Top Mutual Funds 3 Things You Need to Know

Post on: 22 Август, 2015 No Comment

About

Money and time are the keys to compounding wealth.

The power of small sums of money to compound over years is enormous. For most folks, mutual funds are the simplest way to put their money to work, and they’re often the only option through employer-provided 401(k)s. If you’re looking for top mutual funds, there’s more to it than picking the ones that have the best returns over the past few years and hoping they work out, because the performance you see might not be what actually shows up in your retirement account.

Let’s talk about three key things you need to know in order to pick out the top mutual funds for your portfolio.

What are mutual funds?

For those who are new to investing, a quick explanation is important. Mutual funds, in short, are pools of money from lots of people that are invested together in equities, bonds, and other assets like money markets. The idea is that by pooling their small resources, lots of individual investors can hold a diversified portfolio.

There are hundreds of funds out there, but for the most part, there are two key things that have historically led to better returns: low fees and passive management.

1. Passive management is better than active management

You may have heard that monkeys throwing darts at stock tickers outperform most professional money-managers. While I’m not aware of any actual experiments on this subject, a number of researchers have used random selection to build portfolios, and the results have shown consistently that these random choices often do better than actively managed portfolios.

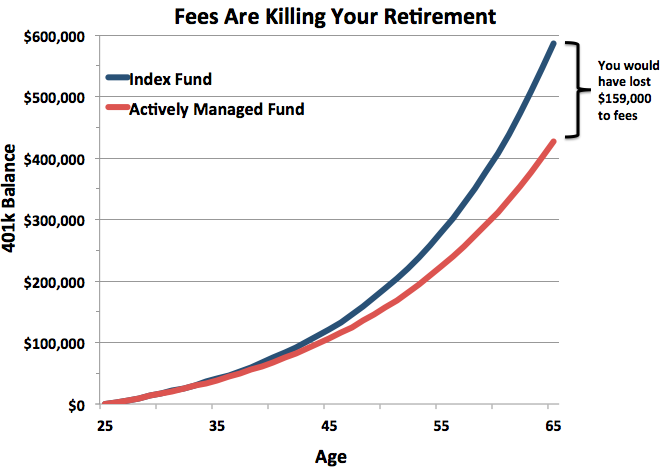

Moving from the experimental to the practical, there’s plenty of evidence that actively managed mutual funds aren’t the best investment in the real world, either. The vast majority underperform the benchmark they’re measured against. When you add in that these actively managed funds also tend to charge the highest fees, it seems downright silly to pay someone to underperform — especially when the impact of fees adds up over time.

Passive funds, on the other hand, cost much less to run and are usually tied to some benchmark index that they mimic, like the S&P 500. for example.

2. Fees, and how compounding interest cuts both ways

Actively managed funds need analysts and experts to find the best places to invest all that money, so they charge more. These costs come in two flavors: loads and management fees. A load involves paying up front to invest in a fund, and this can range from a fraction of a percent to more than 5%. If a fund charges a 5% load, that means you give up $5 for every $100 you deposit. In short, avoiding funds that charge a load is almost an imperative, considering that the evidence overwhelmingly shows that these funds are more likely to produce lower returns than a low-cost index fund .

Fees may look small, but their impact over time can be enormous.

Management fees (and 12b-1 fees for marketing the fund) can range from infinitesimally small to more than 1% per year. While even 1% may sound small, the impact over time is significant. For example, if you invested $1,000 per year for 30 years in a fund that charges a 1% management fee, your ending balance would be more than 20% smaller than it would be if you invested in a low-cost, passive fund with a similar rate of return.

A great mutual fund to start with is Vanguard 500 Index Admiral Shares , which is an S&P 500 index fund with an extremely low expense ratio of 0.05%. This fund is also available as an ETF, the Vanguard S&P 500 ETF .

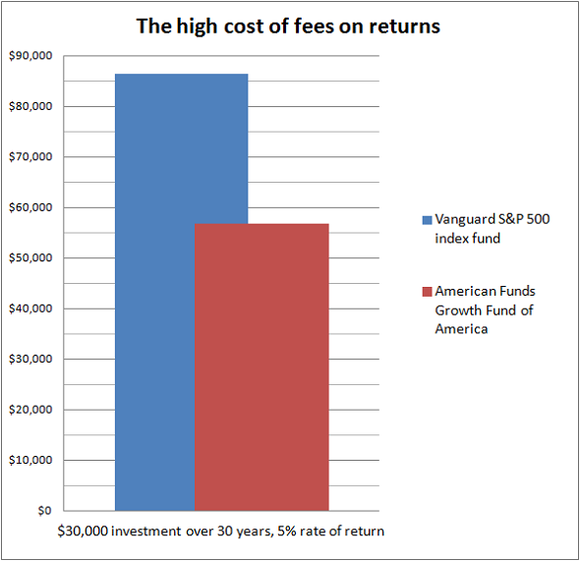

As a comparison, American Funds Growth Fund of America — one of the larger actively managed mutual funds out there, with more than $140 billion in assets — has underperformed the S&P 500 over the past several years, while the Vanguard fund has performed about in line with the S&P 500, as one would expect:

It’s important to note that the performance on the chart is before fees . The Growth Fund of America charges as much as 5.75% every time you invest money in the fund, and its yearly expense fee is a hefty 0.70%. These fees will eat further into your returns.

According to the American Funds prospectus, a $10,000 investment that earned 5% per year (below the historical stock market average) would rack up $1,300 to $1,800 in fees over a 10-year period. A similar investment in the Vanguard index fund would only cost around $62. Invest $30,000 over the course of 30 years, and you’d pay more than $8,000 in fees for the managed fund, versus $613 for the index fund.

But the cash lost to fees is only part of the problem.

You see, losing that amount of money each quarter means you have less money invested, which reduces your capacity to profit from compound returns. Over that 30 years — a shorter time frame than most should spend saving for retirement — based on a 5% annual return, we’re talking about more than $27,000 in lost returns for the fund with higher fees:

Increase the returns to 8% annualized — closer to the actual historical average of the stock market — and those fees would reduce your returns by a whopping $55,000. The lost compounding value due to fees can be bigger than the cost of the fees themselves.

And that’s assuming the managed fund even performs as well as the index — and most don’t.

3. A time to invest in active funds

Many employers’ 401(k) plans only offer managed funds. If your employer offers some level of matching contributions, those matching funds will like make up for the cost of the extra fees and underperformance, and for the same reason that those fees cause you to underperform: The extra money from your employer adds to your compounding power.

Let’s say you invest $30,000 over 30 years into your 401(k), but your employer matches 50% of your contribution. Assuming the funds you invest in charge a 1% management fee — about average for a managed fund — and you average a 5% annual rate of return, you’d still end up with about $17,600 extra thanks to that 50% employer match. The higher your employer match is, the greater the potential returns.

Add in the fact that 401(k)s reduce your taxable income and can be rolled into a personal IRA (and a low-cost index fund of your choosing) if you leave your employer, and it’s crazy not to take advantage of them, even if your investment options are suboptimal.

To sum it up.

Funds with the lowest expense ratios and relatively broad market exposure are the best place to start. If you have a broader selection of funds at your disposal, it’s clear that index funds with the lowest expense ratios are preferable to high-cost actively managed funds. That said, there’s no excuse for not taking full advantage of employer 401(k) matching.

How to get even more income during retirement Social Security plays a key role in your financial security, but it’s not the only way to boost your retirement income. In our brand-new free report, our retirement experts give their insight on a simple strategy to take advantage of a little-known IRS rule that can help ensure a more comfortable retirement for you and your family. Click here to get your copy today.

Copyright © 1995 — 2014 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy .