Trading Success

Post on: 16 Март, 2015 No Comment

Its amazing to me how many traders I meet who have completely the wrong idea of what it means to trade successfully.

Let me make it clear. Trading success and profitabiliy have absolutely NOTHING to do with the following:

- Owning or using the next holy grail fancy technical indicator;

- Tweaking the settings of your fancy indicator;

- Trying to predict the tops and bottoms of the market;

- Grabbing as many points as you can from the market every single trading day;

- Following the next best trading strategy.

None of the above points are going to make you successful. Sure, you may make the occasional money every now and then, but youll be lucky if youve made any profit after a year.

See also the video below for a visual presentation of this article

Using or Abusing Technical Indicators

I know a lot of traders who are fond of trashing the use of technical indicators. I am not one of them.

I do make use of technical indicators in my day trading and I find them very helpful in simplifying and identifying key information about the markets that would have otherwise have taken a very long time.

In the above video I show a real example of how I apply indicators and multi timeframe analysis to carry out my own trades, whether its spreadbetting or trading contracts.

Its not the indicators that are the problem, but about how and when to use them.

Some traders seem to obsess too much about getting their indicator settings right like whether they should use an 18 or 20 period moving average, or use a 14 or 12 period Stochastics.

You know what, it probably will not make a damn bit of difference! If this sounds like you, then the first step is stop focusing on tweeking indicators and learn how to trade instead.

Consistency

To achieve any degree of success in trading you need to first achieve consistency. Consistency involves in being able to carry out and execute your trading plan without hesitation time and time again.

Consistency is also a state of mind: to be able to execute your trading plan you need to have confidence in what you are doing.

If you lack confidence or you find yourself hesitating, then it is probable that you have not tested your trading plan sufficiently or that you do not have a solid or proven plan of action yet.

Conclusion

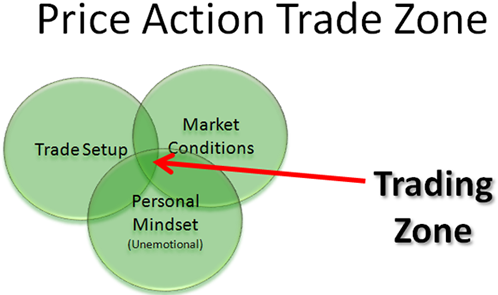

While Technical indicators, newsletters and tip-services have their uses and can be very beneficial they do not replace sound trading skills and principles. These principles focus on: timing your entry and exit, risk control, trade management, money management and most importantly of all, your trading psychology.

If you focus on yourself and building your own trading skills, instead of messing around with the next best indicator or strategy you will achieve not only trading consistency but more profit in your P/L account.

Did you find this article and video useful or helpful? Do you have any related trading stories of your own you wish to share? Feel free to leave me a comment below.