Understanding ETFs What Do You Need to Know SprinkleBit Blog

Post on: 11 Май, 2015 No Comment

Home DIY Investing Understanding ETFs: What Do You Need to Know?

One of the best ways to begin investing in stocks or to add diversity and depth to your current stock investing strategy is with exchange-traded funds, or ETFs. Since their arrival in the early 1990s, ETFs have soared in popularity with the average investor. Whether for a retirement fund, an investment portfolio or a college fund for a growing young investor, ETFs offer a remarkable hedge against risk, provide instant diversification and dont come with fees and murky rules associated with traditional mutual funds.

What Are ETFs?

ETFs are funds that are traded during market hours on all the major stock exchanges. Unlike individual stocks, funds contain pieces of many companies (from a few to thousands) in a single package. These packages almost always fall under the umbrella of one category, such as tech, bio/medical, foreign, industrial, etc. ETFs are no different, and they are available in essentially every sector imaginable.

ETFs dont require a ton of analysis. Since they track indexes, they are passive investments.

Minimums and Taxes

One reason for the wild popularity of ETFs is that unlike most traditional mutual funds there are no minimum investment requirements. Since they trade like stocks on exchanges (hence the name exchange-traded funds), an investor can literally buy a single share. Owners of ETFs also have much less exposure to taxes. Only when an ETF is sold at a profit does its former owner pay capital gains taxes.

Instant Diversity

Not putting all of your eggs in the same basket is one of the oldest adages in stock investing. When investing in stocks, there is always risk. That risk is mitigated when the stocks are spread around to avoid going down with the ship if one company falters. ETFs follow indexes, such as the Dow Jones Industrial Average (DIA) and the S&P 500 (SPDR).

When you invest in an ETF like these, youre putting your confidence not in one company, but all the companies in that index. If the index as a whole rises, your money grows.

Brokerage Firms

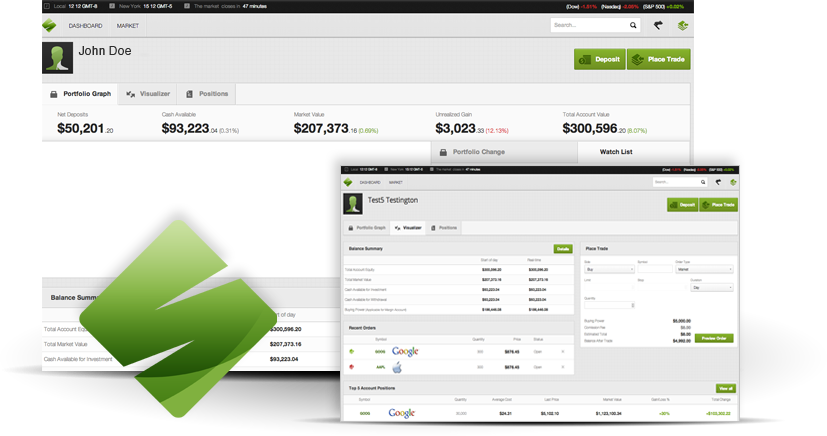

Since they trade like stocks, shares of ETFs must be purchased and sold by licensed brokers. This means the investor needs to go through a brokerage firm, which charges a fee. There are two types of brokerage firms: full service and discount. Full-service brokerage firms cost more but offer counseling, strategy and advice. Discount brokerage firms simply make the trade, reducing costs dramatically. The latter is all thats needed for ETFs, since youre not going after specific stocks that need to be analyzed.

Unlike traditional mutual funds, ETFs dont require a minimum investment.

ETFs offer incredible flexibility for people interested in investing in stocks. They can be bought and sold whenever the markets are open, they dont require a lot of money to begin investing and they avoid heavy tax burdens associated with traditional funds. ETFs are passive investments that track larger indexes, so they are a favorite choice of beginners or people who dont have the time to endlessly analyze individual stocks or complicated funds.

Andrew Lisa is a freelance business writer. He covers investing and profiles online writing services such as the top 10 article writing companies .