Three Ways To Play Bonds In 2014 (TLT BND SHV MUNI VGIT JNK SRLN HYLD)

Post on: 14 Июнь, 2015 No Comment

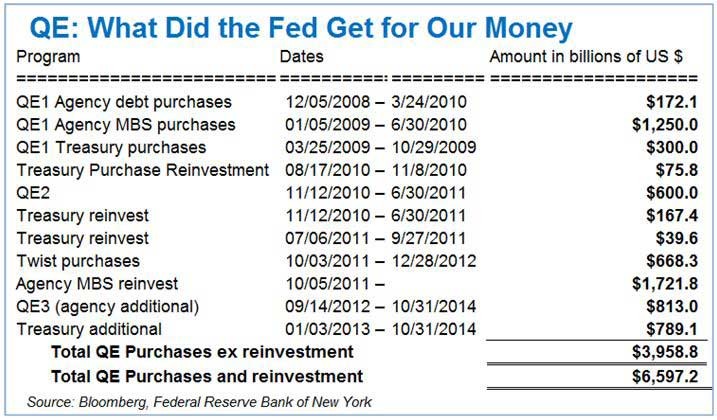

Investors in the fixed income sector are facing a big quandary. The end of the Federal Reserve’s quantitative easing programs. Enacted during the Great Recession, the Fed has been buying bonds- billions of dollars’ worth- every month in order to keep interest rates at low levels. Well, with the economy finally beginning to move forward in positive direction, the end or at least the slowdown of these QE programs could be at hand.

That could be a big headache for investors in broad bond funds like iShares 20+ Year Treasury Bond (NYSE:TLT ). Already, that fund as plunged about 17% since the rumors of the Fed’s tapering has taken hold. That’s because there is an inverse relationship with the price of bonds and rising interest rates.

As the Fed winds down its programs, more losses could be in store for investors. However, there are some places that investors can find comfort in the fixed sector. Making a move towards these bonds in 2014 could be pretty prudent.

A Looming Problem

The Fed’s impending actions with regards to its QE program can cause some unpleasant side effects for fixed income seekers. Already, we’ve felt the effects. From this past May to September- when long-term interest rates rose just 1.3% -bond funds like the Vanguard Total Bond Market ETF (NYSE:BND ) have fallen more than 4%. Overall, investors have pulled a record $164.5 billion out of bond mutual funds since the start of June.

The issue at hand is that as the Fed raises rates, a portfolio of fixed-income securities will likely lose value. Bonds with longer maturities suffer more and the longer the maturity of the bond, the bigger that suffering is. Essentially, for every percentage point gain in yield, a 10-year bond would lose roughly 10% in price, while a long dated a 30-year bond would drop around 30%.

Needless to say, those sorts of losses are hard to swallow.

Yet, investors need not abandon fixed income all together. There are plenty of opportunities and ways for investors to retool their fixed income portfolio to protect against the Fed’s taper effects and even profit from it. Here’s some of the best.

A great way to play the specter of rising rates in the new year is move down the interest rate spectrum. Funds with short durations remain fairly stable when interest rates rise as they are able to roll-over their holdings to higher yielding debt easier than say a long bond. The iShares Short Treasury Bond (NYSE: SHV ) tracks 23 different U.S. Treasury notes with remaining maturities between 0 and 1 year. Overall, SHV’s average bond matures in 5 months. Meaning that will have an easy time rolling over to higher yielding bonds as the Fed raises rates. However, the drawback is that it basically yields nothing.

The trick is to pair it with a slightly longer dated fund to get current yield. Analysts estimate that a duration of 5 years provides just the right balance of inflation beating yield as well as enough protection against rising interest rates. The Vanguard Intermediate-Term Government Bond Index ETF (NASDAQ:VGIT ) tacks 176 bonds and has a duration of 5.1 years. More importantly it yields 1.66%. Pairing it with SHV should provide enough yield and interest rate protection.

Municipal bonds have been rocked by the dual fear of rising rates and a series of high-profile city bankruptcies. However, the bonds now offer some of the best yields after the recent market rout. A ten year muni currently out yields a ten year treasury. And that’s not even considering the tax benefits of holding them. The actively managed PIMCO Intermediate Muni Bond Strategy (NASDAQ:MUNI ) focuses its 161 holdings on quality muni bonds. That focus provides a duration of 4.67 years and a 2.34% yield.

Be Active In “Junk”

Generally, when the economy improves, investors ratchet up their risk profiles. In the fixed income world, that means focusing on high yield or junk bond funds like the SPDR Barclays High Yield Bond (NYSE:JNK ). However, as investors have clamored for yield, junk bond prices have surged and some less than stellar issuers have begun flooding the markets. Both the AdvisorShares Peritus High Yield ETF (NASDAQ:HYLD ) and the SPDR Blackstone/GSO Senior Loan ETF (NASDAQ:SRLN ) use active management to mitigate credit and interest rate risk. Meaning, investors can have high yield, while still fighting the Fed.

The Bottom Line

The New Year promises one certainty in the bond market and that’s the Fed will finally begin its taper and end its bond-buying programs. For those investors in long dated bonds, now could be the best time to tweak their holdings. The previous ETF ideas are just some of the ways that investors can position themselves for the upcoming taper tantrum.

Disclosure — At the time of writing, the author did not own shares of any company mentioned in this article.