Three reasons to invest in stocks Fidelity Investments

Post on: 11 Май, 2015 No Comment

Your e-mail has been sent.

When you’re young, saving for retirement—something that’s years away—probably isn’t your first priority. But that doesn’t mean it’s OK to wait to start saving. The more time your money is invested, the more time it has to grow. And one of the best ways to give your money a chance to grow over the long term is by investing in stocks and stock mutual funds.

“In general, people should be more aggressive in their asset mix when they are younger—that is, tilt more toward stocks,” says Steven Feinschreiber, senior vice president, financial solutions, for Strategic Advisers, Inc. (a Fidelity Investments company that is also a registered investment adviser).

Unfortunately, some younger people appear to be not choosing stocks. When we asked young people (Generation Y, born 1978–1988) how they were investing, 52% of them said they had 50% or less allocated to stocks. Further, 26% said they were in cash only, according to our Retirement Savings Assessment. 1 And that’s not great because too low an allocation to stocks can limit how much money you have when you retire.

Other Fidelity data, however, suggests that there is a potential bright spot that may offer a pathway to better retirement savings outcomes. Many younger investors, who have 401(k)s with Fidelity, have an appropriate allocation to stocks based on their age. This is because many are automatically invested in the default investment option in their 401(k) plan, which is often a target-date fund.

With a target-date fund, you just pick the fund with the target year closest to when you want to retire. The target-date fund manager selects, monitors, and adjusts the mix to match the target retirement date. This suggests that professionally managed investment options, such as target-date funds and managed accounts—which are often options in many 401(k) plans—can help millennials get on the right track for retirement success.

But for those who may be stock shy, here are three reasons why you should choose stocks when saving for a far-off goal like retirement.

1. Stocks have offered the most potential for growth.

Stocks offer the most potential for growth.

Data Source: Ibbotson Associates, 2014 (January 1926–April 2014). Past performance is no guarantee of future results. The asset class (index) returns reflect the reinvestment of dividends and other earnings. This chart is for illustrative purposes only and does not represent actual or future performance of any investment option. It is not possible to invest directly in a market index. Stocks are represented by the Standard and Poor’s 500 Index (S&P 500 ® Index), bonds by the U.S. Intermediate Government Bond Index, short-term investments by U.S. Treasury bills, and inflation by the Consumer Price Index.

U.S. stocks have consistently earned more than bonds over the long term, despite regular ups and downs in the market. Take a look at what $100 would be worth over the history of the stock market (S&P began tracking performance in 1926). During this time, stocks returned an average of almost 10% annually, bonds 5.3%, and short-term investments 3.5%, before inflation. 2 Of course, it wasn’t a straight line up for all, but what this shows is that stocks typically offer more potential for growth over the long term. That’s why investing in stocks or stock mutual funds is so important when saving for retirement or other far-off goals.

2. You can ride out the ups and downs of stocks.

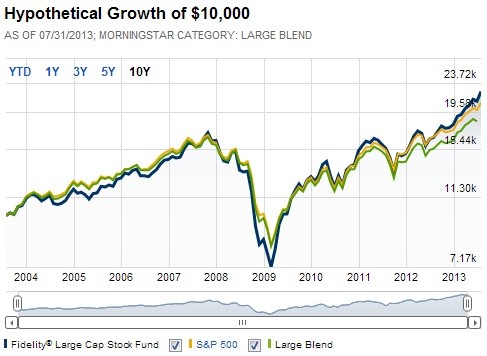

Let’s look back in time to illustrate the point. Consider three very poor market scenarios: the Great Depression, the early 1970s, and the recent 2008 Great Recession. Say you had an aggressive portfolio of 85% stocks and 15% bonds in your 401(k) during the Great Recession of 2008. You would have lost around 44% from October of 2007 to February of 2009. But, if you held on to those stocks, by April of 2011—less than four years later—the portfolio was back to its 2007 high. While this may seem like a long time, it is a small part of a 40-year investment horizon. There is no way to predict how long it will take for the market to recover though. It took almost 14 years during the Great Depression and a little more than three years during the 1973 recession. But in both cases, the market recovered and those who kept investing were rewarded.

If you’re investing for a far-off goal, you can probably ride out a market downturn.

Time to return to peak for aggressive growth portfolio