Top Funds Buying Rackspace Allergan Biogen Idec Apple AGN RAX

Post on: 21 Июнь, 2015 No Comment

T he nation’s top-rated mutual funds the past three months have been big buyers of large medical names such as Allergan (NYSE:AGN ) in their latest reporting periods.

IBD’s biotech/biomedical group was ranked No. 1 among 197 industries as of Tuesday.

Others doing well in the group were Biogen Idec (NASDAQ:BIIB ), Pharmacyclics (NASDAQ:PCYC ) and Salix Pharmaceuticals (NASDAQ:SLXP ). They’ve benefited as the market outlook turned to confirmed uptrend on Feb. 10 and swept higher.

The smart money also showed some love for a handful of household brands, such as iPhone maker Apple (NASDAQ:AAPL ), building supply retailer Lowe’s (NYSE:LOW ), energy drink maker Monster Beverage (NASDAQ:MNST ) and apparel maker Hanesbrands (NYSE:HBI ).

Business social media firm LinkedIn (NYSE:LNKD ) also saw heavy buying from top funds. The stock is trading just 3% off its 52-week high.

Retailers Ulta Beauty (NASDAQ:ULTA ), Home Depot (NYSE:HD ) and O’Reilly Automotive (NASDAQ:ORLY ) have also drawn support from leading funds.

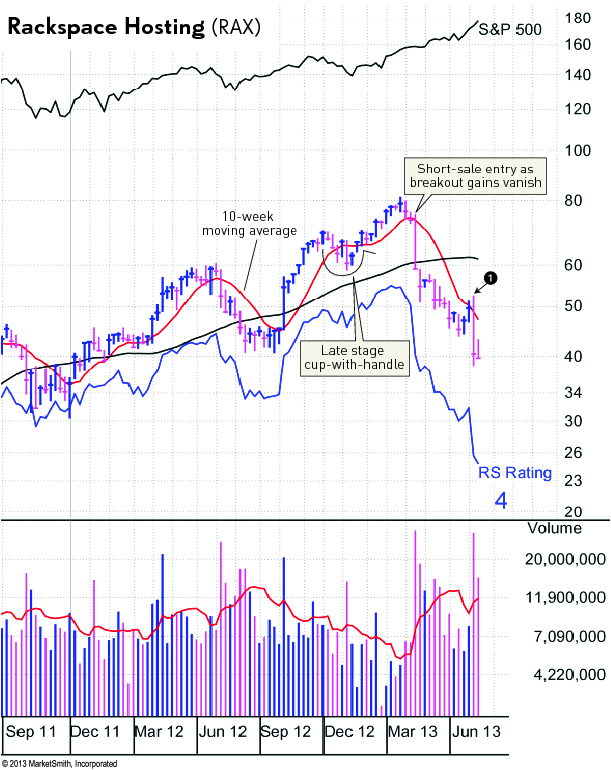

IBD spotted 13 best-performing funds the past three months buying Rackspace Holdings (NYSE:RAX ), investing an estimated $64 million in their latest reporting periods.

Two T. Rowe Price funds, $23.6 billion Mid-Cap Growth and $15.1 billion New Horizons. each added to their positions.

The San Antonio, Texas-based firm provides cloud computing services and web hosting services for businesses.

Rackspace’s growth has been slowing in years. Under new CEO Taylor Rhodes, the company has been repositioning itself into a hybrid cloud vendor with emphasis on managing cloud strategy for enterprise firms rather than competing with large public cloud vendors such as Amazon (NASDAQ:AMZN ) and Google (NASDAQ:GOOGL ).

Rackspace’s earnings growth swung to black the past two quarters, rising 64% and 86%. Revenue growth remained steady, growing 18% and 16% for the same periods.

The stock has been in a strong uptrend since clearing a cup-with-handle base in mid-November. It ran up a 52-week high of 52.45 on Feb. 18. It’s since pulled back 3%, trading at 51.

Sell Side

The nation’s leading funds have been unloading mall operator Simon Property Group (NYSE:SPG ), telecom-cable provider Comcast (NASDAQ:CMCSA ) and credit-card processors Visa (NYSE:V ) and MasterCard (NYSE:MA ) in their latest reporting periods.