TSP Funds

Post on: 16 Март, 2015 No Comment

The Thrift Savings Plan (TSP) is a tax-deferred retirement savings and investment plan that offers Federal employees the same type of investment, savings and tax benefits that many private corporations offer their employees under 401(k) plans. By participating in the TSP, Federal employees and service members have the opportunity to save part of their income for retirement, receive matching agency contributions, and reduce their current tax base.

Unfortunately the TSP only has a certain number of investment funds available at this time for federal employees and service members. Currently there are 5 funds available and 5 Life Cycle Funds. I have gone through and written reviews on all 5 TSP funds and highlight the key take aways for potential investors.

The G Fund The safest fund offered by the Thrift Savings Plan, hands down. a very great alternative during bear markets and for retirees approaching retirement within 1-3 years. Outside of those two scenarios I would highly discourage anyone from allocating their contributions to the G Fund at best perhaps 5-10% of their portfolio but even then inflation will cripple the growth of returns over time.

The F Fund — The best fund for individuals approaching retirement in the next 1-3 years. I believe that the G Fund will offer the appropriate level of protection for individuals approaching retirement however by being invested in the F Fund you have an opportunity of increasing your returns without having to worry about inflation eroding them.

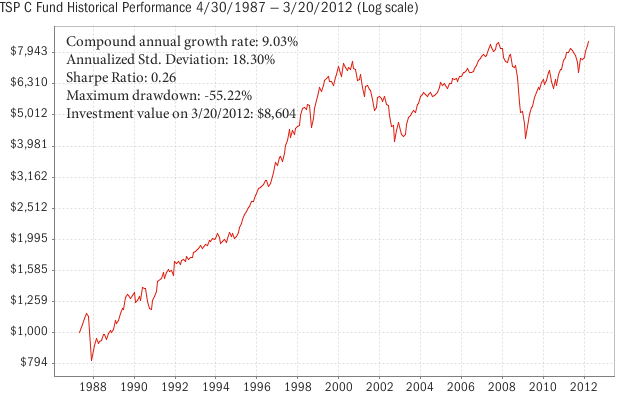

The C Fund — This fund is best for individuals in the beginning and middle stages of their career. This will allow them to enjoy the bull market cycles and avoid the bear market cycles. This type of management of your Thrift Savings Plan will vastly out perform your peers.

The S Fund — Best for individuals with a high risk tolerance and the know how to identify bull and bear market cycles. If you can time these cycles right you can accrue as a small fortune in your Thrift Savings Plan. Definitely would not recommend this fund for individuals within 5 10 years of their retirement.

The I Fund You should steer clear of this fund always. The risk is not worth the reward and quite frankly you can get similar returns investing simply with the S Fund at far less risk. For the daredevils who like to see their money increase quickly I would say the I Fund is definitely for you, just remember what happens when you gamble, you can lose it a whole lot faster than you gained it.

Life Cycle Funds I wouldnt invest in any of these funds for a simple reason. Nobody knows my investment requirements better than myself. Some seniors might be trying to catch up and establish retirement savings. Simply investing mainly in the G & F Funds are not going to accomplish their retirement goals. Subsequently there is no reason why a young man or woman should be invested in the G or F Fund unless it is to seek shelter during a bear market.

While the Thrift Savings Plan is not the most diverse option for retirement, it is the only retirement vehicle offered to federal employees and service members at this time. Here at Brick By Brick Investing we have developed a system that maximizes the returns you can receive in your TSP. In fact, if you had implemented our system over the last 10 years you wouldnt have lost a penny! To get more details of our system check out our guide on How To Increase Your TSP Profits Right Now.