The Rising Risk Of Investing In Bond Funds And ETFs

Post on: 19 Апрель, 2015 No Comment

While interest rates remain extremely low by historical standards, they are starting to creep up. Bondholders, myself included, have been the beneficiaries of the recent long run decline in interest rates. However, there is a good reason to believe that this cannot go on forever and in fact will change course to rising interest rates. Goldman Sachs has been shifting its positions amid rising concern of a potential bond bubble. I’m feeling the same anxiety.

However, this is not the first time there has been a specter of a bond bubble. Back in the summer of 2010, CNN Money ran a piece: Bonds: Avoid the next great bubble. Since that time, the 10 year treasury bond yield has dropped from about 3.3% to just under 2.0% this past Friday. Subsequently, my position in Vanguard’s High-Yield Corporate Bond Fund (MUTF:VWEHX ) has risen 13% with a return of 35.6%. Similarly, ETFs like iShares Core Total US Bond Market ETF (NYSEARCA:AGG ) and SPDR Barclays High Yield Bond (NYSEARCA:JNK ) have risen 4.1% and 10.5% with total returns of 13.4% and 37.5%, respectively. Even lower duration ETFs like iShares Barclays 1-3 Year Treasury Bond (NYSEARCA:SHY ) have eked out a 2.5% total return despite a tiny 0.4% yield.

So while bonds might be in a bubble, we also clearly know that pundits are often off on their timing. However, there are several deeper questions that are more relevant to investors. The main question is looking at the root cause of what could be causing a bond bubble or at least overvaluation. There are several reasons that bonds could be a risky investment looking forward:

Interest rates — The long run decline in interest rates has been a boon to bond investors and in general all investors. However, it is not reasonable to expect interest rates to continue to remain low for extended periods of time. (click to enlarge) Source: Yahoo!Finance

History shows the long consistent decline in interest rates over the past thirty years. The question is whether it will continue, remain flat, or begin to reverse course as investors demand higher returns for their riskier U.S. debt. I personally am not wagering on a continued decline, but how much and when would the reversal occur are open questions. Changing interest rates reflect a fundamental change in the value of bonds.

Inflation — Inflation is like kryptonite for most bonds. Their fixed future payments are rapidly eroded by inflation, which simply manifests itself through ever increasing discount rates. Given the large deficits that the government is running, it would not be unreasonable to think that they might not mind a little inflation to erode the debt. One approach to mitigating this risk is to invest in inflation protected government bonds, like through iShares Barclays TIPS Bond (NYSEARCA:TIP ).

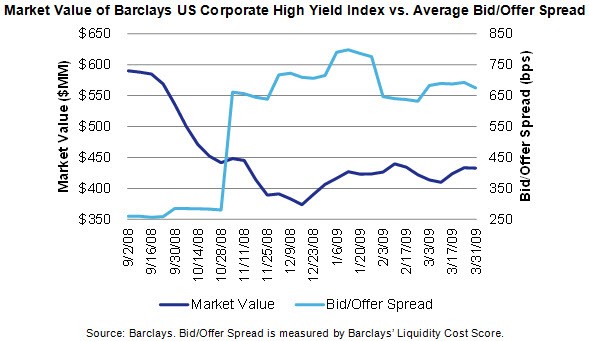

Yield Chasing — Investors, faced with a persistent low interest rate environment, may chase after yield whether it be stock dividends or interest on lower quality corporate bonds. When investors chase the yield and ignore risks, the supply and demand dynamics push the prices of high yield bonds higher and subsequently reduce their yields. Evidence of yield chasing would potentially appear if higher yield bond ETFs and mutual funds show faster compression in their spreads to treasuries than lower yield bond ETFs and funds. The following chart compares the spread to the 10 Year Treasury bond for a range of bond ETFs and funds.

The above graph shows substantial compression in yield among the high yield ETFs including JNK and iShares iBoxx $ High Yield Corporate Bond (NYSEARCA:HYG ). In contrast, iShares iBoxx $ Investment Grade Corp Bond (NYSEARCA:LQD ) has shown a much lower drop in yield, just 0.6%, and smaller compression in spread of just 0.5%. The challenge to this argument is that it is not yield chasing but rather an adjustment back towards fair value for JNK and HYG.

Economic Outlook — Uncertainty about the outlook for the U.S. and global economy can trigger a flight to quality in which stocks are sold and bonds are purchased and investors shift from lower quality bonds to higher quality corporate issues or government issues. Given the looming challenge of sequestration, economic sluggishness, and longer term deficit challenges, investors might begin to seek safer havens for their capital. However, the continued strength of the current bull market (note that bull market is strictly defined by stock performance and not necessarily underlying fundamentals) may pull retail investors from the sidelines.

Psychology — This is another key consideration for viewing markets. As much as investors might want to believe they are rational, research consistently suggests otherwise. I found the following article intriguing for the final observation that investors have made a net $1.6 trillion shift to bond funds over stock funds. The author attributed it to the psychological battering from the financial collapse in 2008.

For much of the last 44 months, most investors, many of them psychologically and financially scarred by the 2008-09 financial crisis, have sworn off the stock market. — Adam Shell

I’ve seen these sentiments dotting the investing commentary landscape for the past couple years. However, the problem in declaring the stock market to be dangerous and bonds to be safe or at least relatively safer is that it creates a new, equally irrational, view of the world. If you held a broad position in the stock market and did nothing during the crisis, you are essentially back in the same place plus dividends. If you added at any time during August 2008 through August 2009 to a broad index, you are now significantly ahead.

Looking forward

I wrote this article because I’ve been thinking a lot about bonds. I have exposure primarily through various funds with an emphasis on high yield funds. I think bonds are clearly becoming riskier, especially the higher yielding funds and ETFs. By riskier, I mean that there is an increasing possibility of declines from both rising interest rates and potential for investors to shift funds to other asset classes. From this perspective, I would probably emphasize lower duration and medium level quality bonds to find a decent balance between interest rate risk and income potential.

Another challenge is around timing; while I think interest rates will rise, it is unclear exactly when this might happen — is it in 1 year or more, would it be gradual (market forces) and step change (Fed decision). One could exit now and re-invest in the stock market, which is taking a different risk, or safe havens like CDs (lots of inflation risk). Neither of these options looks very attractive. Hence, I’m probably not going to substantially reduce any of my bond positions despite some potential for loss in the future. However, I don’t think I would add to my position either.

For investors concerned about inflation, I would suggest TIP or similar investments, companies with significant commodity reserves like oil, gas, or timber, or select real estate investments.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional Disclosure: Disclaimer: This article is for informational and educational purposes only and shall not be construed to constitute investment advice. Nothing contained herein shall constitute a solicitation, recommendation or endorsement to buy or sell any security. I am long VWEHX and VIPSX.