The Evolution of ETFs Systematic Relative Strength Dorsey Wright Money Management Systematic

Post on: 25 Июль, 2015 No Comment

The Evolution of ETFs

The first big ETF, SPY, was designed as an institutional product. It offered a large investor a way to put money to work in the market quickly. It wasnt until iShares came along with a big investor education push that ETFs were marketed to the retail financial advisor. (Dorsey, Wright was intimately involved in the investor education road shows by many sponsors, by the way. And still is.) Now 50% of ETF assets are held through financial advisors. Thats the back story.

Yet according to a study by Greenwich Associates, and reported on here at Index Universe. the biggest growth for ETFs may still be ahead . Greenwichs study indicates that a minority of institutions actually use ETFs, but suggests that a large percentage of them expect to expand their usage over the next three years. The main barrier for the institutions is lack of familiarity with the instruments. From a simple math standpoint, increasing institutional usage of ETFs by a few percentage points has much more potential than trying to push investor education down to the self-directed retail investor.

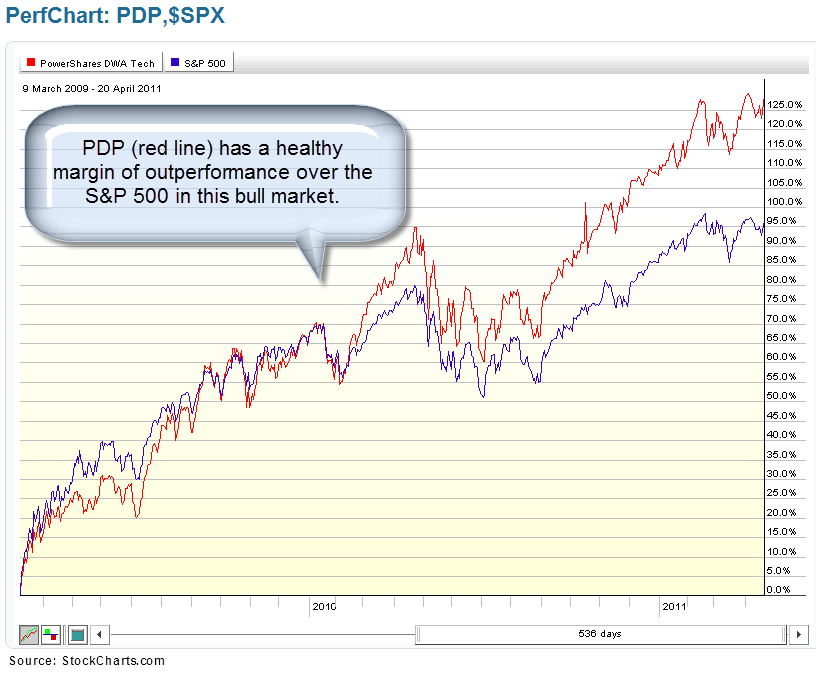

Dorsey, Wright Money Management is on the cutting edge of this trend. We are sub-advisors for two mutual funds, the Arrow DWA Balanced Fund (DWAFX) and the Arrow DWA Tactical Fund (DWTFX), that are comprised almost entirely of ETFs. I would not be surprised to see more and more mutual funds, hedge funds, and other institutions ramp up their use of ETFs over time. The biggest hurdles for institutions, I suspect, involve trading liquidity and NAV tracking. As volume in the ETF marketplace grows, these issues should resolve themselves to some extent. Lots of small, illogical, or me too products may go by the wayside in the process, but eventually the ETF market should be stronger because of it. Personally, I hope we will see an expansion of alpha-generating semi-active strategy ETFs, like the RAFI indexes or our own Technical Leaders Indexes.

Products that use only ETFs, like our Global Macro separate account have made global, tactical asset allocation a reality for the individual investor only because of the proliferation of ETFs in numerous asset classesasset classes that were not easily investable for individuals in the past. As institutions become more involved, we may see a further evolution of sophisticated ETF products in the marketplace. The last five years have been remarkable, but the best may be yet to come.