Two Ways To Maximize Your Roth IRA Returns

Post on: 29 Март, 2015 No Comment

Your Roth IRA plays an invaluable role in your investment portfolio because, if you play your cards right, its a nice, big pool of tax-free retirement savings. And tax-free is hard to beat, right?

How Do You Maximize Your Annual Returns?

In my opinion, the two best methods for maximizing your Roth IRA returns are to:

- Give Yourself Greater Control

- Lower Your Investment Costs

The more control you have over your investments and their associated costs, the better they will perform.

Stay In Control

Some investments give you greater control than others. For example, if you invest in an index fund that tracks the performance of the S&P 500, you know that your investment performance will more or less mirror the performance of the S&P 500. Youve made a conscious decision to have your investment mimic that index. And while you cant make the market obey your every command, you are in control of your ultimate destiny.

But lets say that instead of investing in an index fund, you invest in a mutual fund not tied to any particular index or asset class. In this case, youve given up control. Control over your investment is placed in the hands of a money manager you probably dont know, and this can be very dangerous to your performance. In such a scenario, the fund manager can take excessive risks with your money such as betting 90% of the funds assets on appreciation of the Russian ruble. Maybe its a decision you would agree with, but maybe its not. Either way, youre NOT in control.

Even though every mutual fund comes with a prospectus that outlines the funds overall investment strategy, fund managers can still deviate from that strategy, and you wont know it until the quarterly reports are released. Does this really put you in control?

In some cases, investors who give up control are subject to fraud. For example, lets say you agree to give a stock broker power to manage your portfolio for you. A dishonest broker might engage in churning a process whereby he constantly buys and sells positions within your account in order to receive higher commissions. This practice is illegal and unethical, but it still happens.

In extreme cases, investors who give up control can find themselves victims of a scam or an elaborate Ponzi scheme. The most notable and recent examples are the vicitims of Bernie Madoff. These investors gave up control and oversight of their money, entrusting Bernie Madoff to wisely invest on their behalf. Instead, he stole their money.

Dont let this happen to you. Do your own research, and put yourself in control. Even if you ultimately invest your money in managed funds, make sure you do lots of research, you know what the risks are, and you keep yourself regularly informed in regard to whats happening.

Understanding your investments and properly managing the associated risks goes a long way in preventing the loss of capital and poor investment returns.

Lower Your Investment Costs

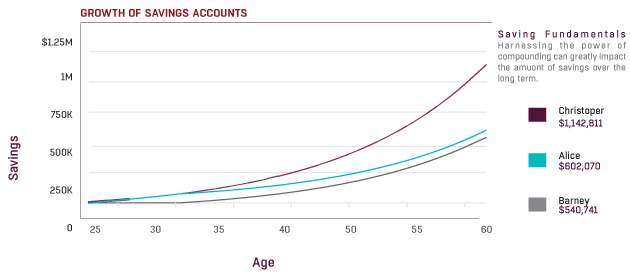

Lowering your overall investment costs is often overlooked as a key to superior investment returns. A few pennies here and there may not sound like much, but when viewed in the context of decades of compound growth, a few pennies can add up to serious dollars.

This is especially true in regard to your Roth IRA. Why? Because the IRS limits the amount of money you can contribute to your Roth IRA each year. If you squander it on unnecessary Roth IRA fees. you can never put it back.

For instance, most people have a maximum annual Roth IRA contribution limit of $5,000. If you needlessly spend an extra $50 per year on investment costs, this constitutes a full 1% of your annual contribution. And 1% can add up to a lot over time .

So how do you lower your investment costs? The primary methods involve lowering your transaction costs and your operating costs.

Lower Your Brokerage Fees (Transaction Costs)

Each time you invest money, theres probably some sort of transaction cost associated with it such as a brokerage fee for buying and selling stock or front-end or back-end fees called loads for mutual funds.

The best Roth IRA investments minimize these transaction costs.

For example, Investor #1 might systematically invest $400 per month in his Roth IRA, using the funds to purchase an ETF each month at $7 per trade. This adds up to $84 per year ($7 x 12 months).

Investor #2 on the other hand, researched low-cost online brokers and found one that allows him to invest the same $400 per month in an index fund transaction-free as long as he doesnt exceed more than 3 transactions per month. This saves Investor #2 $84 per year, which doesnt sound like much does it?

But an extra $84 per year at a 12% rate of return over 40 years adds up to a lot $64,435.68!

Furthermore, the difference between Investor #2 and someone who trades frequently (racking up hundreds of dollars per year in brokerage fees) is staggering. Despite these large sums, the money you save lowering your transaction costs pales in comparison to the money save by lowering your operating costs.

Lower Your Expense Ratios (Operating Costs)

Unlike brokerage fees which eat up an incremental amount of your principal with each transaction, operating expenses eat up a percentage of your principal on an annual and ongoing basis.

This can prove quite costly as even the smallest of percentages (represented by an expense ratio) can add up to a lot of money over the long-term.

For example, lets say Investor #1 invests $5,000 per year in a mutual fund with a 1.1% expense ratio meaning the company which operates the mutual fund charges 1.1% of your annual account principal as a fee for managing the fund.

Investor #2 invests $5,000 per year in an index fund which mimics the S&P 500 and comes with a 0.1% expense ratio.

If both investors garner a 10% annual return over the course of 40 years, Investor #1 ends up with $1,689,412.23 while Investor #2 ends up with $2,212,962.78. That 1% difference in the annual expense ratio each investor pays adds up to a grand total of $523,550.55!

Now, thats not to say you should always go with the lowest expense ratio. But if youre going to invest in something with a higher expense ratio, make sure it generates a higher return on investment in order to offset the higher annual cost. Otherwise, youre shortchanging yourself.

Remember, lowering your costs can help to generate much higher investment returns, but lower costs need to be balanced with an understanding of your investments and the proper management of risk.

For instance, you can lower your operating costs to zero if you buy and sell individual stocks. After all, companies dont charge you a fee for holding their stock. But with these lower operating costs comes a greater risk if you dont understand your investments and properly assess the risks, because owning a few stocks leaves you less diversified than owning hundreds or thousands of stocks in a mutual fund or index fund.

Look Out For Yourself

In the end, taking greater control of your investments and lowering your costs is only possible if you make a concerted effort to become and remain an informed investor.

While its not realistic or desirable to have everyone pouring over stock market returns and analyzing financial documents, proper Roth IRA investing does require a basic level of knowledge and a minimum amount of research.

Inform yourself. Learn. Otherwise, your investment returns will suffer.

This has been a guest post by Britt Gillette. He is the author of Your Roth IRA, a site solely dedicated to helping you manage and understand your Roth IRA.