Top 10 Investor Errors Excess Fees

Post on: 16 Март, 2015 No Comment

Top 10 Investor Errors: Excess Fees

Print This Post

Earlier this week, I mentioned a short list of common errors many investors make. and cobbled together a top 10. Readers had a number of very astute and specific suggestions.

For my list, I wanted to keep it as broad as possible

During each of the next 10 days, I want to flesh out these ideas in some more detail. While I am traveling, I will post one per day in no particular order, starting with today.

You can define fees in a variety of ways, but to me, its any non-investment spending relative to your portfolio that detracts from long term performance .

These can include:

-Mutual Fund Loads

-Advisor fees

-Commissions

-Management fees

-12b-1 fees

-Performance fees

The bottom line is simply this. High fees cut into your returns. Every academic and industry study that has ever looked at this issue has determined that fees are an enormous drag on long-term performance. Typical mutual fund or advisor fees of 2-3% may not sound like a lot, but compound it over 30 or 40 years and it adds up to an enormous sum of money.

One Morningstar study found that while 10% of mutual fund managers regularly outperformed their benchmark, net after fees that number dropped to 1%.

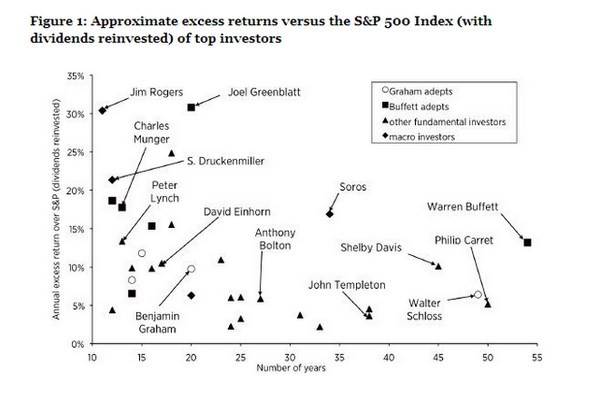

The hedge fund fee structure of 2% plus 20% of the profits is even more of a drag on returns. Other than a handful of superstar managers (that you likely don’t have access to), the vast majority of hedge funds simple cannot justify their costs. Speaking anecdotally, my experience has found that to be true for most of the retail stock brokers and for many of the investment advisors that work on Wall Street.

Its as true for investment advice as it is anywhere else, the wealthy get a better deal. Fees typically drop significantly on accounts over $1m, then even more over $5m and $10m dollars.

Sub $500k accounts pay the highest fees as a percentage of dollar invested. I have a few ideas I want to put into place in the coming quarters to lower these fees appreciably. especially for the accounts under $500k and $100k. I dont believe these accounts typically get especially good service or performance, and I have a few strong ideas about how to change that structure.

Across all of my managed asset clients, my goal is to keep fees down at an average of

1% or less. (it is not an easy target). Investors should expect to pay a little more for smaller portfolios, and somewhat less for much bigger portfolios.

What fees are you paying?

Top 10 Investor Errors

1. High Fees Are A Drag on Returns