The Meanings and Costs of Mutual Fund Classes

Post on: 20 Июль, 2015 No Comment

Is your money with a broker? If so, it is highly likely that you are paying relatively high (and hidden) fees for the mutual funds your broker chooses for (read: sells to) you.

Take a good look at your account statement. Do you see something like “Class A,” “Class B,” or “Class C” in the title of the mutual funds you hold? Most people glance over this piece of information. But the class of your mutual fund is one of the most important things you should take into account when analyzing your investments—perhaps even more important than the performance of the fund.

The term “class” is deceiving. Many assume it has something to do with the quality of the investments within the fund. In actuality, all of the classes contain exactly the same investments. The only difference in the classes is the fees that are paid to your broker. Many people are shocked to learn that their brokers are paid fees from their accounts because they never see a bill. Sound familiar?

A client recently came to me with a portfolio of mutual funds in which the total expenses added up to 3% of the total portfolio each year. Because she had never received a bill and the fees were not explicitly laid out for her, she assumed she was paying nothing. In reality, the fees had simply been deducted from her investments. This is all too common.

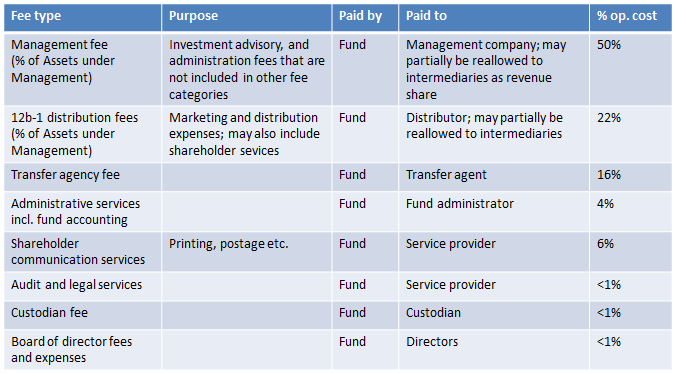

So, how does your broker get paid? Well, the biggest source of income for brokers is commissions on the sale of mutual funds to clients. The rule is (as with most things in life) the lower-performing the fund, the harder it is to sell, and thus the higher the commission that the broker will be paid. These commissions/fees are referred to in the mutual fund world as “loads.” This method of payment presents the broker with a huge conflict of interest—but that it is a discussion for another day.

For an example, take the Fidelity Advisor Emerging Markets Fund, Class A (FAMKX). If you buy this fund, you will pay a 5.75% fee (load) on the front end, and an additional 1.56% in expenses, including a 12(b)(1) fee, for the rest of the time you hold the fund. That means that if you put $10,000 into this fund, you will pay $731 in fees the first year and $156 in fees per year for the rest of the time you hold the fund.

Now take the virtually identical Fidelity Emerging Markets Fund (FEMKX). This does not have the 5.75% fee on the front end and has an expense ratio of 1.09%. This means that you will only ever pay $109 in fees per year for a $10,000 investment in a fund with exactly the same contents.

I like to compare mutual funds to brand names vs. generic medicines. Often, the generic brand of ibuprofen has exactly the same ingredients as the name brands, but costs a lot less.

Expensive mutual funds are fairly easy to avoid if you do your research. 401(k )plans, however, are an exception. It is common for 401(k) plans to limit an investor to a small universe of expensive mutual funds as investment options. In this case, look into whether you can pay a small fee to choose investments outside of the universe available to you under your plan. It will most likely save you a great deal of money in the long run.

All of this is not to say your broker doesn’t deserve to get paid—but does he deserve to be paid five times what you would pay for the same product elsewhere? The bottom line is that these purposefully hidden fees reduce your returns. Do yourself a favor: Pull up your accounts and look up the expenses on every fund you hold.