Understanding ETF What is an ETF and How Does it Work

Post on: 12 Июнь, 2015 No Comment

ETFs have become very popular in the recent years, however some investor’s still do not fully understand ETFs so here is a premier. We will discuss what an ETF is, how ETF works, advantages and disadvantages of ETF and compare ETF to Mutual Funds .

What is an ETF and How Does it Work?

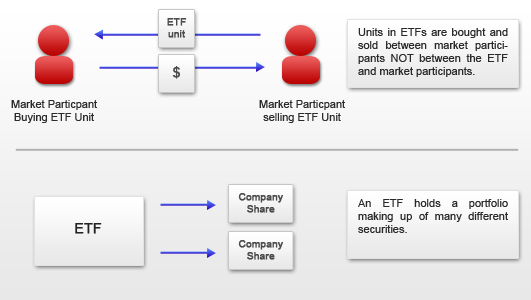

An ETF shares characteristics with both, Mutual funds and Stocks. It is like a mutual fund, in the sense that both are compromised of a basket of underlying investments, both contain several stocks and/or bonds. However an ETF usually tracks an index, like the Dow Jones or S&P500 and its goal is not to outperform the index but merely mimic its returns. A Mutual fund on the other hand is actively managed and the manager tries to beat the index. Let’s look at an ETF to make things a little more clear:

If you want to learn more about investing, check out Excess Return and download a great free Investment Guide E-Book!

XIU is compromised of the largest 60 companies (by Market Capitalization) on the TSX, when you look at the objective of the XIU it says:

The iShares™ CDN LargeCap 60 Index Fund seeks to provide long-term capital growth by replicating, to the extent possible, the performance of the S&P®/TSX® 60 Index through investments in the constituent issuers of such index, net of expenses. The Index is comprised of 60 of the largest (by market capitalization) and most liquid securities listed on the TSX, selected by S&P using its industrial classifications and guidelines for evaluating issuer capitalization, liquidity and fundamentals.

That basically sums up what an ETF is, it tries to replicate the index it is following. There is not constant trading or stock picking going on, ETFs are passive.

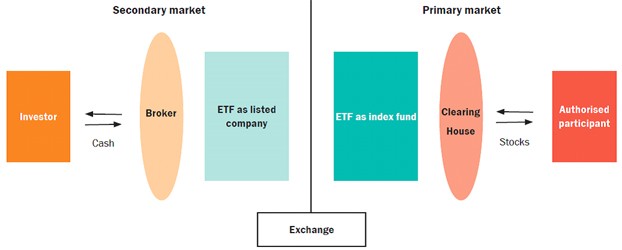

Unlike a mutual fund, ETFs trade on stock exchanges and can be bought and sold throughout the trading day (Mutual funds can not be traded throughout the day), therefore ETFs price will fluctuate during the trading session. Sometimes there can be great price swings throughout the day and short term investor’s can see big losses.

Advantages of ETF

ETFs have many advantages over Mutual Funds her are a few important ones.

Cost: ETFs usually have a much lower MER fees when compared to Mutual Funds, MER for XIU is 0.17% while the MER for a similar Mutual Fund would be over 2%, a HUGE difference. But beware not all ETFs are low cost.

Accessibility. As mentioned previously ETFs trade on the stock exchange, so they can be purchased and sold throughout the day, mutual funds can not be traded on the exchange, it takes at least one day to process the trade and generally there will be a “lock in” period with mutual funds depending on how you opted to pay the commissions.

Disadvantages of ETF

There are not too many disadvantages to ETFs, Jim @ Bargaineering says “they are the playground of day/swing traders, so regular investors get caught in the swings” this is specially true of leveraged ETFs like the Horizons BetaPro and Powershares.

Matt @ Stead Finance has a more detailed post coming up on the disadvantages of ETFs.

Cost of ETF

As with any investment there are costs associated with ETFs, the cost of ETFs consist of two components:

- Commissions. Since ETFs trade like stocks you have to pay a commission to buy and sell ETFs. The exact amount will depend on your broker and account type.

- Management Fees. Like Mutual funds there is a management fee for ETFs, however these fees are much lower when compared to mutual funds. Generally MER for ETFs are below 1% and for mutual funds the average is about 2% depending on the type of fund. (For more details on MER see Mutual funds )

Who should buy ETFs?

The great thing about ETFs these day’s is that there are wide variety of ETFs available to investors with different risk levels, a conservative investor can purchase a Bond ETF where a more aggressive investors can purchase Equity ETFs and emerging market ETFs. ETF is great for lump sum investing, because of the low MER over long period you will save thousands compared to mutual funds. ETF can also be a good option when you Dollar Cost Average. however this will depend on your regular investment amount.

Remember you pay commission every time you purchase an ETF so if your contribution amount is low the commission can be a drag on your investment, if you invest $400/month and your commission fee is $20/trade your cost will be 5% way to high. In these cases you have two options, either you do it less frequent with a larger sum, say ever 3 months with $1200, or you purchase mutual funds for the time being till you accumulate enough to reduce your costs. Either do not forget the magic of compounding. so start early.

How to get started?

All you need is a broker account and some money to get started, check out iShares Canada for some ETFs available on TSX. Here is a Canadian discount broker review you can get started.