The SuperStar allETF portfolio 2002

Post on: 20 Апрель, 2015 No Comment

PaulB. Farrell

LOS ANGELES (CBS.MW) — Another strong sign of a recovery has been flashing across our radar lately: renewed interest in exchange-traded funds.

They’re hot again and grabbing the headlines:

- ETF assets exploding worldwide. mushrooming 43 percent around the globe.

- Five months ago Barclays launched its new international iShares MSCI EAFE (EFA), quickly becoming one of the 10 largest ETFs, and Vanguard just announced its second ETF, the Vanguard Extended Market VIPER (VXF).

- Nasdaq announced a new sibling for its popular Qubes-100, this one tracking the entire Nasdaq Composite.

- Plus, the SEC is exploring a radical plan to permit actively-managed ETFs!

With interest heating up, it didn’t surprise me when readers began asking for a SuperStar all-ETFs Portfolio.

Last week we reviewed our SuperStar Portfolio of traditional mutual funds. Now, here are our suggestions on building an all-ETF SuperStar Portfolio:

First — allocate your bond funds

Although ETF experts will tell you ETFs work for both buy’n’hold investors and active traders, the visible absence of bond index ETFs suggests otherwise.

So please remember, you still need some fixed-income funds in order to build a successful all-ETF portfolio.

My advice: Calculate your bond fund allocation first. And buy them first. Whether you’re a 20-year-old college grad or a 60-year-old retiree, make darn sure you focus on fixed-income funds before equities. Then and only then look at these stock ETFs.

Core large-cap ETFs (40%)

Once you’ve locked in the fixed-income portion of your portfolio, take the next step by allocating 40 percent of your stock portfolio to core large-cap holdings.

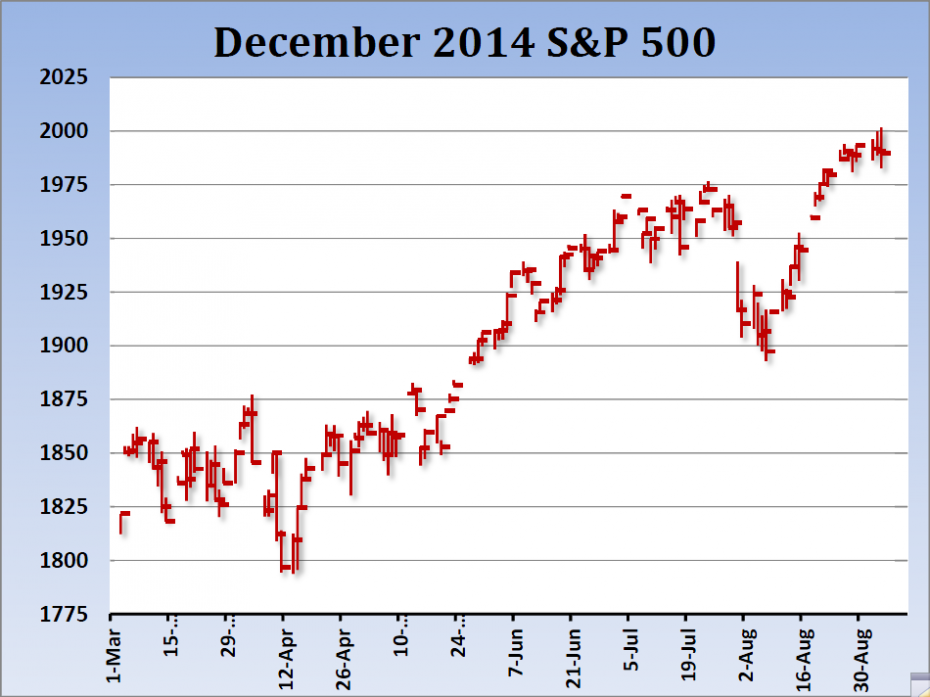

Launched in 1993, the $31 billion Standard & Poor’s Depositary Receipts SPY, -0.61% is the biggest and oldest exchange-traded fund on the market.

Affectionately called the Spider, (SPDR) it tracks the S&P 500 index just like a typical S&P 500 index mutual fund. There are also ETFs available for just the Value (IVE) and Growth (IVW) components of the S&P 500.

Another $3.8 billion is invested in Barclays iShares S&P 500 (IVV). And if you prefer the blue-chip Dow-30, buy the Diamond DIA, -0.79% where another $3.1 billion is invested. Other large-cap variations include the Fortune 500 Index Tracker (FFF) and State Street’s streetTRACKS US Large-Cap Growth (ELG).

Mid-caps and small-caps (30%)

Your allocation will probably be focused on these ETFs:

For mid-caps, the S&P 400 Mid-Cap Spider MDY, -0.60% or the iShares S&P Mid-cap 400 (IJH).

For small-caps, Barclays iShares Russell 2000 IWM, -0.36% or iShares S&P Small-Cap 600 (IJR) will serve.

Also note that growth and value versions of the above indexes are also available as ETFs.