Types of Innovation and Design Dominance

Post on: 16 Март, 2015 No Comment

Types and Patterns of Innovation

- Product innovations are embodied by the business outputs goods and services

- Process innovations are innovations in the way business is conducted, such as techniques in marketing or production, to improve efficiency e.g. Reducing defect rate, or increasing output rate

- Product innovations for one organization might be a process innovation for another new distribution service (product innovation) allows its customers to distribute faster (process innovation)

- The difference lies in how far the innovation lies from existing practices

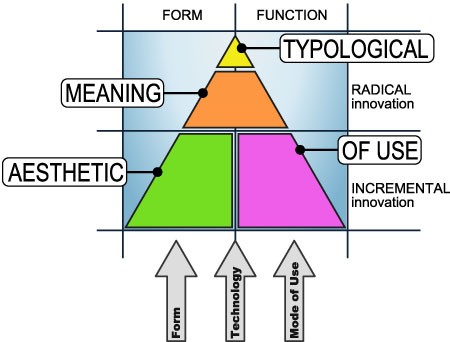

- A radical innovation is like the introduction of the motorized car to replace horse-drawn carriage, whilst the iPhone 4 is an incremental innovation on the iPhone 3

- Radicalness is defined by a combination of newness and the degree of differentness. It is also sometimes defined in terms of risk

Competence Enhancing v Competence Destroying

- Competence enhancing innovation builds on the company’s existing knowledge base

- Competence destroying innovation doesn’t build on the existing knowledge and sometimes renders it obsolete

Architectural Innovation v Component Innovation

- Most products or processes are hierarchal nested systems. This means that at any unit of analysis, the entity is a system of components, and each of these components is a system of smaller components and so on

- Component innovation is the change in the parts that make up the product but don’t have a significant effect on the overall configuration of the system

- Architectural innovation is the change in the overall design of the system or the way that components interact

Technology S-Curves

- The rate of technology’s performance improvement and the rate at which the technology is adopted in the marketplace (rate of diffusion) repeatedly have been shown to conform to an s-shape curve

Technologies do not always get to reach their limits

- May be displaced by new, discontinuous technology

- A discontinuous technology fulfills a similar market need by means of an entirely new knowledge base

- E.g. Switch from carbon copying to photocopying, or vinyl records to compact discs

S-Curves in Technology Diffusion

- Adoption is initially slow because the tech is unfamiliar

- It accelerates as technology becomes better understood

- Eventually market is saturated and rate of new adoptions declines

- Technology diffusion tends to take far longer than information diffusion

- Technology may require acquiring complex knowledge or experience

- Technology may require complementary resources to make it valuable (e.g. Cameras may not be valuable without film)

S-Curves as a Prescriptive Tool

- Managers can use data on investment and performance of their own technologies OR data on overall industry investment and technology performance to map the s-curve

- While mapping the technology’s S-Curve is useful for gaining a deeper understanding of its rate of improvement or limits, its use as a prescriptive tool is limited

- True limits of technology may be unknown

- Shape of s-curve can be influenced by changes in the market, component technologies or complementary technologies

- Firms that follow the s-curve model too closely could end up switching technologies too soon or too late

S-Curves of diffusion are in part a function of s-curves in technology improvement

- Learning curve leads to price drops, which accelerate diffusion

Types of Adopters

- First 2.5% to adopt the innovation

- Adventurous

- Comfortable with a high degree of complexity/uncertainty

- Access to substantial financial resources

Early Adopters

- Next 13.5%

- Well integrated into social system

- Great potential for opinion leadership

- Other potential adopters look to early adopters for information and advice, so these guys are like missionaries for new products and services

- The next 34%

- Adopt innovations slightly before everyone else

- Not really opinion leaders, but peer interaction is frequent

Late Majority

- The next 34%

- Skeptical

- Scarce resources?

- Last 16%

- Base their decisions primarily on past experience and possess almost no opinion leadership

- Highly skeptical

Theory in Action

Technology Trajectories and “Segment Zero”

- Technologies often improve faster than customer requirements demand

- This enables low-end technologies to eventually meet the needs of the mass market

- Thus, if the low-end market is neglected, it can become a breeding ground for powerful competitors

Technological change tends to be cyclical:

Each new S-Curve ushers in an initial period of turbulence, followed by rapid

- Utterback and Abernathy characterized the technology cycle into two phases:

- The fluid phase (when there is considerable uncertainty about the technology and its market; firms experiment with different product designs in this phase

- After a dominant design emerges, the specific phase begins (when firms focus on incremental improvements to the design and manufacturing efficiency)

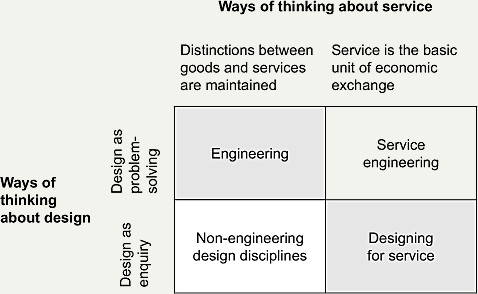

Standards Battles and Design Dominance

- Many industries experience strong pressure to select a few single dominant designs

- There are multiple dimensions shaping which technology rises to the position of the dominant design

- Firm strategies can influence several of these dimensions, enhancing the likelihood of their technologies rising to dominance

W hy Dominant Designs are Selected

- In markets with network externalities, the benefit from using a good increases with the number of other users of the same good

- Network externalities are common in industries that are physically networked

- E.g. Railroads, telecommunications

Government Regulation

- Sometimes the consumer welfare benefits of having a single dominant design prompts government organizations to intervene, imposing a standard

- General standard of mobile communications in EU (GSM)

Result: The Winner Take All Markets

- Natural monopolies

- Firms supporting winning technologies earn huge rewards; others may be locked out

Increasing returns indicate that technology trajectories are categorized by path dependency :

- End results depend greatly on the events that took place leading up to the outcome

A dominant design can have far-reaching influence; it shapes future technological inquiry in the area

Winner take all markets can have very different competitive dynamics than other markets

- Technologically superior products do not always win

- Such markets require different firm strategies for success than markets with less pressure for a single dominant design

In many increasing returns industries, the value of a technology is strongly influenced by both:

- Technology’s standalone value

- Network externality value

Technology’s Standalone Value

- Includes such factors as:

- The functions the technology enables customers to perform

- Its aesthetic qualities

- Its ease of use

Network Externality Value

- Includes the value created by:

- The size of the technology’s installed base

- The availability of complementary goods

- A new technology that has significantly more standalone functionality than the incumbent technology may offer less overall value because it has a smaller installed base or poor availability of complementary goods

- NeXT Computers were extremely advanced technologically, but couldnt compete with the installed base value and complementary good value of Windows

- To successfully overthrow an existing dominant technology, new technology often must either offer:

- Dramatic technological improvement (e.g. Videogame consoles)

- Compatibility with existing installed base and complements

- Subjective information (perceptions and expectations) can matter as much as objective information (actual numbers)

- Value attributed to each dimension may be disproportional

Competing for Design Dominance in Markets with Network Externalities

- We can graph the value a technology offers in both standalone value and network externality value

- We can compare the graphs of two competing technologies, and identify cumulative market share levels (installed base) that determine which technology yields more value

- When customer requirements for network externality value are satiated at lower levels of market share, more than one dominant design may thrive

Are winner-take-all markets good for consumers?

- Economics emphasizes the benefits of competition

- However, network externalities suggest users sometimes get more value when one technology dominates

- Should the government intervene when network externalities create a natural monopoly

- Network externality benefits to customers rise with cumulative market share

- Potential for monopoly costs to customers