Top mutual funds v funds over time

Post on: 16 Март, 2015 No Comment

Choosing between an actively managed mutual fund, with experts making timely adjustments, or an index fund that goes with the market flow? The answer isnt always straightforward.

Plan Your Retirement

Back in the ‘80s and ‘90s, a mutual fund manager named Peter Lynch became a big star for taking Fidelity’s Magellan stock fund from $20 million in assets in 1977 to $14 billion in 1990.

He beat the market in 11 of 13 years, generating a 29 percent average annual return.

Unfortunately, people like Peter Lynch are rare birds in the investment world. Moreover, bull markets like the one Lynch had the benefit of in the ‘80s have been more the exception than the rule since the 2008 financial crisis.

There are more than 7,000 mutual funds and, needless to say, few if any of them boast the performance of Magellan under Peter Lynch. They all rely on managers who ostensibly have a knack for picking stocks, but not all of them do. Also, a really talented fund manager might leave and turn the fund over to someone less experienced.

Consequently, finding a mutual fund that outperforms the market on a consistent basis would be difficult, although not impossible.

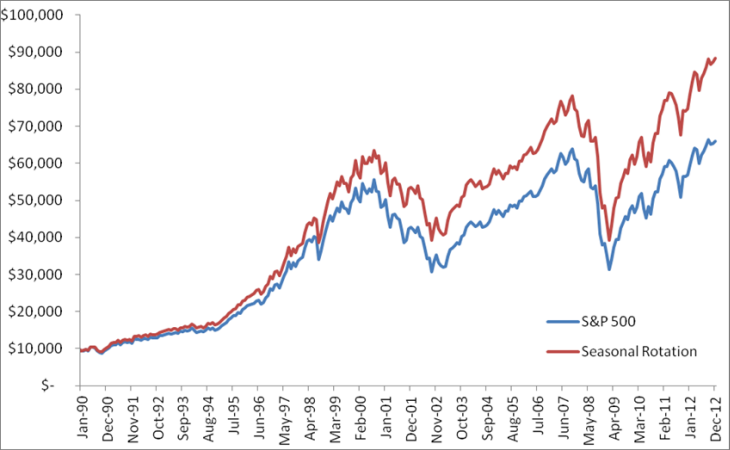

For that reason, a lot of investment professionals have come to see index funds as preferable to traditional mutual funds for buy-and-hold investors. Index funds are mutual funds. Where they differ from traditional funds is that they simply track indices like the Standard & Poor’s 500 index or the Russell 2000 small-cap index or an index of a foreign country’s stock.

An index fund that tracks the S&P 500 simply holds all the stocks in that index. There’s no active management, thus fees are lower.

Index funds also have less turnover than regular mutual funds, so their transaction costs are lower, too.

The mutual fund industry resists the notion that index funds are better investments than actively-managed funds. So do some brokers, who get larger commissions for selling actively-managed fund shares than index fund shares.

So, which is right for you?

In a bear market, your index fund is going to lose value. Maybe a lot. And if you think that kind of drop will cause you to panic and sell at an inauspicious time, then it might not be the right approach for you.

But don’t count on active management to save you in a down turn. Mutual fund values can drop in a down-market, too.

Here’s the lesson: Your portfolio assets should be allocated in a way that matches your goal and the risks you’re willing to take to achieve it. Hopes of beating the market shouldn’t enter into the decision.

Educational, not Investment Advice:

This information is provided for education purposes only and is not intended to provide investment advice. SEI does not claim responsibility for the accuracy or reliability of the information provided.