The Peril of Picking Best Mutual Funds

Post on: 26 Апрель, 2015 No Comment

The financial media regale investors with a steady diet of ways to pick the best mutual funds. The selection criteria vary but often include no sales load, long manager tenure, recognition by well-known websites such as Morningstar and long-term performance. On the surface, it seems to make sense, but let’s dig deeper and take a hard look at the data.

McGraw Hill Financial performs a real service to investors by publishing its S&P Indices Versus Active funds scorecard twice a year. You can access its latest report from September 25 here.

Here’s of a summary of the findings for the period ending June 30:

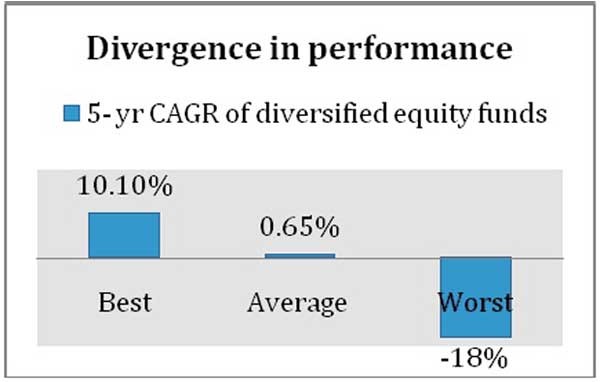

- Most active managers in almost all categories underperformed their benchmark for the past one-, three- and five-year horizons.

While this data is depressing enough for proponents of active funds, it gets worse. Over the past five years, nearly 27 percent of domestic stock funds, 24 percent of international stock funds, and 19 percent of fixed income funds merged or liquidated. Maybe the question you should ask your broker is not: Can you pick an actively managed fund that will outperform the benchmark? Instead, ask: How confident are you that the actively managed fund you are recommending will survive the next five years?

When I present this data to investors, the question I often get is: Since some actively managed funds outperform their benchmark, why not focus on selecting those funds? The answer is that no one has figured out how to do so prospectively. I am fond of saying that brokers look in their rearview mirror and think it reflects what they can see in their windshield.

The headline of a recent article in Forbes by respected financial journalist John Wasik refers to this illusion as the continuing tall tale of past performance. Wasik references the data showing that only a very small percentage of top-performing funds were able to repeat that performance for the subsequent three years. Yet the financial media continue to tout past performance as evidence of the likelihood of stellar future performance. Many investors fall for the hype, because they are ignorant of the overwhelming data to the contrary.

The daily grist of many brokers involves a pitch that they have the ability to select outperforming actively managed funds. Don’t fall for it.

Dan Solin is the director of investor advocacy for the BAM ALLIANCE and a wealth adviser with Buckingham Asset Management. He is a New York Times best-selling author of the Smartest series of books. His next book, The Smartest Sales Book You’ll Ever Read, will be published March 3, 2014.

The views of the author are his alone and may not represent the views of his affiliated firms. Any data, information and content on this blog is for information purposes only and should not be construed as an offer of advisory services.