Top 4 Things Successful Forex Traders Do New Forexer

Post on: 11 Май, 2015 No Comment

Trading in the financial markets is surrounded by a certain amount of mystique because there is no single formula for trading successfully. Think of the markets as being like the ocean and the trader as a surfer. Surfing requires talent, balance, patience, proper equipment and astute discrimination. Would you go into the water if there were sharks swimming all around you or dangerous rip tides? Hopefully not. (Benjamin Graham pioneered cutting edge concepts that propelled other top investors to fame. Read The 3 Most Timeless Investment Principles .)

The attitude to trading in the markets is no different to that required for surfing. By blending good analysis with effective implementation, your success rate will improve dramatically and, likeآ many skill sets, good trading comes from a combination of talent and hard work. Here are the four legs of the stool that you can build into a strategy to serve you well in all markets.

Leg No.1 Approach

Before you start to trade, recognize the value of proper preparation. The first step is to align your personal goals and temperament with the instruments and markets that you can comfortably relate to. For example, if you know something about retailing, then look to trade retail stocks rather than oil futures, about which you may know nothing.آ Begin by assessing the following three components.

The time frame indicates the type of trading that is appropriate for your temperament. Trading off of a five-minute chart suggests that you are more comfortable being in a position without the exposure to overnight risk. On the other hand, choosing weekly chartsآ indicates a comfort with overnight risk and a willingness to see some days go contrary to your position.

In addition, decide if you have theآ willingness and time to sit in front of a screen all day or if you would prefer to do your research quietly over the weekend and then make a trading decision for the coming week based on your analysis. Remember that the opportunity to make substantial money in the markets requires time. Short-term scalping, by definition, means small profits or losses. In this case you will have to trade more frequently. (Find out about the various styles of this trading strategy in Scalping: Small Quick Profits Can Add Up .)

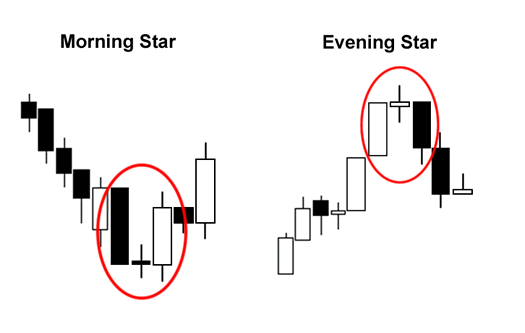

Once you choose a time frame, find a consistent methodology. For example, some traders like to buy support and sell resistance. Others prefer buying or selling breakouts. Yet others like to trade using indicators such as MACD, crossovers etc. (Learn more in our Technical Analysis Tutorial .)

Once you choose a system or methodology, test it to see if it works on a consistent basis and provides you with an edge. If your system is reliable more than 50% of the time, you will have an edge, even if its a small one. If you backtest your system and discover that had you traded every time you were given a signal and your profits were more than your losses, chances are very good that you have a winning strategy. Test a few strategies and when you find one that delivers a consistently positive outcome, stay with it and test it with a variety of instruments and various time frames. (For more, check out our Trading Systems Tutorial .)

You will find that certain instruments trade much more orderly than others. Erratic trading instruments make it difficult to produce a winning system. Therefore, it is necessary to test your system on multiple instruments to determine that your systems personality matches with the instrument being traded. For example, if you were trading theآ USD/JPY currency pair in the forex market, you may find that Fibonacci support and resistance levels are more reliable in this instrument than in some others. You should also test multiple time frames to find those that match your trading system best. (Uncover the history and logic behind this popular trading tool inآ Taking The Magic Out Of Fibonacci Numbers. and Advanced Fibonacci Applications .)

Leg No.2 Attitude

Attitude in trading means ensuring that you develop your mindset to reflect the following four attributes:

- Patience

Once you know what to expect from your system, then have the patience to wait for the price to reach the levels that your system indicates for either the point of entry or exit. If your system indicates an entry at a certain level but the market never reaches it, then move on to the next opportunity. There will always be another trade. In other words, dont chase the bus after it has left the terminal; wait for the next bus.آ آ (Learn more in Patience Is A Traders Virtue .)

Leg No.3 Discrimination

Different instruments trade differently depending on who the major players are and why they are trading that particular instrument. Hedge funds are motivated differently than mutual funds. Large banks that are trading the spot currency market in specific currencies usually have a different objective than currency traders buying or selling futures contracts. If you can determine what motivates the large players then you can often piggy-back them and profit accordingly. (For more on this type of strategy, see Stop Hunting With The Big Players .)

- Alignment

Pick a few currencies, stocks or commodities and chart them all in a variety of time frames. Then apply your particular methodology to all of them and see which time frame and which instrument is most responsive to your system. This is how you discover a personality match for your system. Repeat this exercise regularly to adapt to changing market conditions.

Leg No.4 Management (Implementation)

Since there is no such thing as only profitable trades, no system will trigger a 100% sure thing. Even a profitable system, say with a 65% profit to loss ratio, still has 35% losing trades. Therefore, the art of profitability is in the management and execution of the trade.آ آ (Learn more in The Myth Of Profit/Loss Ratios .)