Top 5 Best International Mutual Funds to invest in 2014

Post on: 14 Май, 2015 No Comment

5 Top and Best International Mutual Funds to invest in 2014

Some of the Top and Best International mutual funds have given, returns of 55% in last 1 year. With US economy growing at a faster pace in last 2 years, mutual funds which invested in the US economy and worldwide have provided excellent returns. In this article, I would provide some hidden gems of top and best global/international mutual funds which you can invest in 2014.

What are global / international mutual funds?

Before we jump into the best funds, I would provide a quick summary about global and international mutual funds. In case you are already familiar about them, you can jump to the next section.

International/Global mutual funds invest in non-domestic securities market across the globe. Investment in international mutual funds offers good opportunities to participate in the growth of the profitable markets of various countries.

Also Read: Top 5 tax saving mutual funds (ELSS) to invest for 2014

Why should you invest in an international mutual fund now?

US economy has been growing in the last 1-2 years. US Analysts expect that it would continue to rise for next 2-3 years. There is good growth in various parts of the world. The growth pace can be slower, but we feel this would provide good opportunities to invest especially through international mutual funds.

5 Top and Best International Mutual Funds to invest in 2014

We have analyzed 5 top and the best mutual funds to invest and below is the analysis.

1) FT Feeder Franklin US Opps fund

Overview: The Fund seeks to provide capital appreciation by investing predominantly in units of Franklin U. S. Opportunities Fund, an overseas Franklin Templeton mutual fund, which primarily invests in securities in the United States of America. This is one of the top mutual funds in the International fund category.

Annualized returns: Last 1 year returns are 53% and last 2 years annualized returns are 30.5%.

Suitable for: This fund invests in FT US Opportunities fund which invests in top US Stocks. This is purely based on US economic growth. US economy is expected to grow at a higher pace even in next 2-3 years. However, this is high risk, high return fund. One should consider this risk before investing in this.

2) Motilal MOSt Shares NASDAQ 100 ETF

Overview: This funds investment return tries to match the performance of the NASDAQ 100 Index, subject to tracking error. The NASDAQ-100 Index consists of the 100-largest US and global non-financial companies that are listed on the NASDAQ Stock Market. Effectively, this is a global index since about half of the revenue of these companies comes from outside the US. The diversification offered and benefits of investing in the top-100 of the largest non-financial sector companies make it unique.

This is one of the second best mutual fund in International category.

Annualized returns: Last 1 year returns are 52% and last 2 years annualized returns are 35% annualized returns.

Suitable for: This fund invests in top US Stocks where half of the revenues for such companies come outside US. Hence, the performance of this fund depends on overall economic growth across worldwide. Even this fund too is high risk, high return fund. One should consider this risk before investing in this.

3) ICICI Pru US Blue Chip Equity

Overview: The scheme seeks to provide long term capital appreciation by primarily investing in equity and equity related securities (Incl ADRs/GDRs issued by Indian and foreign companies) of companies listed on the New York Stock Exchange (NYSE) and NASDAQ.

Annualized returns: Last 1 year returns are 41%.

Suitable for: This is relatively new fund floated by ICICI MF 1 year back. This fund invests in top large cap and blue chip Stocks in US. Comparing to other international this fund is relatively safer. However, since this is US based fund, the risk would continue and depends on US economic growth.

4) Birla SL International Equity Fund

Overview: The plan would exclusively invest in international stocks. The aim of the plan is to create a portfolio that is diversified worldwide, to take benefit of low correlation between various countries, and to create a portfolio of high quality and high growth stocks.

Annualized returns: Last 1 year returns are 28%, 3 years annualized returns are 17% and last 5 years annualized returns are 18%.

Suitable for: This is a relatively stable fund and provided consistent returns in last 5 years. Since this invests across worldwide, the risk is moderate and one can expect good returns in the long run. However, do not expect high returns of 50% per annum, which you are currently seeing in other international mutual funds which are basically driven by the US growth market.

Also Read: Top 5 midcap/small cap mutual funds to invest in 2014

5) ING Global Real Estate Fund

Overview: The scheme will invest at least 65% in ING Global Real Estate Securities Fund, up to 35% in the units of other similar overseas mutual fund schemes and may also keep up to 20% of its corpus into money market securities.

Annualized returns: Last 1 year returns are 13%, 3 years annualized returns are 14% and last 5 years annualized returns are 19%.

Suitable for: This is also a relatively stable fund and provided consistent returns in last 5 years. Since this invests across worldwide in real estate segment, the risk is high. However, one can expect good returns in the long run. However, even in this fund too, do not expect high returns of 50% which you are currently seeing in other international mutual funds which are basically driven by the US growth market.

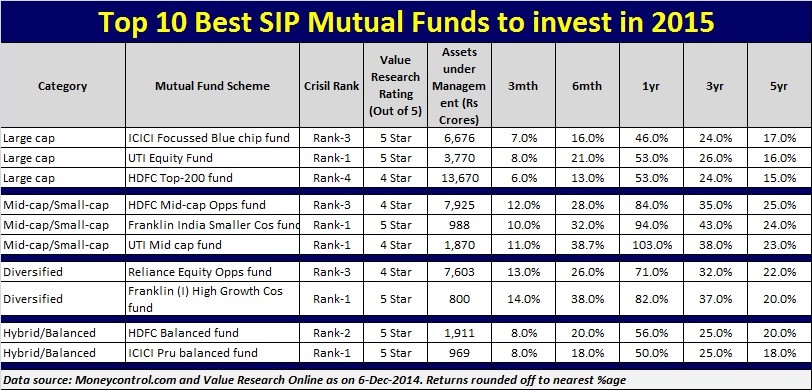

Quick summary and comparison statement

Conclusion : Investment in global mutual funds can provide you good returns over the long run. However, you should keep watching the performance of these funds as they would see a downturn within short span of time with changing global economical and political conditions.

If you found this article is good, share the link in Twitter/Face book.

Suresh

Top and Best International Mutual Funds to invest in 2014