The Intermarket Rieki

Post on: 16 Март, 2015 No Comment

Login Form

Tuesday, 18 January 2011 19:04

Confirmation and non confirmations are at the heart of technical analysis. Whether it’s the Dow Theory speaking about the confirmations between Dow Industrial and Transports as a tenet for a trend continuation or it’s an intermarket ratio line breaking a multiyear trendline, we are always seeking an evidence for continuation or reversal of a trend.

Pattern identification is a high skill and also at the heart of technical analysis, but there are a few published rules regarding the workability and backtested results of non confirmations. Non confirmations are as prone to failure as any other market pattern. Times have changed. New age technicians should accept that market complexity has increased and the days of Joseph Granville confident fanfare forecasts may take a while to return. Accuracy needs more than visual skill today.

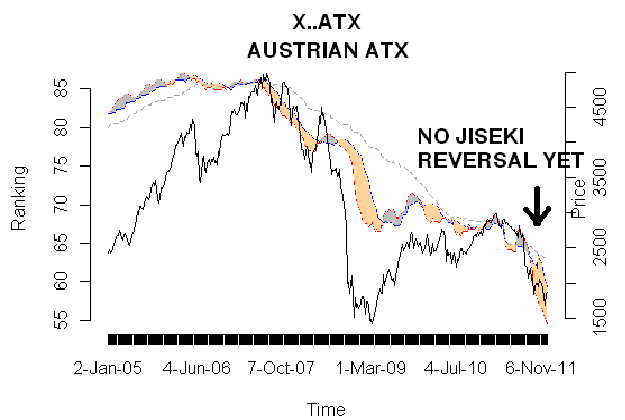

This is the reason just spotting confirmation and non confirmation may not be enough. One needs a system which can actually quantify what does non-confirmation mean in percentage terms. And whether beyond a certain level that non confirmation between two correlated assets could bring about a reversal in the secular (or monitored) trend.

The performance cycle Rieki provides a percentage figure to non confirmation. Non confirmation is the other name for underperformance. If Dow Jones Industrial (DJI) underperforms Dow Jones Transport (DJT), it is non-confirming the blue chip index at a certain degree of time. If the underperformance continues, it will invariably produce the lower highs or lower lows of Dow Theory at some degree of time (minor, intermediate or primary).

Here we have illustrated the performance cycles of DJT and DJI. DJT is a top ranked global asset and has outperformed the DJI since the start of the year. Rieki pair performance cycle between DJI vs. DJT (Fig 3) illustrates the 17% outperformance of transport vs. Industrials. The intermarket Rieki still favors transports over Industrial. The larger this divergence between two leading indices gets higher the chance for an extremity. And more we push into extremity more we have a chance of reversal in polarity when transports should start underperforming the Industrial. This reversal in performance brings us closer to an inflexion. Whether that inflexion reverses the Dow also is another study.

orpheus.asia/2009/03/27/a-dow-theory/) the current status of the cycle suggests that DJT out performance is reaching a historical high against DJI suggesting that 2009 should witness a multi month reversal in DJI. It did. We have to review the ongoing case now.

Mukul Pal, CMT, Orpheus Capitals. Global Alternative Research