The Importance of Tax Diversification in Retirement Planning

Post on: 4 Август, 2015 No Comment

August 22, 2011

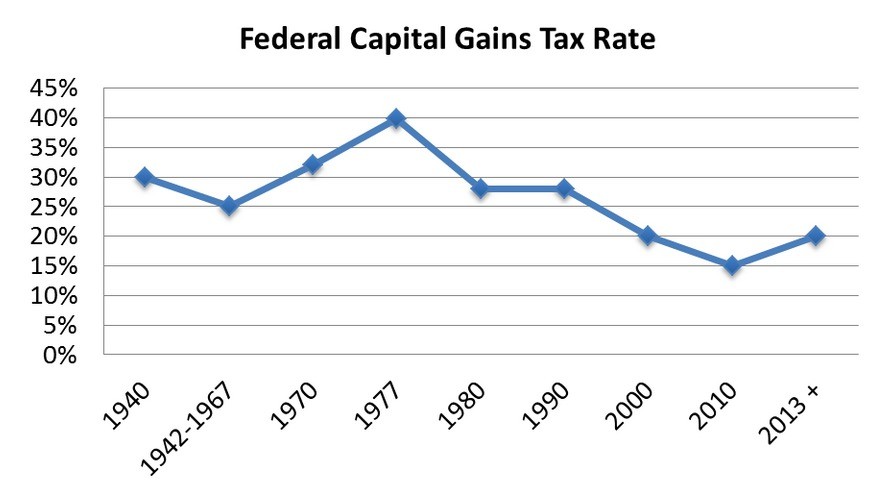

Tax deferral — it’s one of the primary reasons people save money in tax sheltered retirement plans. Sure, we want to save money for retirement, but the ability to lower current taxable income in the process — that’s too good to pass up. But tax deferral isn’t anything like being tax exempt. meaning escaping taxation altogether. Under tax deferral we merely shift tax liability to some point in the future, which is to say that taxes will have to be paid eventually .

Most of us are concerned about tax planning during our working years, after all, who wants to pay more in taxes than they should? But retirement is when the tax bill comes due on most things that have the term “tax deferred” attached to it, and that burden can be higher than many people imagine. The tax liability on the income from several plans can add up causing a surprisingly large tax bite in the golden years. Higher retirement income can also have a multiplier affect on taxes:

- The greater your overall income, the more of your social security benefits will be taxable.

- Certain tax deductions have “floors” based on gross income. For example, a major deduction in retirement years is the medical deduction, but in order to take it, you have to exceed the floor of 7.5% of gross income—the higher your gross, the less you’ll be able to deduct.

Since retirement plans are qualified plans, and thus cannot be shifted quickly or easily, advance tax planning is as important as it is overlooked. One of the best ways to handle this is by incorporating tax diversification into retirement planning. Tax diversification simply means that money is spread among various asset accounts in such a way that minimizes taxable income in retirement.

Retirement Options and Their Tax Impact

What are the tax implications of the various typical retirement sources?

Pensions

True, not many people have traditional defined benefit pensions anymore, but if you’re one of the lucky few who do you have a bit more tax planning to do. Pension income is generally taxable, so if you anticipate having it you might want to emphasize contributing to retirement accounts and other assets that won’t increase your tax liability in retirement.

Social Security

We touched on this above, but your social security benefits will be taxable to the extent that half of your social security income — plus your other income — exceeds $25,000 ($32,000 if married filing joint). What this means is that the higher your overall income is, the more of your social security benefits will be taxable.

401K/403B plans

These are classic tax deferral plans, and many people accumulate large balances that can significantly increase retirement tax liability. Not only do they have higher contribution limits than other plans, but they often include an employer match that can make them grow even faster. But what’s good for accumulation can be a negative for taxes. The problem is complicated by the fact that required minimum distributions (RMD’s) kick in at age 70 ½, which is to say that you must take withdrawals even if you don’t need the money. And those withdrawals will add to your taxable income.

Traditional IRAs

Traditional IRA’s can be a mixed bag, tax wise. RMD’s also begin at 70 ½, and when the withdrawals come, 100% of the income you’ve earned in the plan will be taxable. But there may be some relief on the contribution side. Any contributions made that result in a tax deduction in the year the contribution was made will also be fully taxable at withdrawal. However contributions that weren’t tax deductible when made can be withdrawn tax free. Since you’ll have a mix of taxable and non-taxable withdrawals, you’ll still have a tax liability, but you can get some relief on the non-deductible portion. Moral of the story: non-deductible IRA contributions might have a place in your retirement mix!

Roth IRAs

Roth IRAs are probably your best retirement tax diversification play. Since withdrawals after age 59 ½ are free of income taxes on both the contribution and income portions, money movements and withdrawals from these accounts will have no impact on your tax liability. Early and aggressive funding of these accounts can reduce reliance on fully tax deferred plans and the tax liability that they bring at retirement. Not sure if you qualify for a Roth? Learn about Roth IRA eligibility.

Non-retirement savings

The money you’ve saved up in bank accounts, stocks, mutual funds and other investments that were not part of a retirement plan can be moved and used free of tax consequences. You fund them out of after tax income so you’re free to do what you like with them. Sure, any income earned on them will be taxable, but principal withdrawals never are. This makes them an important part of a retirement tax diversification plan. If you need a large amount of money in a given year and withdraw it from tax deferred retirement accounts, you will create a sizable increase in your taxable income. However, if you can instead draw the money from non-retirement assets, no tax liability will be created. This will be extremely important in years in which financial needs are especially great. With proper tax diversification in your retirement assets, you should be able to avoid the worst of any unanticipated tax surprises in your retirement years. But you have to take action now to keep your options open later.

Photo by Shayne Kaye via Flickr