The Role of Risk in Mutual Fund Strategies keys to customizing portfolios

Post on: 4 Апрель, 2015 No Comment

The Role of Risk in Mutual Fund Strategies

Jack Piazza

I dentifying individual risk tolerance is one of the basic factors in determining an optimum investment strategy for a mutual fund portfolio. Regardless of the return objectives and time horizon within a portfolio, risk tolerance affects both asset allocation and the selection of fund categories (i.e. large value, small growth, international, short-term bond, intermediate-term bond, etc.).

Let’s first define risk. In general, risk refers to the fluctuations in the price of a security — these fluctuations, known as volatility. can range from very stable to erratic. In addition, many different types of specific risk exist which can affect investment value: bonds generally have various degrees of credit risk, inflation risk, interest rate risk and principal risk; stocks can have dividend risk, market risk, and, in foreign stocks, currency and political risks.

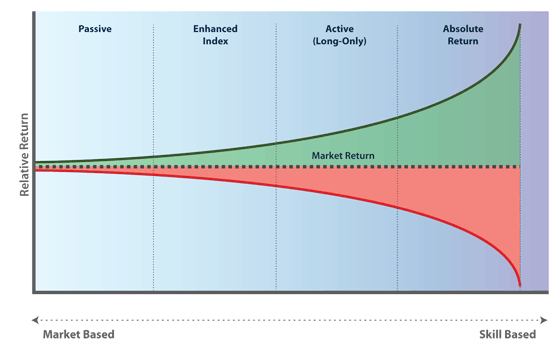

As the level of risk increases, both volatility and total return potential proportionately increase; conversely, as the level of risk decreases, both volatility and total return potential proportionately decrease. This standard risk/reward rule is often illustrated with risk and reward both escalating over a broad spectrum beginning with cash reserves, changing to bonds and then ending with stocks:

Although stock funds exhibit greater risk and reward compared to bond funds, each has a separate risk/reward spectrum. The following examples depict risk/reward on an escalating basis by fund category:

Stock funds.

large value

Bond funds.

short-term

I n mutual funds, risk tolerance is normally associated with the degree of fluctuations in the price of bond or stock funds. Investors typically fall into one of three categories of overall risk tolerance: conservative, moderate or aggressive .

Conservative risk tolerances will accept lower returns to minimize price volatility.

Moderate, or average, risk tolerances will accept greater price volatility than conservative risk tolerances to pursue higher returns.

Aggressive risk tolerances will accept large swings in price volatility to seek the highest returns.

T here are two contrasting viewpoints regarding the application of risk tolerances in mutual fund strategies. One treats risk tolerance as a basic asset allocation adjustment. covering only one risk/reward spectrum (cash, bond and stock funds); examples include aggressive growth (100% stock), growth (80% stock, 20% bond), moderate growth (60% stock, 40% bond), conservative growth (40% stock, 60% bond), and income (20% stock, 70% bond, 10% cash). The other viewpoint treats risk tolerance as a fund category allocation after selecting a basic asset allocation — and then selecting the types of fund categories which are suitable for the desired risk tolerance — this method allows more precision and customization in designing an investment strategy than the basic asset allocation method .

Choosing a basic asset allocation before selecting fund categories is critical. In formulating an appropriate mutual fund portfolio strategy, the determination of risk tolerance should be the last criteria before fund category selections. Selecting fund categories prior to establishing a basic asset allocation (based on investment stage, time horizon, return objectives, portfolio size, then risk tolerance) leads to haphazard fund selection, resulting in an ineffective and inappropriate strategy — see Three Common Mistakes in Mutual Fund Investing for further information.

Using the fund category allocation method, conservative, moderate or aggressive risk tolerances can combine with a variety of return objectives, subject to certain time horizon restrictions. For example, any one of these risk tolerances can match with a growth, balanced or income-oriented return objective, provided that the time horizon is long-term. With short-term or intermediate time horizons, any one of these three risk tolerances can match with an income-oriented return objective (growth-oriented return objectives require long-term time horizons).

L et’s look at a hypothetical situation that uses the fund category allocation method. In one scenario, Jones and Smith share nearly identical investment objectives. Each will retire in 10 years and wants to reallocate $100,000 in a long-term, balanced-oriented plan (equal emphasis on growth and income); however, Jones prefers an aggressive risk tolerance, Smith a conservative risk tolerance. In this scenario, a fundamental allocation consisting of 50% stock funds and 50% bond funds applies to both portfolios. The application of these risk tolerances could create the following fund categories and their allocation percentages (note: this is just one example of many possibilities in this scenario ):

Jones.

25% large-cap growth, 15% mid-cap growth, 10% small-cap growth | | 25% multisector bond, 15% high-yield bond, 10% international bond

Smith.

30% large-cap value, 15% mid-cap value, 5% small-cap value | | 20% short-term bond, 15% intermediate-term bond, 15% GNMA

In this scenario, these portfolios reflect the investment objectives and preferences of Jones and Smith; yet both are very different in fund categories and allocations — even though risk tolerance is the only investment characteristic difference between them.

Guidelines for Determining Risk Tolerance

- Be realistic with regard to volatility — seriously consider the effect of potential downside loss as well as potential upside gain.

- Determine a comfort level — if you are not confident with a particular level of risk tolerance, then select a different level.

- Regardless of the level of risk tolerance, adhere to the principles of effective diversification — the allocation of investment assets among different fund categories to achieve a variety of distinct risk/reward objectives and a reduction in overall portfolio risk.

- Reassess risk tolerance at least annually — sometimes your risk tolerance may change due to either major adjustments in return objectives or to a realization that an existing risk tolerance is inappropriate for your situation.

W hen combined with investment objectives of time horizon, investment stage, return objective and portfolio size, risk tolerance can be used to design an optimum investment strategy by customizing fund category allocations and suitable mutual fund selections. However, the initial key is to define all of the objectives and preferences so that the allocation strategy can be well-diversified and give a clear, precise focus to the plan.