Understanding Investment Fees From Brokerage Commissions to Sales Loads

Post on: 26 Июнь, 2015 No Comment

As with most things in life, there’s no free lunch when it comes to investing. Whether you choose stocks, bonds, mutual funds, or some other type of investment vehicle to help you reach your goals, almost all investments have fees and expenses associated with them.

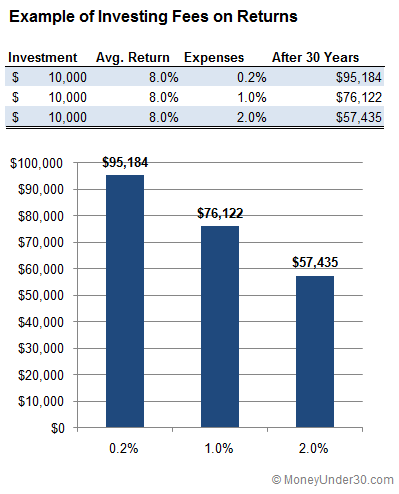

As an investor, it’s important to be aware of these costs because investment expenses directly affect the return of your investment; typically, the higher the cost, the lower the return after expenses. As such, lower cost investment options often make sense for many investors. Unfortunately, identifying low cost solutions isn’t always easy; while some costs are very visible and transparent, others are not.

Let’s explore some of the more common expenses that investors may encounter.

The Obvious…

Investment Advisory Fees

Rather than receiving compensation on a per transaction basis in the form of commissions, many investment advisory firms charge a fee for service. Known as investment advisory fees. these asset based fees are typically assessed as a percentage of assets under management and serve as compensation for the advice, service and investment decisions that the investment advisor makes on behalf of the client. A transparent cost to the investor, the investment advisory fee typically appears on client statements.

Custodial Fees

Assessed to cover the costs of safekeeping, recordkeeping and account reporting services that are provided by custodial firms, custodial fees are typically expressed as a percentage of assets under management, and are also included on client statements.

Typically associated with mutual fund shares, sales loads may be referred to as Front-End Loads (Class A shares), Back-End Loads (Class B Shares), or Level Load Shares (Class C Shares).

Front-end loads. or initial sales charges, are up-front fees that are assessed on each investment in the fund. Incurred immediately when one invests in a fund, the sales charge is expressed as a percentage of the amount invested and is built into the purchase price of the shares.

Back-end loads, or deferred sales charges, are an alternative to the traditional front-end sales charge. Rather than paying an up-front fee, investors are charged a contingent deferred sales charge if they redeem their shares within a certain time period – typically within the first five to six years from the date that the shares were purchased. It is important to note, however, that although the deferred sales load declines each year, annual distribution and service charges (the 12b-1fees) are typically higher than for front-end load shares, and may offset the declining sales charge. After a period of years, however, these distribution charges are typically reduced to be comparable to the 12b-1 fees associated with front-end load shares.

Level load shares have no upfront sales charge, but some funds assess a 1% fee if shares are redeemed within the first year of the investment. After the first year, any deferred sales charge is no longer applicable, however, investors are traditionally assessed 12b-1 fees that are greater than those of front-end shares for the life of the investment, thereby increasing the overall cost.

And Not so Obvious…

Expense Ratios

The expense ratio is an annual fee that is assessed to shareholders of mutual funds or exchange traded funds (ETFs). Expressed as an annual expense, this fee represents the percentage of assets deducted each fiscal year to cover fund expenses that include management fees, administrative fees, and 12b-1 fees, as well as operating costs and other asset-based expenses that are incurred by the fund. While not readily visible on investment confirmations or client statements, expense ratios are outlined and disclosed on the fund’s quarterly fact sheet and in the fund’s annual prospectus, and are a key measure of how expensive a fund may be compared to others.

Turnover Ratio

Although not a direct fee to the client, the turnover ratio is a measure of the fund’s trading activity. Each time a security is bought or sold within a portfolio the fund incurs a transaction cost, so logically, higher turnover results in higher cost.

Typically, funds hold cash in a portfolio in order to meet daily redemptions as well as to have funds available for potential transactions. Given that investors pay the fund’s expense ratio on 100 percent of the holdings, the fund is being paid to hold cash. In instances when the non-cash holdings generate a return that is greater than the earnings received on cash, investors are missing out on the higher return that they otherwise could have earned. This is known as an opportunity cost, and under these relative return conditions, it increases as the fund’s cash holdings increase.

Bid-Ask Spread

The bid is the price that someone is willing to pay for a security at a specific point in time, whereas the ask is the price at which someone is willing to sell. The difference between the two prices is called the bid-ask spread. If youre a seller, you receive the lower price (the bid), and if youre a buyer, you pay the higher price (the ask). This spread is often interpreted as an indication of liquidity, with less liquid securities having wider spreads. High turnover of securities with similarly wide bid-ask spreads typically leads to higher costs.

Brokerage Commissions

Whenever trading occurs in a mutual fund, there are commissions paid to a broker to execute the transactions. These commissions within the fund are not required to be disclosed, and are not transparent to the investor. Unfortunately, commissions generated by high turnover funds can reduce your return so it pays to understand a fund’s trading activity before you choose to invest.

So how should one apply this knowledge of investment expenses to the practical world of investing? Very simply, we believe that investors should try to better their investment experience by controlling those things that are within their power namely fees and taxes. While you can’t control the markets or your investment return, by choosing your investments carefully, you can control the fees you pay, and to some degree, the taxable distributions that you may receive from your portfolio.

While some firms may offer investment products that appear to have no fees, investors are wise to read the prospectuses and disclosure documents carefully; just because one can’t readily see the fees doesn’t mean that they don’t exist.

Symmetry believes in full fee transparency so that investors are fully informed as to the cost of their portfolios. Just because their fees are transparent, however, does not mean that Symmetry portfolios are expensive; in fact, quite the contrary. As an investor in Symmetry, you can be assured that your portfolio is consistently managed to be both cost and tax efficient, with both the obvious and the less apparent costs in mind.

This article was contributed by Symmetry Partners, LLC. an investment advisory firm registered with the Securities and Exchange Commission. The opinions expressed in this article are the authors own and do not necessarily represent the views of NerdWallet.

Photo Credit: Paying Money by Shutterstock

We want to hear from you and encourage a lively discussion among our users. Please help us keep our site clean and safe by following our posting guidelines. and avoid disclosing personal or sensitive information such as bank account or phone numbers. Any comments posted under NerdWallet’s official account are not reviewed or endorsed by representatives of financial institutions affiliated with the reviewed products, unless explicitly stated otherwise.