The Four Hidden Costs of Mutual Funds (This Could Save You 33%! )

Post on: 31 Июль, 2015 No Comment

I recently read an article by John Bogle, the founder of Vanguard. The article, The Arithmetic of All-In Investment Expenses. is a very detailed piece about investing costs over and above whats reflected in the expense ratio of a fund or ETF.

There are four hidden mutual fund fees that arent captured in the expense ratio. That may come as a surprise to many of you, but its true. So lets talk about these four hidden fees, and their impact on returns:

1. Transaction Cost

Mutual funds and ETFs are regularly buying and selling shares of companies that the funds own. And just like we have to pay a fee to buy or sell a share, so do mutual funds. Of course, theyre buying on a much larger scale than we are. That helps them keep their costs lower on a per share or per transaction basis. Even with economies of scale, transaction costs really add up. And, believe it or not, they arent covered in the expense ratio.

In Mr. Bogles article, he goes to great lengths to estimate these costs. He searched through a number of studies mentioned in the article. Some estimated that trading costs could be as much as 1.44% 144 basis points. Others have estimated these costs to be as low as 30 basis points. Mr. Bogle puts his estimate at about 50 basis points for actively managed funds. So youre paying another .5%, on average, in transaction costs above and beyond the expense ratio.

We can, of course, debate whether or not Mr. Bogle got his estimates right. Some may think the expense is more or less than 50 basis points. And, obviously, itll vary from one fund to another. But whatever the costs actually are, theyre an additional cost on top of the expense ratio.

With index funds, theyre not buying and selling as they change their minds as to which stocks they want to invest in. Theyre just buying shares as new money comes into the fund, and selling shares as folks leave the fund. Of course, they may have to do some buying and selling to track the index. But those transaction costs are so minimal that they often dont noticeably impact the funds performance.

And theres an easy way to determine this. If an index fund has no significant transaction costs, it should underperform the index its tracking by the amount of its expense ratio. So if the expense ratio is .05%, for example, they should underperform their index by roughly .05%.

Ive looked at a number of Vanguard funds, and for the most part, this is correct. The fund may be off by one basis point particularly for the large cap U.S. index funds. But theyre basically missing the index by the amount of their expense ratio. So the transaction costs are so small that they dont even register.

When it comes to actively managed mutual funds, Mr. Bogle puts the transaction costs at .5%.

2. Cash Assets

Actively managed funds often keep a fair amount of the money invested in cash. In fact, Mr. Bogle estimates that actively managed funds keep, on average, about 5% of their assets in cash. This raises two questions. How can we determine how much cash a specific fund has and how does that affect our returns.

How much cash does a mutual fund have?

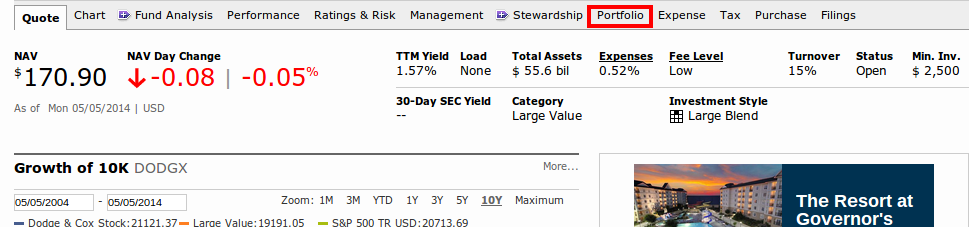

Go to Morningstar.com and search for a mutual fund using its name or ticker. I searched for the Dodge & Cox Stock Fund (DODGX). I dont invest in this fund anymore, though I have in the past. In Morningstar you can see the funds portfolio:

This tells you the percentage of assets the fund keeps in cash. In this case, its 1.38%, much lower than the 5% average. Thats one of the reasons I think that the Dodge & Cox Stock Fund is one of the best actively managed funds.

If I were to invest in a U.S. large cap stock fund thats actively managed, this would be high on my list. I should add that their expense ratio of .52% is higher than an index fund, but much lower than the average expense ratio of actively managed funds.

The Cost of Cash in Mutual Funds

There is a premium for equity over and above cash. In other words, we expect the return on equities over a long time period to exceed the return on cash. Mr. Bogle assumes a 6% premium for stocks over cash.

If the fund has 5% in cash, over the long term, its going to cost you about 30 basis points or .3% in lower returns. This is actually a little more complicated than Im making it out to be. Mr. Bogle actually assumes the drag on your return will only be half of that 15 basis points. From my perspective, thats a reasonable assumption. But, still, you can assume another 15 basis points in hidden costs, depending on how much your mutual fund keeps in cash.

3. Sales Loads

There are really two different kinds of sales loads. The first is loaded funds, where you have to pay a 5% fee to buy into the funds. The 5% sales charge goes to the brokers, who get commissions for selling you the funds.

The percentage of funds that charge loads today is lower than it used to be. The sales charges are lower, too. Today, theyre typically around 5%. Decades ago, 8% was common. But even though this is less of a problem, sales funds are still around.

And a lot of people, even those buying no-load funds, use advisors to help them. As I mentioned in the last podcast. the average cost of using an advisor is about 1%. And even if you arent using an advisor, there could be brokerage fees, depending on whether you invest in ETFs or mutual funds.

Mr. Bogle assumes another 50 basis points when you factor in all of these costs. You can avoid some or all of these sales loads, depending on how you invest.

How Much Will You Lose?

I know weve only talked about three hidden costs of mutual funds so far. Well get to the fourth. But, for now, understand that you can avoid (or at least mitigate) most or all of these hidden fees, depending on how you invest.

You can avoid direct and indirect sales loads by choosing funds with no sales load and investing without advisor. You can avoid most transaction costs if you invest primarily in index funds. And you can avoid the drag on your investments that cash will have by choosing funds with a lower percentage of their portfolio in cash.

But lets assume that youre paying at least most of these hidden fees. Mr. Bogle adds all these fees up and averages them out. The result is 2.27% in total fees for the average actively managed mutual fund.

Mr. Bogle assumes a 1.12% expense ratio for the average actively managed mutual fund, which is fair. Add to that all the hidden fees weve talked about so far, and it ads up to 2.27%. Compare that to an index fund, where the average total cost is about .06%.

What Difference Does it Make?

So what? On the surface, 2.27% doesnt seem like that big a deal.

But lets assume that stocks return 7%, a modest assumption based on historical data. If you lose 2.27% in an actively managed fund to all these fees, it will consume 33% of your total return over a lifetime of investing .

This is the magic of compounding. With these fees, youre losing 2.27% every year, but youre also losing the interest or growth you would have enjoyed had you not lost the 2.27% to begin with.

In one year or even five years, that may not be a big deal. But in 10 years, it starts to hurt. In 20 to 30 years, as this problem builds up, it has more and more impact. And, according to Mr. Bogle, you end up losing almost 33% of your returns.

So what does the .06% fees associated with index funds consume in terms of your total return? Less than 1%.

So lets assume that youre 30 years old, and youve already started investing. Youre going to work until youre 70, so youre investing over 40 years. Do you go to actively managed funds where 2.27% a year will eat away at your nest egg, or do you stick with index funds and pay much less?

Mr. Bogle goes through this example. He assumes youre making $30,000 per year and assumes a 3% annual growth rate and contributions to a 401(k) or an IRA in line with that kind of salary. In 40 years, your actively managed investments in a 401(k) will total $571,000. Not bad.

But what about the index funds that charge only 6 basis points? Youll earn a total of $927,000. Thats a $366,000 difference.

The Fourth Hidden Cost

Actively managed funds, by and large, are less tax efficient than index funds. If your money is in a 401(k) or an IRA, that doesnt matter. But if you have money in taxable accounts, pay attention.

Actively managed funds buying and selling shares more frequently than do index funds. These transactions occur for various reasons, primarily the result of the funds manager moving in and out of stocks in an attempt to maximize returns. This makes actively managed funds less tax efficient than index funds.

Again, we can look at this through a MorningStar tool. Go back to Dodge & Cox (though you can do this with any fund, of course) in Morningstar. Now click on the tax tab.

It will show you the funds pre-tax return and the tax-adjusted return. MorningStar actually calculates a tax-cost ratio for each mutual fund to give you a sense of how bad the tax hit will be for that mutual fund based on many factors primarily capital gains because of the constant buying and selling.

So heres the thing to understand. The 33% of your total return lost because of 2.27% fees is in a tax-advantaged retirement account, a 401(k) or an IRA. Put that same money in a taxable account, and the tax inefficiencies of an actively managed fund will quickly add up.

Tax inefficiencies mean that in a taxable account, youll lose not 33% of your total return, but 43%! The increase is due to the increased taxes youll pay each year.

Not All Actively Managed Funds are Evil

I dont believe all actively managed funds are evil. Yes, most of my investments are in index funds, but not all of them. I think theres a time and a place for actively managed funds. Actively managed funds are helpful in some cases. Consider the emerging market bond fund, for example. This is the type of asset class that benefits from active management, more than, say, a large cap U.S. equity asset class.

Also, you may only have actively managed funds as an option in your 401(k), or they may be your only way to get exposure to certain asset classes if your choices are limited. So dont assume all these funds are bad. But do closely scrutinize any actively management funds that you can choose from before you make your investment.

On the whole, actively managed mutual funds are a lot more expensive than index funds. Some are a lot less expensive than the average of 1.12% Mr. Bogle used in his article. The Dodge & Cox is one example, at 52 basis points. Its not cheap compared with index funds, but its less than half the industrys average.