TimePriceResearch Cycles

Post on: 16 Март, 2015 No Comment

Pages

Cycles

The root of the problem of time cycle is, that there always seems to be a current, or dominant cycle, that we can see on our chart right now. The rub is, another cycle is always about to become dominant, overpowering the one we have just located and invested in. Larry R. Williams (2003): Long-Term Secrets to Short-Term Trading. p. 23

The cause of cycles is generally that some restorative force exists whenever any system is displaced from its equilibrium. This applies equally to the motion of a pendulum, the orbiting of planets and the state of the economy, because it doesn’t matter whether the system and the restoring force is physical or not.

It may be confidently said that although cycles are found in everything, they are never perfectly regular, but the period of the cycles also varies in cycles. In the case of the planets, they have eliptical orbits causing small variations in motion, but the disturbance of other bodies also causes other variations over varied time scales.

Do cycles work in finance? I always feel uncomfortable answering this question, as it depends on what we are looking for. we deal with the fast evolution of open systems. The stock market now and the stock market in early 1990s are totally different entities — electronic trading systems have changed the look of this land a lot. The stock market in early 70s and in 90s are different entities as well — the money of big financial institutions have changed the landscape of the stock market land significantly. And the stock market in the beginning of 20th century compared to the stock market in 70s is also a different entity — economical forces have been changed a lot within this period. Another peculiarity of financial cycles (and any phenomena where the humankind plays the main role) is that they work inside an OPEN system. What forces move or affect the stock market? It seems to me — everything: FED news, economical/corporate reports, the weather, political perturbations and many other factors plus something that we do not know yet. This is what we call fundamental factors. If in geology we can specify the most influential factors and create models based on these factors, in regards to the stock market we cannot do that as there are too many factors. As a result, a geologist can be a very specialized professional using a very specific set of factors, while a financial analyst cannot do so. A financial analyst has to keep an open mind taking into consideration too many factors.

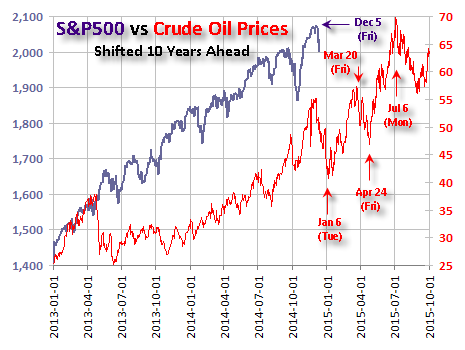

Add to that the fact that the influence of fundamental factors on the stock market is indirect. There is an agent between the two, and it is the humankind. FED news does not affect the stock market directly, it is a reaction of traders/investors on these news that affects the stock market. Therefore, creating forecast models (for example, a Neural Network model) that take into account fundamental factors (FED actions, oils price, etc.) and cook from these factors a probable price movement, we forgot about about humankind who estimates all these fundamental factors.