Time to start valuing human capital as an asset on the balance sheet

Post on: 16 Март, 2015 No Comment

Sponsored by:

Are people an asset or a liability? For decades, accountants have categorised employees as a liability due to their salaries and future pensions. But in an era where more companies offer services instead of goods, and CEOs often talk about employees as their greatest asset, it is time for the 21st century ledger to match current rhetoric.

The discussion revolving around sustainable business often focuses on how nature should be valued on a company’s balance sheet. Puma caused a stir last year with its environmental P&L statement and Microsoft now levies an internal carbon fee on all business units. But while business leaders excitedly discuss the price of carbon and sort out how to assign a value to nature, the people who are the foundation of these companies’ are often overlooked. Instead, they should be placed on the left side of the balance sheet, due to their knowledge, skills and labour that together represent a valuable resource.

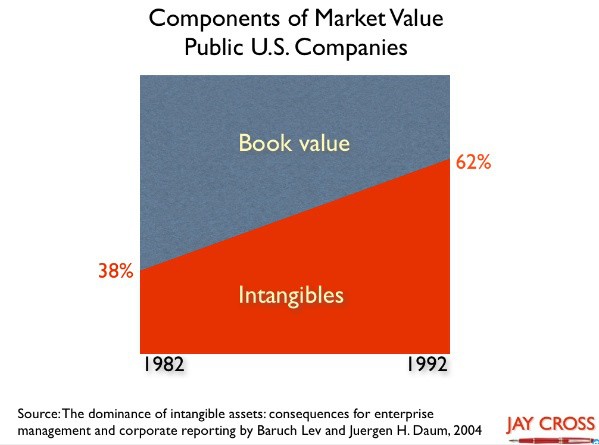

Determining the actual value of this intangible asset is a difficult nut to crack. In 1978, 80% of a company’s value was easy to enumerate because it was mostly tangible assets such as factories and equipment. But now 80%of a company’s value is comprised of intangible assets such as brand value, intellectual property and, of course, people.

Nevertheless, current accounting practices, which worked well in the era of Henry Ford and J.P. Morgan, are inadequate in the 21st century context of companies like Ford Motor and JP Morgan Chase. People invent products at Apple, develop new sustainable fabrics at Nike, work with suppliers at Aldi or greet customers at Walmart. All these workers have value. Accounting and finance just haven’t worked out how to value these people in the same way that they can assign a monetary value to an enterprise software system or a fleet of lorries.

But as HIP Investor CEO R Paul Herman argues, the challenge of formulating an assigned value to human beings, and even the risk that such figures could be manipulated by dodgy financial analysts, does not mean that accounting standards should not be updated to reflect the realities of 21st century business. While a few companies are taking the lead and setting the standard, none of these are in Europe or North America.

Infosys. the giant ICT services firm based in India, has assigned a value to its entire workforce since 2008. The company adopted the Levi-Schwartz human resources accounting model to calculate all of its employees’ collective worth. This enables Infosys’ stakeholders to view the firm’s commitment to investing in employees across all functions and levels of experience. Other companies, including Tata, state that they assign a value to human capital, but Infosys by far is the most transparent about how it arrives at ratios that measure this investment and eventual results.

Herman offers three reasons why assigning valuation to human capital has not yet occurred on either side of the Atlantic. Firstly, accounting standards including FASB and GAAP do not require it. Secondly, people-based companies are not even close to establishing a system of people-based accounting. And finally, if a renegade CEO decided to include human assets on the balance sheet, most likely he or she would be restrained by a sceptical general counsel or chief financial officer who would view increased disclosure as carrying greater risk. Another argument, according to Herman, is the belief that companies do not own people and therefore should not account for them. That is technically true, but companies clearly reap the benefits of their employee’s work. Furthermore, the study of the balance sheets of a company such as Starbucks reveals that, while they do not own the properties in which they operate, they often capitalise the leases — as an asset.

Despite the tight job market and Wall Street’s continued demand to maximise shareholder value, the recognition that people are an asset makes a compelling business case for several reasons. Academic and private sector research suggest that companies that invest in their employees, and therefore create a positive environment in which they can work, perform better financially than their competitors. Stakeholders, however, deserve access to data beyond a letter from the CEO that would verify this fact. The number of socially responsible investors is only on the upswing, and a transparent methodology by which stakeholders can measure this metric will only win trust and additional investment in the long run. And Wall Street’s fixation on short-term results will change as a new valuation paradigm will encourage executives to invest in their employees, not drop the axe when a bad quarterly report hits the news wires.

Leon Kaye is founder and editor of GreenGoPost.com

This content is brought to you by Guardian Professional . Become a GSB member to get more stories like this direct to your inbox