UK Balance of Payments

Post on: 16 Март, 2015 No Comment

The Balance of Payments is the record of a country’s transactions / trade with the rest of the world.

The balance of payments consists of:

- Current Account ( trade in goods, services + investment incomes + transfers)

- Capital Account / Financial Account (capital and financial flows, net investment, portfolio investment)

- Errors and omissions. It is hard to collect all data so some is missed out.

In theory there should be a balancing between capital and current / financial account. If there is a current account deficit, there should be a surplus on the capital / financial account.

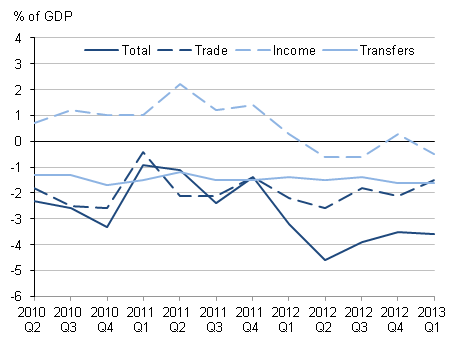

UK Current Account

The UK current account deficit wa s£20.7 billion in Quarter 3 2013, up from a revised deficit of £6.2 billion in Quarter 2 2013. The deficit in Quarter 3 2013 equated to 5.1% of GDP at current market prices, up from 1.5% in Quarter 2 2013 (page updated 8th Jan. 2014 )

In 2012, the UK’s current account deficit was £59.8 billion.

This shows a deterioration in the current account. The current account deficit for Q3 2012 was over £12bn (Seasonally adjusted measure). Q3 2012 as a % of GDP 3.2%

Components of Current Account

- Trade in goods

- Trade in services

- Total income (e.g. investment income)

- Total current transfers

UK Current Account from Jan 2013

UK Current Account Deficit

Since the mid 1980s, the UK has generally had a persistent current account deficit. Essentially, the UK has been importing more goods and services than it has been exporting.

source: balance of payments data selector ONS

Reasons for a Current Account Deficit

1. Overvalued exchange rates. Countries in the Eurozone which became uncompetitive (e.g. Greece, Portugal and Spain) experienced large current account deficits. This is because an overvalued exchange rates means exports are more expensive, but imports are cheaper. This encourages domestic consumers to buy imports. It also makes it hard for exporters because they are relatively uncompetitive. See: competitiveness in the Euro .

2. High Consumer Spending. If there is rapid growth in consumer spending, then there tends to be an increase in imports causing a deterioration in the current account. For example, in the 1980s boom, we saw a fall in the savings rate and a rise in UK consumer spending; this caused a record current account deficit. The recession of 1991 caused an improvement in the current account as import spending fell.

3. Unbalanced Economy. An economy focused on consumer spending rather than investment and exports will tend to have a bigger current account deficit.

4. Competitiveness. Related to the exchange rate is the general competitiveness of firms. If there is a decline in relative competitiveness, e.g. rising wage costs, industrial unrest, poor quality goods then it is harder to export causing a deterioration in the current account.

Components of UK current account deficit

What Explains the UKs Persistent Current Account deficit?

1. Deficit in Goods. Since the process of de-industrialisation accelerated in the early 1980s, the UK has had a large deficit in goods. The UK still manufacturers goods, but we have become a net importer especially of manufactured goods (e.g. clothes, computers, cars). The graph below shows the sectors with the biggest deficit.

For example, this shows the UK had a deficit of £12.56 bn for finished manufactured goods in Q2 of 2012. The UK is also a net importer of oil and food.

This deficit in goods, is partly offset by a surplus in services (e.g. insurance and finance) but, it is not sufficient to overcome the trade deficit.

2. Financial flows. The UK has been able to attract sufficient financial flows, e.g. portfolio flows to finance the UKs current account deficit.

3. Relatively Low Saving Rate

The UK has had a relatively low saving rate compared to some of our competitors. Though recent increases in the saving rate havent prevented a deterioration in the current account.

Policies to Reduce a Current Account Deficit

To reduce a current account deficit, we need to pursue policies involving some or all of the following:

- Reduce consumer spending through tight fiscal and tight monetary policy. E.g. higher income tax will reduce disposable income and therefore reduce spending on imports (however, it will also lead to lower economic growth)

- Supply side policies to improve competitiveness.

- Devaluation of the exchange rate. This makes exports cheaper and imports more expensive. See: exchange rate and balance of payments

UK Balance of Payments

In Q2 2012. the main components of the balance of payments were:

- Current Account £ -15 962m

- Financial Account + £ 5 785m

- Capital Account + £1000 m

- net errors and Omissions + £9177 m

- net balance = £0 m

In other words, if we have a deficit on the current account to buy goods from China, we need foreign currency to come from some other source to keep buying these imports.

- One example is to think of UK consumers buying Chinese goods causing a deficit on the current account.

- Then Chinese banks and firms invest some of this money back into UK investment trusts or build a factor in the UK. These leads to a credit on the financial account.

- Our current account deficit is being financed by a surplus on financial flows.

- See also: balance of payments disequilibrium

Components of Financial Account

- Direct investment

- Portfolio investment

- Financial derivatives (net)

- Other investment

- Reserve assets

UK Current Account Compared to other Countries

By 2012, the UK has developed one of largest current account deficits.

Does a Current Account Deficit Matter?

Should we worry if the UK has a current account deficit?

Yes, we should worry

- It is a sign of uncompetitiveness, which will lead to lower economic growth and poorer prospects in the long run.

- If capital / financial flows dry up, it could lead to depreciation in the exchange rate and a fall in living standards

- It is a sign of an unbalanced economy.

No, we shouldnt be concerned

- The UK has had a persistent deficit since the mid 1980s. Countries with large current account surplus have not necessarily done better, e.g. Japan had a long period of stagnation.

- In era of globalisation, financial flows are easier to attract and therefore the deficit is financed by these capital inflows.

- If the current account was too large, there should be a depreciation in the exchange rate to restore the balance. A current account deficit is a bigger concern in a fixed exchange rate (like Euro) because there is no option of depreciation.

Terms you may come across

- Trade deficit. The trade deficit is the biggest component of the current account. This means trade in goods in services; though some times people may mean to refer to the trade in goods.

- Widening of Trade Deficit. This means the deficit on trade in goods became larger. Also referred to as a deterioration or worsening.

- Balance of payments crisis. When a current account deficit cant be financed by capital flows causing a rapid devaluation in the exchange rate.