Trailing Stop Loss Orders

Post on: 16 Март, 2015 No Comment

We all have probably used stop loss orders to limit our risk in a trade, but how can you use the stop loss order to help manage your trades? You can adjust the initial stop order or “trail” the stop as the position moves in your favor. The initial stop loss orders are an important tool to manage your initial risk. However, let’s discuss using trailing stops on your trades once they are made.

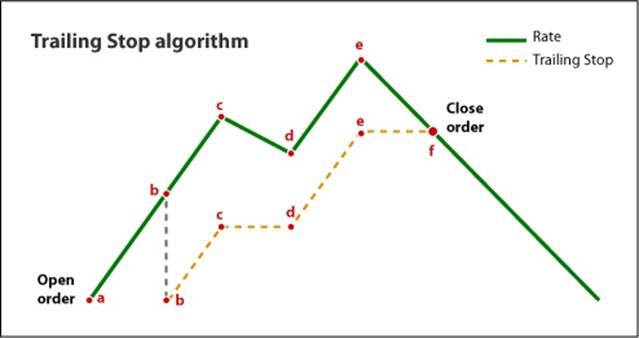

So what are trailing stop loss orders and how do they work? Just like initial stop loss orders, the trailing stop promotes trading discipline by taking most of the emotion out of the exit decision, thus helping you to protect profits and capital. There are two different kinds of trailing stops – first, automatic trailing stops and, second, manual trailing stops. The benefit of an automatic stop order is that it can be set at a predetermined percentage away from the current market price. A trailing stop for a long position would be set below the position’s current market price. For a short position, it would be set above the current market price. A trailing stop is designed to protect profits in the security by enabling a trade to remain open and continue to profit as long as the price is moving in a positive direction, either long or short, but then closing the trade if the price changes direction by a specified percentage, letting the trade exit or being “stopped out” at the trailing stop level. With a manual trailing stop, you would move the stop up or down, whether going long or short, in the direction of the trade, using some method, such as the low of the last 3 bars for a long trade, or the high of the last 3 bars for a short trade, for example. The advantage to using a manual trailing stop, depending on the method used, allows you to scale the trailing stop using current market ranges, instead of preset percentage as in an auto trailing stop.

An example of an automatic trailing stop is a stock that is $50 dollars at market and you place an entry order. At the same time, you place a trailing stop 5% or $2.50 away from the market price. As the stock price moves 5%, the trailing stop will move to break even and then continue to trail on up every time the stock moves another 5%.

One of the trickier things about a trailing stop is where to place it away from the market. In our example, if you place the trailing stop at 5% and that is too tight for the market, you will often get stopped out prematurely. Or, on the other hand, you place it too wide, you run the risk of losing too much capital if it starts to move against you. This issue applies to either a manually adjusted trailing stop or to automatically moving trailing stops.

In conclusion, the real advantage to using trailing stops is that you will be able to reduce your risk as the stock or other security moves in your favor and, once you move to breakeven, you can start to protect profits along the way. So always use an initial stop loss order and then trail it in order to extend the potential profits; instead of using a fixed target, use a trailing stop loss to exit your trades. This can potentially improve your winning trades as they move.

Jim Scharman

Jim has been helping traders become successful for more than 20 years and is Profits Run’s resident ETF expert ready to help you make sense of the Electronically Traded Funds market. Connect with us on Google+