Transparency in ETFs at Work

Post on: 20 Апрель, 2015 No Comment

ETF 101 News:

Exchange traded funds are widely known for their transparent nature, providing anyone with a fund wrapper that closely mirrors its net asset value and a tool that reveals what investors will be exposed to.

Transparency in ETFs help facilitate efficient arbitrage opportunities to keep the price in line with the NAV and allows investors to easily look into their underlying holdings when construction a portfolio, writes Rusty Vanneman, chief investment officer at CLS Investments, for InvestmentNews .

ETFs trade like a stock on an exchange, with prices that fluctuate throughout the day. Consequently, if the ETFs price is trading above its NAV, an authorized participant will sell the ETF for a basket of the underlying holdings at a profit, bringing down the ETFs price to the NAV. On the other hand, if the price is below the NAV, the AP can buy the ETF for a basket of underlying securities at a profit.

Through arbitrage opportunities when an ETF is trading at a premium or discount to its NAV, market makers help diminish deviations from the NAV or so-called ETF tracking errors. Consequently, knowing that the an AP will help keep tracking errors to a minimum for the majority of ETFs, investors are confident that the ETF wrapper will reliably reflect the value of its underlying market.

Additionally, the ETFs transparent nature also allows investors to closely scrutinize individual holdings and sector tilts.

When building a risk-managed portfolio, it becomes imperative to know what you are buying, Vanneman said in the article. And with ETFs, I believe that the transparency they provide is indeed one of their key features, giving the product category a big leg up on mutual funds.

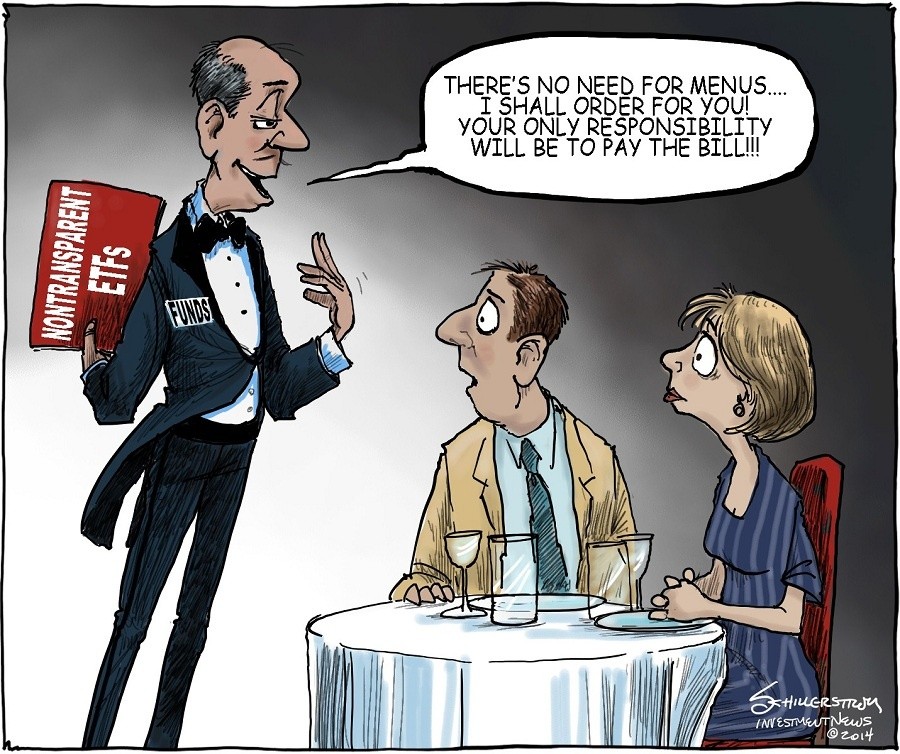

For instance, active mutual funds that only reveal holdings on a quarterly basis may quickly shift positions in a short timeframe, leaving investors in the dark with what they are actually holding. In contrast, most ETFs, both active and passive, will update holdings on a daily basis. [Vanguard ETFs Eschew Daily Disclosure ]

Since I know that ETFs holdings are listed, and I know arbitragers are out there trolling to pick up these nickels and dimes that may only appear for fraction of a second, I am confident that the ETF Im buying for investors is doing exactly what I thought it would do when I put it in a portfolio, Vanneman added.

For more information on ETFs, visit our ETF 101 category .

Max Chen contributed to this article .

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.