Under the Hood Alternative MultiStrategy Funds Part I

Post on: 14 Август, 2015 No Comment

Alternative multi-strategy funds have continued to grow in popularity over the past several years as investors and advisors have sought out ways to diversify their portfolios with a single allocation. In the last year alone, $10.9 billion of net new assets flowed into the category according to Morningstar, helping to bring the total category assets up to $31 billion as of April 30. This is slightly behind the total assets of the short government bond fund category and a bit ahead of the natural resources category.

The Third Asset Class

In many ways, alternatives can be thought of as the third asset class in a portfolio, helping investors extend beyond just stocks and bonds. The simplicity of alternative multi-strategy funds is that they come pre-packaged for investors, the same way that balanced funds do so in the traditional asset management space.

However, one of the unique features of most (but clearly not all) of these funds is that they are both multi-manager and multi-strategy funds, all combined into one. In other words, the advisors of these funds hire different external managers to manage each of the multiple investment strategies that the advisor has selected to include in the fund’s allocation.

So far this year, eight new alternative multi-strategy funds have been launched (Morningstar uses the name multialternative to describe the category,) and out of those eight, six fall into the multi-manager, multi-strategy bucket. The remaining two funds are single-manager, multi-strategy funds. A full list of liquid alternative funds launched in 2014 can be found in the New Funds tab on the menu bar above.

Digging Deeper

Let’s break down some of the high level differences in these six new funds as a starting point in evaluating alternative multi-manager, multi-strategy funds.

Two of the six funds, one from Arden and one from Permal, have been launched by firms that are well known managers of alternative (i.e. hedge fund) investment allocations. Neither firm actually manages underlying investment strategies themselves. Instead they focus on finding hedge fund managers, performing due diligence on those managers, and ultimately, building and managing portfolios of these managers. The mutual funds they have launched are essentially a replication of the approach they use to invest assets on behalf of institutional investors, such as public and private pensions funds.

One fund from Context Asset Management is very similar to the above two funds in that Context itself oversees the allocations to each of the managers in the fund, and the investment team has a background in identifying and evaluating hedge fund mangers, and building portfolios of these managers. While the company itself is relatively new, it and its chief investment officer have a pedigree from a large family office that has invested in hedge funds for many years and helped establish Context. As a result, you can think of them as a direct allocator of assets, much like Permal and Arden above.

The fourth fund, this one from Dreyfus, is run as a fund of mutual funds whereby a portfolio manager at Dreyfus allocates to different alternative strategies, but the exposure to each of those strategies is made via other Dreyfus and non-Dreyfus mutual funds. As a result, it has similar diversified exposure to a range of alternative investment strategies, but rather than having each of the underlying managers manage their portfolios directly in the fund (i.e. manage separate accounts specifically for the fund,) Dreyfus makes the allocations to these strategies via other mutual funds (note that Dreyfus does have the flexibility per the prospectus to manage assets directly in the fund rather than through other mutual funds, but today does not do so).

The last two funds are offered by firms that have outsourced the manager selection and portfolio construction to an external advisor, rather than doing it themselves as in the case of the prior four funds. The Virtus fund has hired Cliffwater, an alternative investment consultant that works primarily with large institutional investors, to evaluate hedge fund managers and build the portfolio allocation. Wells Fargo has taken a similar approach with their fund, but rather than hiring an alternative investment consultant, they have hired the Rock Creek Group, an investment advisory firm that manages fund-of-hedge fund portfolios similar to Arden and Permal. While not exactly the same type of firm, both Cliffwater and Rock Creek are respected within their fields and focus on evaluating hedge fund managers and constructing alternative investment portfolios.

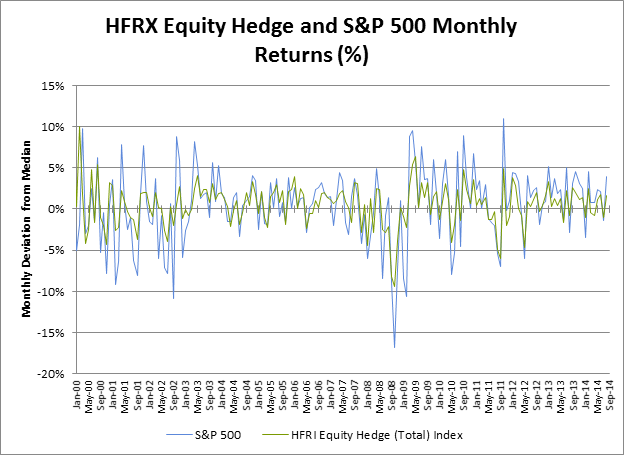

At a high level, the six funds have a similar multi-manager, multi-strategy structure, but do have some differences in how they approach the manager selection and portfolio construction components of their funds. While these differences are important to understand, and can have an impact on fund performance, two of the larger issues that need to be evaluated are the same two issues faced by any other multi-asset (and/or multi-strategy) investment portfolio: asset allocation and security selection. These two factors are the underlying driver of both short and long-term investment performance.

In comparing traditional balanced funds, which are typically managed by a single investment management firm, to alternative multi-strategy portfolios, you can think of asset allocation and security selection a bit differently. As outlined below, asset allocation in a balanced portfolio equates to investment strategy selection in the alternative multi-strategy portfolios, while security selection equates to manager selection.

Traditional Balanced Portfolios