Understanding Mutual Fund Fees_2

Post on: 29 Март, 2015 No Comment

With over 15,000 mutual funds that account for over 20% of American’s household financial assets, mutual funds are one of the most widely debated investments choices. The majority of mutual funds are outperformed by indexes such as the S&P 500, and a large part of that can be attributed to fees built into the mutual fund.

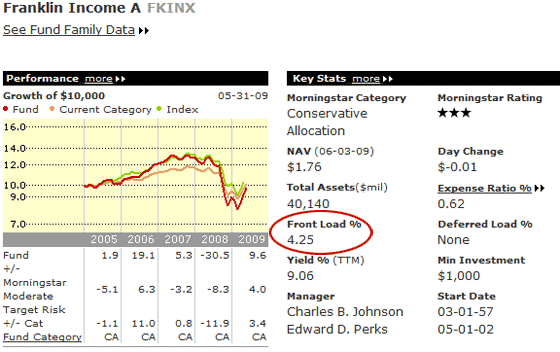

When you are picking out mutual funds you should take some time to look at the expense ratio. The expense ratio allows investors to compare expenses across funds by dividing the fees in the fund by the average net assets of the fund. It is important to remember that much of the time the funds historical return is stated without consideration of fees. Lets look at what the main types of fees are.

Distribution fees – These fees pay for marketing and distribution of the fund’s shares. These are the charges commonly referred to as 12b-1 fees and load fees. When looking for funds, keep an eye out for no-load funds as they don’t charge a fee in the beginning (front-end load), at the end (back-end load) and the 12b-1 fees can’t be greater than .25%.

Management fees — This is the fee paid to the manager of the fund and the sponsor of the fund.

Shareholder transaction fees – These are fees that pay for specific transactions. It’s important to remember that these fees are not included in the expense ratio discussed above.

Securities transaction fees – Mutual funds are a collection of securities that are continuously bought and sold. When these underlying securities are bought and sold expenses such as commissions may be incurred. These fees are also not included in the expense ratio. Usually the higher the turnover in the fund, the higher these fees will be.

Other fund expenses – The rest of the fees can usually be classified here, such as administrative and communication fees.

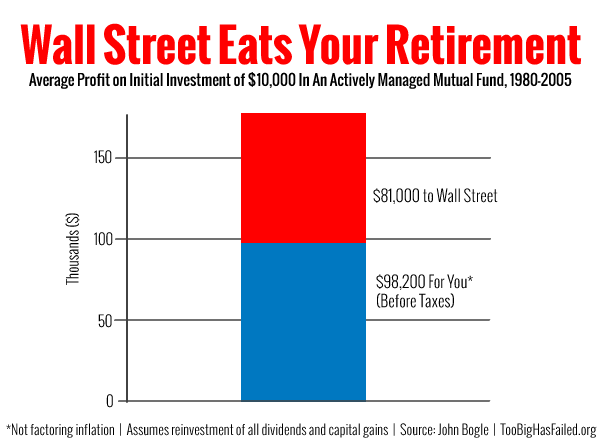

When it’s all said and done these fees can add up quickly for investors trying to hold a diversified portfolio. Research has shown over-and-over that one of the easiest ways to increase potential returns is to reduce the the percentage of fees you pay. This is a primary consideration in our investment management philosophy and is a common thread among other successful investors.

Investment Advisory services are offered through Regal Investment Advisors, LLC. a SEC registered Investment Advisor. Arbor Retirement Solutions, PLLC is independent of Regal Investment Advisors, LLC.