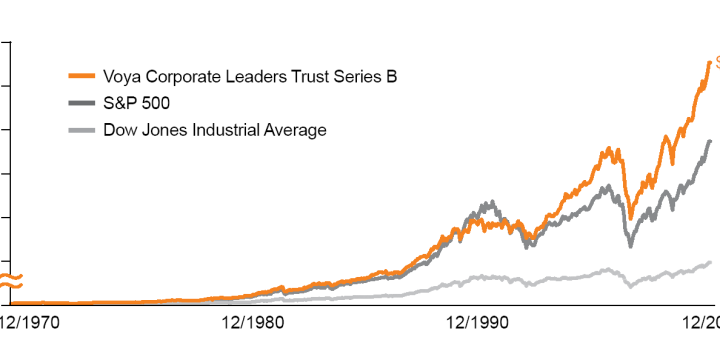

A stock market index is the basket of companies in the stock market, fulfilling certain criteria. These indices are used as a yardstick to check the performance of numerous financial instruments like mutual funds. Mutual funds that perform better than their benchmark index are said to outperform the market and those that perform poorer to the benchmark are said to underperform the market.

Now again stock indices can be segregated in numerous ways. The indices can be divided on the basis of the market capitalization of the companies like BSE 30, consisting of top 30 companies in terms of market capitalization in India, BSE Midcap comprising major midcap companies in India and BS SmallCap comprising the largest smallcap companies in India.

Next, market index can be divided on the area of operation of companies.

E.g. BSE IT is an index tracking the IT companies in Indian markets and BSE Realty does the same for Indian realty. Similarly there is NASDAQ comprising the IT companies in US, both American ones and the foreign ones listed on the US markets.

Now after the company is included in the index, it is given a certain weightage. This weightage can be decided on the market capitalization of the company, or on the basis of its price. The first type of index is also known as market-value weighted or capitalization-weighted index e.g. Hang Seng and the second one is price-weighted index e.g. Dow Jones Industrial Average. In the case of market-value weighted index, a couple of index heavyweights can significantly impact the movement of index, even though the other index components have not seen any major changes. But for price-weighted index, a change in the price of a single index constituent can impact the movement of entire index. (Find out about Share Trading. Also make sure to visit uBank Term Deposit.)

Now if the company does find the mention in the index, it does not mean it will remain there forever. The index components do keep on changing on a periodic basis, when either the market capitalization or the share price changes. So you need to keep a watch on the indices while making investments.

Index funds and ETFs rely heavily on the index composition. These are mutual funds designed to mirror the market indices. They invest in the index stocks in the same proportion as they are present in the index. E.g. if the index fund tracks the BSE 30, it will invest in the same shares as those of BSE 30. Now if Reliance Industries comprise 1/3 of BSE 30, the fund will also invest 1/3 of its corpus in Reliance Industries. Now if Reliance Industries comprises 1/4 of BSE 30, the fund will also reduce its exposure to the stock to 1/4. And if the stock is dropped from the index, the fund will also follow the suit. Hence if you have invested in any index fund or ETF, you need to keep a close watch on the change in the index composition.

The market is not for everyone. But those who can make it work can rake in the profits. Find out about Share Trading. Also make sure to visit uBank Term Deposit for your trading needs.