The Financial Comparisons Between Two Companies Finance Essay

Post on: 16 Март, 2015 No Comment

Abstract

The analysis has been done using secondary data. The secondary data is available through the company’s main home website where the annual financial reports of the company are available of 2006-2010 financial years for Nike Inc.

For Adidas the analysis is done only by using the data from the financial years 2006 – 2009 as the annual report for the year 2010 is not published by the home website of the company yet.

The method which is applied to find out the financial comparisons between the two companies is the efficiency ratio analysis which will help us to show how the firm’s resources are being used and can be held as a strong measure on the firm’s financial performance.

Another method is the profitability ratio as we know that the profit is the main key to find out the financial performance of the company hence the GPM and the net profit margins of the companies are calculated by using the formulae.

Each analysis has been supported with the help of a graph which shows the trend of the companies to arrive at the final conclusion.

186 Words

Introduction: -

The main aim of my commentary is to investigate the financial performance of Adidas and Nike Inc which are two rival companies. Adidas and Nike Inc are the only companies which dominate the footwear, sportswear and sports equipment sector of the market. For testing the financial strength of the companies, I have tried to use the revenue and profit ratios. In the era of globalization, to attract the investors, the financial data of the two competitors is available on the net. A broad comparison is drawn between the two companies based on sales turnover and other relevant ratios to get an understanding of the financial structure and its effectiveness in the business. Both the companies have strived hard to keep the image of their companies high with the help of these reports to attract more people to invest in their company and to buy more shares. The companies can be compared by the revenues they earned over those financial years, the sales of the company, the sales turnovers of the company, using the various tests and to comment on the performance of the company overall.

Normally, people look at the balance sheet and the profit and loss account to know the success of the company and to decide whether they want to invest in a company or not. But, it is worth noting that ratio analysis give a better picture of the trend of the company over the years, it pin points the exact highs and lows for the company and comparing the same on an industry level it can be observed whether the industry as a whole is facing crisis or it is the company’s inability to generate profits.

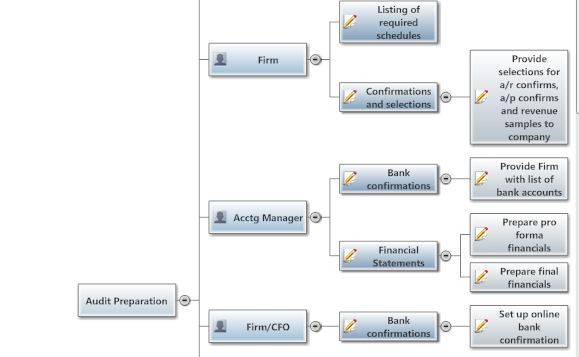

In the essay I have used historical comparisons which involve comparing same ratio for Adidas and Nike Inc. By using historical ratios the comparisons over the years show a trend which will help us to assess the financial performance of both the companies. This will help us conclude which company has done well financially better than its counterpart. So I have done the comparisons by using the profitability ratio as the profit is a key objective for most of the businesses and can act as a strong measure of a business’s success. The efficiency ratio is also used in finding out the financial performance of these companies. Efficiency ratios show us how well a firm’s financial resources are being used in which the stock turnover and the return on capital employed are calculated from the financial reports of both the companies.

Main Findings: -

For Nike Inc

2006 – 2007 these financial years specifically showed consistency in their performance without making heavy losses which is the primary aim of all the companies.

2008 was a good year for the company as here the company showed good signs of improvements and performed better than the years 2006, 2007 and 2009 in all cases

2010 was the best year so far as the company has made improvements and has earned the maximum in this year. It is seen that the company after having a drastic fall in the year 2009, the company has bounced back from drought in almost every case and have performed better than the previous year’s which is a very good thing for the company. In 2010 the company has the best performance.

2009 the company Nike Inc had handled very well due to the recession the companies had been affected in a huge way like a huge decline in their work but in the case of Nike Inc there wasn’t much problem for them if compared to others

For Adidas

2006 – 2007 these financial years showed consistency in the performance of the company

In the year 2008 the company had the best financial performance and had performed very well

2009 has been a very bad year in case of financial performance for Adidas as the company has had a major decline in their financial performance which is an alarming state for the company.

The year 2009 was a very bad year as the world was hit by a major recession and had created a major slump in the case of many businesses.

Adidas was hit by this recession and it was affected in a major way as they incurred heavy declines in their financial performances.

shoesobsessions.files.wordpress.com/2008/08/ad-2-copia.jpg

NIKE INC

Profitability Ratios for Nike Inc

Gross Profit Margin (‘GPM’)

Profit would be the main aim for many businesses and can help act as one of the methods to measure of the firm’s financial success and performance. The GPM ratio portrays the value of gross profit as a percentage of the sales revenue. The GP M ratio is expressed as percentage with the help of the formula.