Triple Top Chart Pattern

Post on: 16 Март, 2015 No Comment

Introduction

A triple top is considered to be a variation of the head and shoulders top. Often the only thing that differentiates a triple top from a head and shoulders top is the fact that the three peaks that make up the triple top are more or less at the same level. The head and shoulders top displays a higher peak — the head — between the two shoulders.

According to experts including Murphy, making a distinction between these two patterns is largely academic because they both imply the same thing.They are both reversal patterns of an upward trend in a stock. The triple top marks an uptrend in the process of becoming a downtrend.

What does a triple top look like?

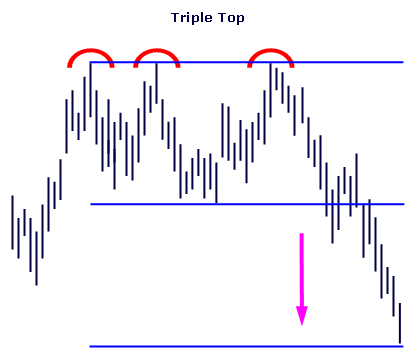

As shown below, the triple top pattern is comprised of three sharp peaks, all at the same level. A triple top occurs when prices are in an uptrend. Prices rise to a resistance level, retreat, return to the resistance level again, retreat, and finally, return to that resistance level for a third time before declining. In a classic triple top, the decline following the third peak marks the beginning of a downtrend.

While the three peaks should be sharp and distinct, the lows of the pattern can appear as rounded valleys. The pattern is complete when prices decline below the lowest low in the formation. The lowest low is also called the confirmation point.

Bulkowski advises that this pattern can have many variations. He continues, however, to advise that an investor should ensure that the three peaks are well separated and not part of a congestion pattern. Each top should be part of its own minor high, a distinct peak that towers about the surrounding price landscape.

Elaine Yager, Director of Technical Analysis at Investec Ernst and Company in New York and a member of Recognia’s Board of Advisors suggests they should be noticeably distinct peaks and they do not have to be precisely at the same level.

Why is this pattern important?

Like the head and shoulders top which it resembles so closely, the triple top is considered by experts to be a reliable pattern. According to Schabacker, there is a good explanation for placing reliance on this pattern. The pattern illustrates three successive attempts to break through a resistance level. Price cannot move above a certain point, despite three tries. Each failure adds weight to the indications of reversal, explains Schabacker.

Is volume important in a triple top?

Generally, volume in a triple top tends to be downward as the pattern forms. Murphy advises that volume should be lighter on each rally peak.Volume then picks up as prices fall under the confirmation point and break into the new downward trend.

Both Bulkowski and Schabacker place less significance on the downward progression of volume. While both agree that investors should see relatively high volume on the first peak, they also agree that volume on the other peaks can be confused and irregular. Volume should be higher on the peaks than at the lows. Bulkowski’s statistics suggest that an investor should see a volume burst at the time of breakout and during the few days following the decline in price below the confirmation point.

What are the details that I should pay attention to in the triple top?

1. Duration of the Pattern

This pattern can take upwards of several months to form. According to Bulkowski, average formation time is approximately four months. In addition, experts, including Schabacker and Murphy, agree that the longer the pattern takes to form, the greater the significance of the price move once breakout occurs. The three highs do not need to be equally spaced from one another.

2. Need for an Uptrend

The triple top is a reversal pattern marking the transition period between an uptrend and a downtrend in prices. It is crucial to the existence of this pattern that it begin with an uptrend of stock prices.

3. Decisive Breakout

Investors are advised to wait for prices to make a definitive break below the confirmation point of a triple top pattern. If prices do not fall below the confirmation point after the third peak is reached, the pattern is not a triple top. In a bull market, for example, it is common to see three highs which look like the beginning of a well-formed triple top. If prices, however, do not fall below the confirmation point, they can just as easily pull away from the highs established by the three peaks and then continue on in the upward trend.

4. Volume

As discussed, it is typical to see volume diminish as the pattern progresses. This should change, however, when breakout occurs. A valid breakout should be accompanied by a burst in volume. Certain experts are less concerned by seeing a steadily diminishing trend in volume as the pattern progresses through its three highs. Schabacker comments that the volume picture can often be confused and irregular.7 All agree, however, that an investor will want to see a definite increase in volume at the time of the break through the confirmation point.

5. Rally after Breakout

Yager notes that a high percentage of triple tops have rallies back to the point of the breakdown more often than not.

How can I trade this pattern?

Begin by calculating the target price — the minimum expected price move. The triple top is measured in a way similar to that for the head and shoulders top.

Calculate the height of the pattern by subtracting the lowest low from the highest high in the formation. Then, subtract the height from the lowest low. In other words, an investor can expect the price to move downwards at least the distance from the breakout point less the height of the pattern.

For example, assume the lowest low of the triple top is 170 and the highest high is 220. The height of the pattern equals 50 (220 — 170 = 50). The minimum target price is 120 (170 — 50 = 120).

Bulkowski calculates that the measure rule is not completely reliable for the triple top, estimating that nearly 50% of all triple tops will fall short of their minimum target price.

Edwards and Magee warn that true triple tops are few and far between. So, it makes sense to be cautious when assessing what might initially look like a developing triple top.

According to Edwards and Magee, an investor should never jump the gun with a triple top.If the triple top is not completed by breaking through the confirmation point, experts advise caution. The pattern can fail to complete and just as easily recommence an upwards trend. However, Edwards and Magee also explain that if the pattern has been confirmed by a valid breakout, then the pattern seldom fails. Stick to the breakout rule, they advise, and you will be safe.

Rallies are common with triple tops. An investor can trade that return move to his or her advantage. According to Bulkowski, if an investor misses the breakout, there’s still time to place or add to a short position when prices resume their rally towards the former breakdown level. In this case it would have been 170.

Are there variations in the pattern that I should know about?

1. Hybrid Variation

There is a hybrid variation that appears to be a cross between a double and triple top. The middle peak is slightly lower than the left and right peaks. This is still a valid reversal pattern.

2. Fourth Peak

It is possible for the pattern to display a fourth peak before reversal occurs.