Two University of Chicago professors win Nobel Prize in economics

Post on: 23 Июнь, 2015 No Comment

Along with 3rd winner, their work reshaped the field of finance

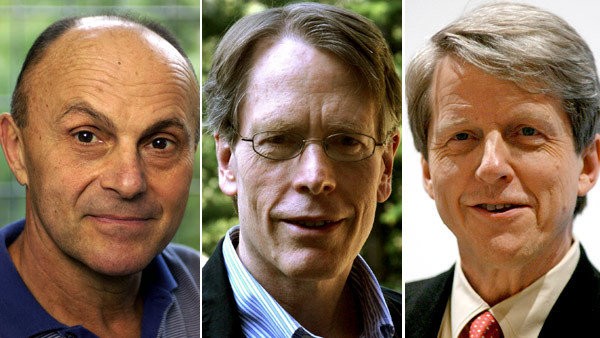

Nobel laureates Hansen, from right, and Fama speak after a reception. The interaction you get from your colleagues is so influential in building your work that you cannot underestimate its impact, Fama said. (Chris Walker, Chicago Tribune)

Go looking for an economist at the University of Chicago, and you have surprisingly decent odds of running into a Nobel Prize winner.

Along with a third winner, Robert Shiller of Yale University, they will share in the $1.23 million prize.

Their work has had a profound impact on academic research and changed the field of finance. The emergence of low-fee, index mutual funds that are part of every retirement plan is one prominent example.

Modern finance is very much about the empirical study of asset markets, due in large part to the work of these laureates, said John Campbell, a Harvard University economics professor. For me, personally, these are three men whose work I’ve been studying, working with and grappling with my entire professional life.

For a few hours Monday, the serious atmosphere on the University of Chicago campus was replaced with joy and excitement, as the university feted its latest laureates. A boisterous, standing-room-only crowd of students and faculty greeted Fama and Hansen as they met the news media in the sunlit atrium at the U. of C. Booth School of Business.

Gary Becker, 82, who was awarded the economics prize in 1992, sat in the front row. He fondly remembers being treated as a celebrity after he won.

You’re treated like you’re royalty, and for the rest of the year you’ll have all the doors open for you, he said. Everybody wants you to speak. It’s a remarkable period of time. I recommend it to everybody.

Fama, 74, and Hansen, 60, both credited the university for building a roster of distinguished faculty in the economics department. The faculty promotes an intellectually rigorous yet collegial culture, they said.

I’ve said this many times before, but whatever I am owes at least two-thirds of it, maybe three-quarters, maybe 90 percent to the University of Chicago, Fama said at a morning news conference. The interaction you get from your colleagues is so influential in building your work that you cannot underestimate its impact.

Hansen thanked the many role models and co-workers in the economics department who have molded his work. For them, economics was supposed to do something. It was supposed to explain the world, and it was supposed to be critical, he said.

The university claims 89 Nobel winners as its own, including 28 Nobels in economics, which is formally known as the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. The university includes in its total some professors who won the Nobel after leaving U. of C.

Including Fama and Hansen, there are six Nobel laureates currently on the economics faculty. The others are Becker, Roger Myerson, James Heckman and Robert Lucas Jr.

Francois Gourio, a senior economist at the Federal Reserve Bank of Chicago, earned his Ph.D. from the U. of C. in 2005. He said the tradition of academic excellence carries on because the faculty is dedicated to research, and that drips down to students.

Fama studied economics as a graduate student at U. of C. in the 1960s, after briefly flirting with French as an undergrad. His research on stock prices started as a Ph.D. student and led to the influential 1965 paper Random Walks in Stock Market Prices. His work demonstrated that stock prices are extremely difficult to predict in the short run and that new information is very quickly incorporated into prices.

When Fama began his work, finance was not seen as an intellectually rigorous occupation. It was quite radical at the time to think that statistical methods and economic theory could be brought to bear in the financial markets.

Fama’s efficient market hypothesis has had numerous practical applications. Other researchers have tested Fama’s theory by studying actively managed mutual funds those funds operated by professional stock pickers. They have found it is very difficult to beat the market. That’s why index funds broad-based mutual funds and other collections of investments have become so popular: Going with the pack often produces better returns than going it alone.

Regulators use his theory to study abnormal movement in particular stocks to hunt for insider trading.

Fama is an inveterate researcher who is known for constantly testing the same theory he developed in the 1960s.

Rather than being a proponent of the efficient market theory, he was and is far more interested in testing that idea, said Alexi Savov, an assistant professor of finance at New York University’s Stern School of Business, who studied under both Fama and Hansen at U. of C. He’s a data-driven person who really wants to know the way things really are, versus a proponent. He’s much more interested in the data than the theory.