Trading The Trend Keep It Simple

Post on: 16 Март, 2015 No Comment

If you know your history of the US stock market, on May 17, 1792, the stock market as we know it today was initiated with 5 securities traded amongst 24 stockbrokers and merchants. This initial meeting all started under a Buttonwood tree known today as the Buttonwood agreement. Early years of trading didn’t require early morning wake ups. You have to wonder what indicators and lines those merchants were using to keep themselves in the trade. Truth, they simply met every so often to exchange shares and go on their merry way. So simple.

How far have we come since those days? What have we done to the simplicity of trading?

You have to wonder if our stock market forefathers were concerned with the technical like of iron condors, RSI indicators and the technical magnificence that shines forth from our monitors each day. The obvious is that the early years didn’t require the technical grandeur that we have today. Today we are bogged down with 23 hours of trading possibility in thousands of endless indicators to fill our charts. For every newcomer to the market, the eternal search for the holy grail of trading, spending countless of hours and dollars to have the perfect trading system. Nothing simple in that.

Several years back I received a copy of a letter from a floor trader, commenting on how ludicrous it was that we crumb traders use all these indicators while they use nothing of the sort. Perhaps true, it seems that we have become so enthralled with the hundreds of indicators out there to make ourselves feel better about our trading and perhaps even charge someone hundreds or thousands of dollars for it for re-inventing the wheel. The bottom line message in that letter to me was that simplicity was still existent in the market place, minus all the technical advances of trading, on a grander scale that still lives on from 68 Wall Street. It is us, the crumb traders that have made it so complex.

As a representative of the crumb traders of the world, I confess that I am at the whim and dispose of some of these indicators to make myself feel more assured of my trading. However, there is one tradition that I still hold to, and that is the simplicity of trading. I know I can post numerous charts here that would make your head spin and wonder what is that person thinking and why are they making it so difficult. For myself, as an educator, I love to teach others how to trade and if I can make that as simple as possible, I have had a good day.

I don’t lay claim to any new methods. I do not have the holy grail to trading. What I do have, is the combination of a very simple indicator that keeps me in the trade for the long term, whether it be an intraday or swing trade. It’s a simple as the moving average. Why make things more complex in an already complex market?

I’d like to indulge and invite you to ask yourself, what keeps you in the trade? Not a tough question but in a technical world with computers that are trading in nano-seconds to the crumb traders of the world, what stops you from being in and out of trades all day.

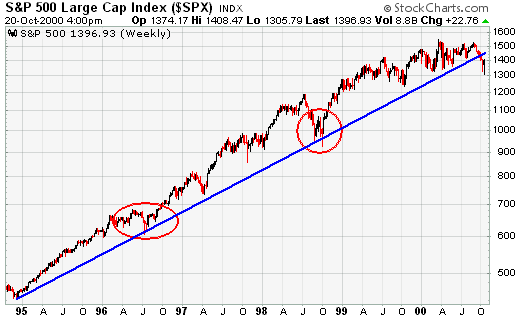

Do you have enough patience to wait for a setup day in and day out for charts like these?

Setup of 4 moving averages to the upside to keep you in the trade. Notice I have removed the bars to remove the emotion from my trading

3 chart confirmation with Heikin Bars to keep you in the trade SHORT