Understanding ClosedEnd Funds (CEFs)

Post on: 5 Июль, 2015 No Comment

This text is adopted from a brochure entitled Understanding the Advantages of Closed-End Funds, which is produced by the Closed-End Fund Association (CEFA), the national trade association representing the closed-end fund industry.

Introduction

Closed-end funds (CEFs) are professionally managed investment companies that offer investors an array of potential benefits. While often compared to traditional open-end mutual funds, closed-end funds have many distinguishing features and are, perhaps, more challenging for potential investors to fully comprehend. In addition, they offer investors numerous ways to generate income through portfolio performance, dividends and distributions, and through trades in the marketplace at beneficial prices.

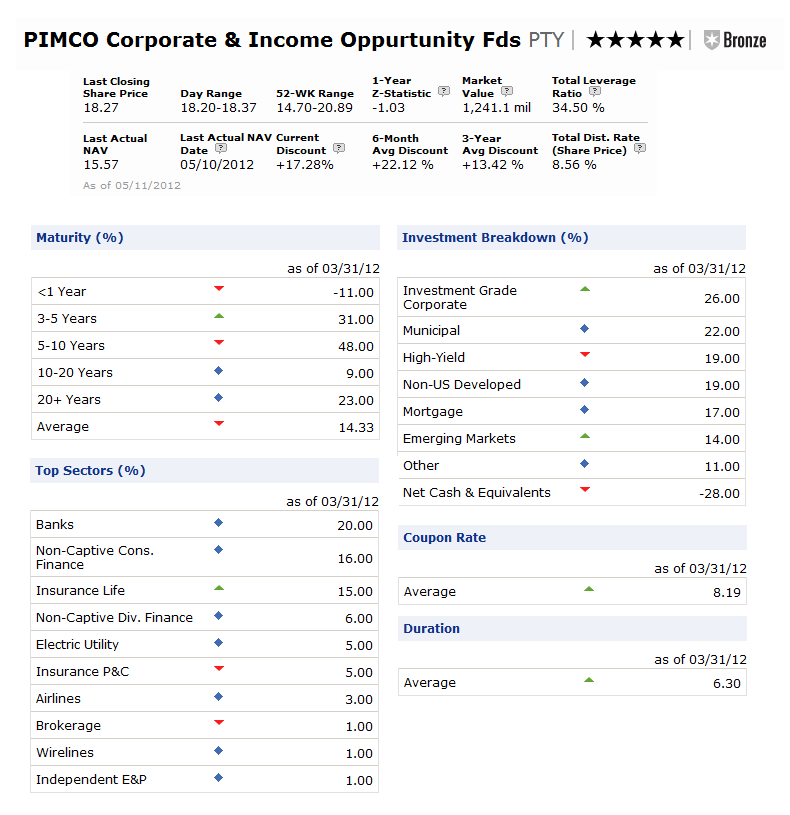

CEF shares are listed on securities exchanges and bought and sold in the open market. They typically trade in relation to, but independent of, their underlying net asset values (NAVs). Intra-day trading allows investors to purchase and sell shares of closed-end funds just like the shares of other publicly traded securities. Net asset value per share (NAV) represents the total value of all assets held by the fund (minus its total liabilities), divided by the total number of common shares outstanding. Market price is the price at which investors may purchase or sell shares of the fund. Market price is determined in the open market by buyers and sellers, based on supply and demand. The funds market price fluctuates throughout the day and may differ from its underlying NAV. Shares of the fund may trade at a premium to (higher than) or a discount (lower than) NAV. The difference between the market price and the NAV is expressed as a percentage of NAV.

There is no assurance that a fund will meet its investment objective or that distributions will be made. You could lose some or all your investment. In addition, closed-end fund frequently trade at a discount to their net asset values, which may increase your risk of loss.

Investment Company Industry

Investment companies have been around for over 100 years; however, the foundation for their current popularity was laid with the passage of the Investment Company Act of 1940 (the 1940 Act). This legislation and subsequent amendments and related rules have provided the blueprint for millions of individual investors to obtain professional management of a diversified portfolio of securities at a reasonable cost.

There are two principal types of investment companies: open-end and closed-end.

Open-end funds (more commonly known as mutual funds) continuously offer their shares to investors and prospective investors and stand ready to redeem their shares at all times. Transactions in shares of mutual funds are based on their net asset value (NAV), determined at the close of each business day. Sometimes the transaction price includes an adjustment for a sale. redemption or other charge. NAV is the value of the funds assets less its liabilities divided by the number of the funds outstanding shares. The invested capital in a mutual fund tends to fluctuate based on investor sentiment.

Closed-end funds have a fixed capital structure and number of shares outstanding, hence the term closed-end. Following an initial public offering, their shares are traded on an exchange between investors. Transactions in shares of closed-end funds are based on their market price as determined by the forces of supply and demand among investors in the marketplace. Interestingly, the price of a CEF may be above (at a premium to) or below (at a discount to) its NAV. The transaction price will also include a customary brokerage charge. The invested capital in a closed-end fund is fixed and will change only at the direction of management. Capital can be increased through the issuance of shares in conjunction with a rights offering or through the reinvestment of certain fund dividends and distributions. Capital can be reduced when shares of the fund are repurchased in conjunction with a stock repurchase program or tender offer.